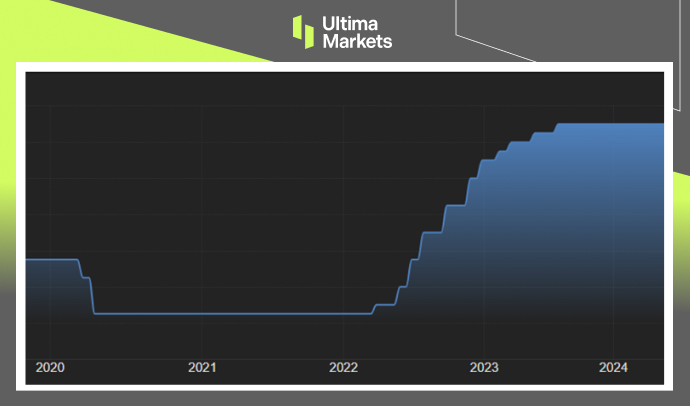

In July 2024, the Federal Reserve kept the federal funds rate at 5.25%-5.50% for the eighth consecutive meeting. The decision aligned with market expectations. The central bank noted progress towards its 2% inflation target, though inflation remains somewhat elevated. Economic indicators suggest continued solid expansion, with job gains moderating and unemployment rising slightly but still low.

The Fed believes risks to its employment and inflation goals are becoming more balanced. However, it doesn’t anticipate rate cuts until there’s greater confidence in the sustainable movement towards 2% inflation. During the press conference, Chair Powell discussed potential scenarios for 2024, ranging from multiple rate cuts to none at all. He suggested a September cut could be possible if inflation trends align with expectations.

(Federal Funds Rate Levels)

On Wednesday, major US stock indices closed higher as the tech sector rallied, led by chip stocks. The S&P 500 gained 1.58%, the Nasdaq rose 2.63%, and the Dow added nearly 100 points (0.24%). Markets reacted positively to the Federal Reserve’s latest interest rate decision and comments.

Tech stocks dominated market performance. Nvidia surged 12.81% after Morgan Stanley named it a top pick, partially recovering from recent losses due to market rotation toward traditional economic sectors. AMD jumped 4.36% following better-than-expected results. Broadcom and Qualcomm rose 11.96% and 8.39% respectively, buoyed by reports that some foreign companies might avoid US export restrictions on chipmaking to China. However, not all tech stocks fared well. Microsoft lost 1.08% due to disappointing cloud results.

(S&P 500 Index Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server