Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Focus on AUD/JPY.

Fundamentally speaking, Japan’s inflation has not declined, which increases the probability of the Bank of Japan’s future tightening policy. After a long-term depreciation, the yen has space for a short-term rebound. AUD/JPY has less room for arbitrage than USD/JPY. With strong USD, please watch out for AUD/JPY bear.

Technically speaking, the AUD/JPY daily stochastic oscillator shows a dead cross, falling below the 50 median line.

(Golden daily cycle, Ultima Markets MT4)

The exchange rate began to decline after falling below the 65- day moving average. It is worth noting that before the short-term moving average crosses again, the market has a high probability of touching the 240 -day moving average and rising again.

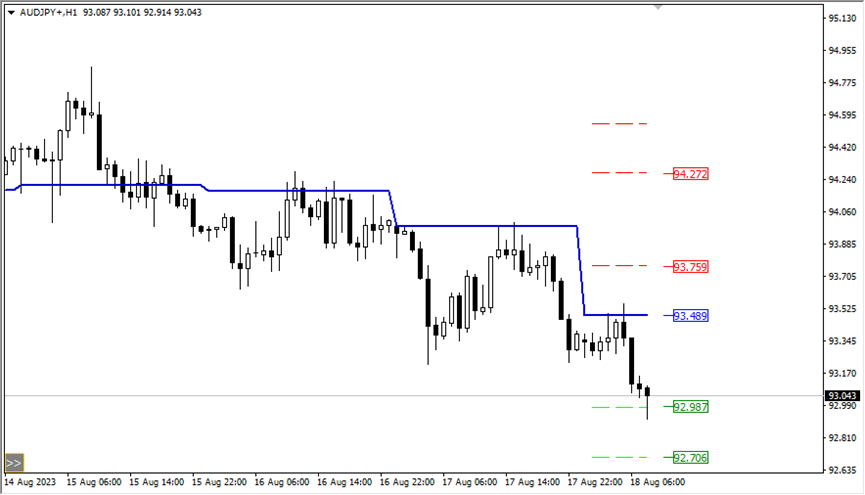

(AUD/JPY in 1 -hour period, Ultima Markets MT4)

In 1-hour period, the bearish trend is obvious, and the exchange has fallen below the 2400 -period moving average. However, there is a certain probability that it will find support and rebound there. You may wait for short entry here.

(AUD/JPY in 1 -hour period, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price is 93.489,

Bullish above 93.489, the first target is 93.759, and the second target 94.272.

Bearish below 93.489, the first target is 92.987, and the second target is 92.706.

Disclaimer Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server