What is MT5? A Comprehensive Guide: From Concepts to Advantages!

In today’s ever-changing financial markets, a powerful and flexible trading platform is key to investment success. MT5 (MetaTrader 5), as one of the world’s top trading tools, is not limited to forex but also covers a wide range of assets such as stocks, futures, and more, making it highly favored by investors. You may be wondering: What exactly is MT5? Why has it become the platform of choice for traders? This article will comprehensively analyze MT5’s unique appeal, from its basic concepts to its core advantages. Whether you are a newcomer to the market or a professional seeking efficient tools, MT5 provides advanced technical support and a flexible trading experience. Its fast execution, multi-chart analysis, and automated trading features help you stand out in the competitive market. Ready to explore the limitless potential of MT5? Let’s uncover its mysteries and begin your trading journey!

What is MT5? A Comprehensive Overview of Basic Concepts

MetaTrader 5 (MT5) is the next-generation trading platform developed by MetaQuotes, released in 2010 as the successor to the widely popular MetaTrader4 (MT4). Designed to provide a more comprehensive multi-asset trading experience, MT5 was developed in response to the rapid evolution of financial markets and traders’ growing demand for diversified investment options. Unlike MT4, which is primarily optimized for forex trading, MT5 was developed to upgrade trading platform capabilities, supporting a wide range of financial products such as forex, stocks, commodities, indices, futures, energy, and cryptocurrencies. This transformation marks MT5 as a key player in the evolution of trading platforms, making it the ideal choice to meet the demands of modern financial markets.

MT5 offers a variety of powerful features to meet the diverse needs of traders:

- Multi-Asset Trading: Supports a variety of asset classes, including forex, stocks, futures, and cryptocurrencies, enabling flexible portfolio diversification.

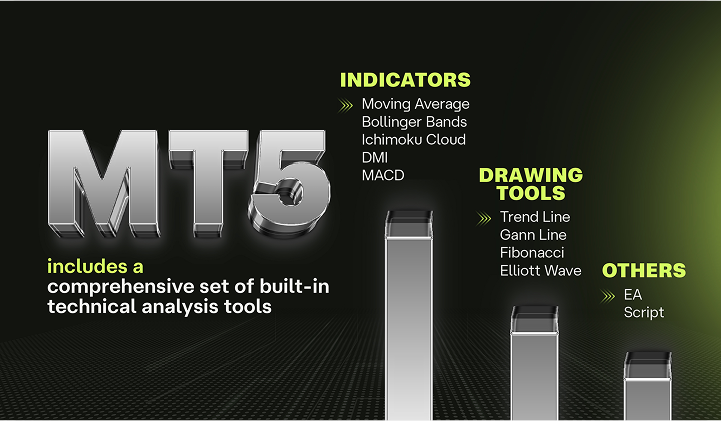

- Advanced Technical Analysis Tools: Includes over 80 built-in technical indicators and chart analysis tools to help traders analyze the market with precision.

- Algorithmic Trading (EA) Support: Allows traders to create and implement automated trading strategies, enhancing trading efficiency.

- Market Depth (DOM): Provides market depth data on prices, helping traders gain insights into market liquidity.

- High-Speed Order Execution: :Ensures fast execution of trade orders with no re-quotes and zero slippage, making it ideal for high-frequency trading.

Core Advantages of MT5: Why Is It So Popular?

1. Multi-Asset Trading

MT5 supports a wide range of asset classes, including forex, stocks, futures, indices, commodities, precious metals, energy, and even cryptocurrencies. Traders can access global markets without the need to switch platforms, allowing them to seamlessly trade from USD/JPY to Bitcoin (BTC/USD). This one-stop experience enhances both efficiency and convenience.

2. Wide Range of Technical Analysis Tools

MT5 offers over 80 technical indicators (such as moving averages, RSI) and a variety of charting tools to help traders analyze price movements and market trends. Whether for short-term fluctuations or long-term trends, traders can gain deep insights and develop more precise strategies through customizable charts.

3. More Timeframes

Compared to MT4, MT5 offers 21 additional timeframes (ranging from M1 minutes to MN monthly charts), including 2-minute (M2) and 4-hour (H4) intervals. This variety allows traders to choose the appropriate analysis period, whether for fast-paced short-term trades or long-term investments held for months.

4. Advanced Automated Trading Features

MT5 supports automated trading through Expert Advisors (EAs) and the MQL5 programming language, allowing traders to write programs to execute strategies. The strategy tester provides multi-currency, multi-threaded backtesting capabilities, enabling users to simulate historical data and ensure strategy reliability in actual market conditions.

5. Support for Multiple Platforms

MT5 is compatible with Windows, macOS, iOS, Android, and web versions, enabling traders to trade anytime and anywhere. For example, traders can check quotes on their mobile devices, analyze charts on their computers, or place quick orders through their browsers, offering a seamless cross-device experience that meets modern trading needs.

6. More Order Types

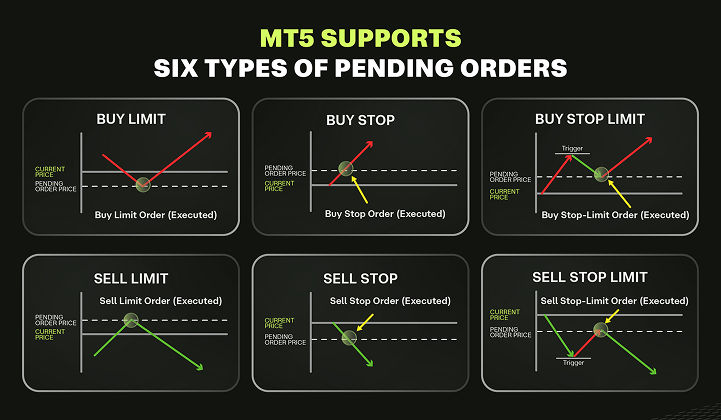

MT5 offers a variety of order types, including market orders, limit orders, stop orders, and trailing stop orders. These tools allow traders to set entry and exit points flexibly in volatile markets, such as using trailing stops to lock in profits, enhancing risk management capabilities.

7. Advanced Strategy Testing Features

The strategy tester in MT5 not only supports backtesting on a single currency but also offers multi-currency, multi-thread, and distributed testing. Traders can use historical data to simulate strategy performance, quickly optimize parameters, and improve the success rate and stability of automated trading.

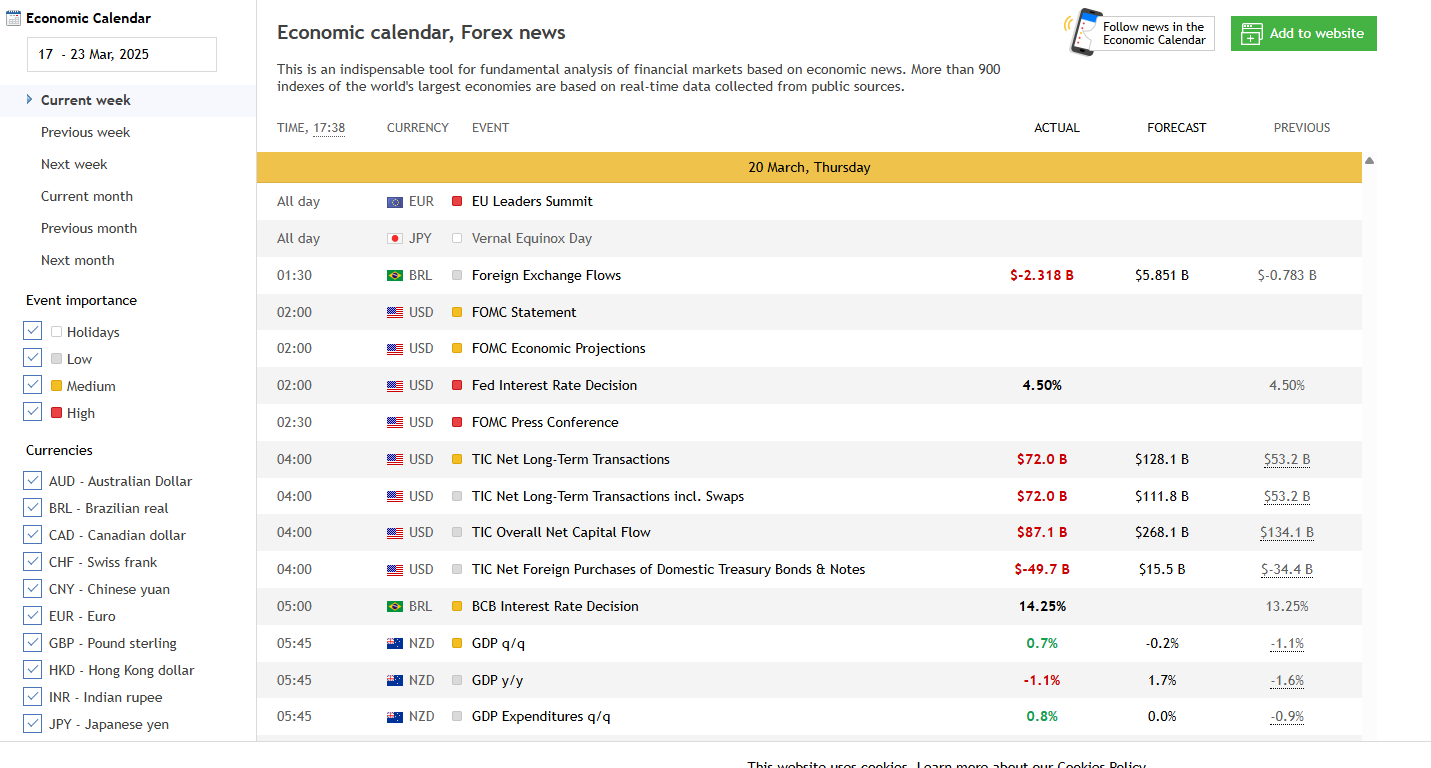

8. Built-in Economic Calendar

MT5 comes with a built-in economic calendar, providing real-time information on global economic events, such as interest rate decisions or employment data releases. Traders can stay informed of market dynamics without leaving the platform, allowing them to adjust strategies in advance to respond to potential volatility.

9. Free to Use

Unlike paid advanced charting software (e.g., TradingView), MT5 is completely free. By opening an account with a broker that supports MT5, traders can access all features, including unlimited technical analysis and trading operations, offering excellent value for money.

10. Multi-Language Support

MT5 supports multiple languages, including Traditional Chinese, Simplified Chinese, English, and Japanese, ensuring that traders around the world can use the platform without language barriers. Even on different language operating systems, MT5 will display text correctly, preventing garbled characters and enhancing the user experience.

11. Multi-Account Management

MT5’s multi-account management feature allows traders to operate multiple accounts simultaneously, such as managing client portfolios or diversifying personal funds. With detailed reporting tools, traders can track the performance of each account in real-time, improving efficiency.

MT5 vs MT4: Which One Should You Choose?

Both MT5 (MetaTrader 5) and MT4 (MetaTrader 4) are developed by MetaQuotes and are highly favored by traders. However, they have significant differences in functionality and application. Many traders face the dilemma of choosing between the two: which one is more suitable for them? Below, we provide a comparison of their features and offer suggestions to help you make a decision based on your trading needs.

1. Feature Comparison Overview

Both MT4 and MT5 have simple and user-friendly interfaces, but MT5 has been upgraded in many areas. The following table provides a detailed comparison of the two:

| Feature | MT4 | MT5 |

| Broker Availability | Very popular | Very popular |

| User Interface | Easy & Simple | Easy & Simple |

| Rollovers and Hedging | Can | Can |

| Programming Language | MQL4 | MQL5(include IDE) |

| No. Order Execution Types | 3 | 4 |

| No. Pending Order Types | 4 | 6 |

| Market Depth | No | Yes (Not available initially, will be improved later) |

| Technical Indicators | 30 | 38 |

| Time Frames | 9 | 21 |

| Economic Calendar | No | Yes (Available within APP) |

| Relevant Reports | Only table | Table + Charts, exportable to Excel |

| Pending Order View | Only lots | Lots + Trading volume + Milliseconds |

| Dockable Charts | No | Yes |

| Market monitoring | Not very detailed | More detailed + Convenient navigation |

| Partial Order Fill | No | Yes |

| Email System | No attachments | Has attachments |

| Strategy Tester | Single-thread | Multi-currency + Proxy management |

| Fund Transfer Between Accounts | Not support | Support |

| Exchange-Traded | Not support | Support |

| Reset | Not support | Support |

2.Which one should I choose?

- Features and applicability of MT4: MT4 is user-friendly, offering 3 types of order execution and 30 technical indicators, making it ideal for beginners focused on forex trading. It has wide broker support and abundant resources, making it a reliable choice for newcomers.

- Features and applicability of MT5: MT5 supports multi-asset trading (such as stocks and cryptocurrencies), provides 38 indicators, 21 timeframes, and multi-threaded strategy testing, making it suitable for advanced and professional traders. If you need multiple market opportunities or automated trading, MT5 has the advantage.

- Transition suggestion: If you are familiar with MT4, you can continue using your existing account while opening an MT5 demo account to try it out. Based on your trading goals, decide whether to switch.

How to Avoid MT5 Scams: Tips for Identifying Fake Platforms

MT5 (MetaTrader 5) is widely popular in the trading market due to its multi-asset support and powerful features, making it a target for scammers. While the advantages of MT5 and its differences from MT4 have been discussed earlier, using MT5 requires ensuring the platform’s security. Below are common types of scams and prevention tips to help you identify fake platforms and protect your funds.

Common Scam Types:

- Fake MT5 Platforms: Scammers create websites or apps that closely resemble MT5, luring traders into entering account details or making deposits, only to steal funds or data.

- Illegal Brokers: Some unregulated brokers falsely claim to offer MT5 services, but lack proper credentials. Traders’ funds may not be protected and could even be misappropriated.

- Fake High Returns: Through forged emails or messages, scammers impersonate MT5 or brokers to lure individuals into clicking malicious links to steal sensitive information.

- Fake High Returns: Some platforms use the MT5 name to promise unrealistic returns, only to run Ponzi schemes. They attract traders to invest funds, then disappear with the money.

Prevention Tips

- Choose Regulated Brokers: Prioritize brokers regulated by reputable authorities such as the UK’s FCA (Financial Conduct Authority) or Australia’s ASIC (Australian Securities and Investments Commission). Check the broker’s registration status on the regulator’s official website to ensure its legitimacy. For example, regulated platforms like Ultima Markets provide security assurances.

- Verify Software Source: Only download MT5 from the official MetaQuotes website or trusted brokers, avoiding third-party sources. Check that the download link uses HTTPS protocol to ensure the source is legitimate.

- Be Wary of Unrealistic Promises: If a platform guarantees high returns or asks for upfront fees, be cautious as these are often signs of a scam.

- Strengthen Security Measures: Use strong passwords and regularly update MT5 software. Enable two-factor authentication (if available), and monitor account activity. If any unusual activity is detected, contact the broker immediately.

By following these measures, traders can effectively reduce the risk of scams and safely use the powerful features of MT5. Security is the foundation of enjoying the benefits of MT5.

Conclusion: Is MT5 Right for You?

MT5 (MetaTrader 5) is a versatile trading platform, and its value has been fully showcased in its “basic concepts,” “core advantages,” and “differences from MT4.” Is it right for you? Here is a summary of its advantages from both beginner and advanced perspectives, encouraging further exploration.

The Value of MT5

- Ideal Tool for Beginners: MT5 has an intuitive interface and offers multi-asset trading options (such as forex, stocks, and cryptocurrencies), allowing beginners to explore the market gradually. The built-in 38 technical indicators and economic calendar also help beginners understand market dynamics and get up to speed quickly.

- Advanced Tool for Experts: For professional traders, MT5’s 21 timeframes, automated trading (EA) support, and multi-account management features offer flexibility and efficiency. Its multi-threaded strategy tester also optimizes complex trading strategies, meeting advanced needs.

Is It suitable for You?

-

- Trading Goals: If you focus on forex and prefer simple operations, MT4 may suffice. However, if you want to explore multiple markets or automated trading, MT5 is a more powerful option.

- Experience Level: Beginners can start with MT5’s demo account to familiarize themselves with its features, while advanced traders can utilize its tools to improve their trading performance.

- Diverse Needs: MT5 supports a wide range of asset types, making it suitable for traders planning to diversify their investments.

Suggestions

Getting started with MT5 is not difficult. Opening a demo account is a risk-free starting point, allowing you to experience its multi-asset trading and analysis tools. Many regulated brokers offer free MT5 services along with educational resources to assist in learning. Interestingly, MT5’s built-in economic calendar provides real-time updates on global events, helping you seize market opportunities, which is invaluable for any trader.

The significance of MT5 lies in its balance of ease of use and professional features. Whether you are a beginner or an expert, you can benefit from its capabilities. I encourage you to further explore MT5, embark on your trading journey, and discover its potential through hands-on practice.

Glossary

Get started or expand your knowledge of trading at any level with a wealth of financial industry terms and definitions that you won’t find anywhere else.

- A

- B

- C

- D

- E

- F

- G

- H

- I

- J

- K

- L

- M

- N

- O

- P

- Q

- R

- S

- T

- U

- V

- W

- X

- Y

- Z

Bookmarked Trading Term(s)

Glossary

- A

- B

- C

- D

- E

- F

- G

- H

- I

- J

- K

- L

- M

- N

- O

- P

- Q

- R

- S

- T

- U

- V

- W

- X

- Y

- Z

-

AMM (Automated Money Market)

A decentralized system that uses algorithms to automatically manage liquidity and trading in financial markets without traditional market makers.

Bookmark

-

APR (Annual Percentage Rate)

The yearly interest rate a trader pays on borrowed funds or e arns on investments, excluding compounding.

Bookmark

-

APY (Annual Percentage Yield)

The yearly interest rate a trader earns, including compounding, which reflects the real return on an investment.

Bookmark

-

Asymmetric Cryptography

A security method using two different keys (public and private) to encrypt and decrypt data, ensuring secure transactions.

Bookmark

-

Asymmetric Encryption

The apportionment of premiums and discounts on forward exchange transactions that relate directly to deposit swap (interest arbitrage) deals, over the period of each deal.

Bookmark

-

Atomic Swap

A direct peer-to-peer exchange of different cryptocurrencies without the need for intermediaries, reducing counterparty risk.

Bookmark

-

Balance Of Trade

The value of a country's exports minus its imports.

Bookmark

-

Bar Chart

A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar.

Bookmark

-

Barrier Level

A certain price of great importance included in the structure of a Barrier Option. If a Barrier Level price is reached, the terms of a specific Barrier Option call for a series of events to occur.

Bookmark

-

Barrier Option

Any number of different option structures (such as knock-in, knock-out, no touch, double-no-touch-DNT) that attaches great importance to a specific price trading. In a no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not 'touched' before expiry. This creates an incentive for the option seller to drive prices through the strike level and creates an incentive for the option buyer to defend the strike level.

Bookmark

-

Base Currency

The first currency in a currency pair. It shows how much the base currency is worth as measured against the second currency. For example, if the USD/CHF (U.S. Dollar/Swiss Franc) rate equals 1.6215, then one USD is worth CHF 1.6215. In the forex market, the US dollar is normally considered the base currency for quotes, meaning that quotes are expressed as a unit of $1 USD per the other currency quoted in the pair. The primary exceptions to this rule are the British pound, the euro and the Australian dollar.

Bookmark

-

Cable

The GBP/USD (Great British Pound/U.S. Dollar) pair. Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid 1800s when the GBP was the currency of international trade.

Bookmark

-

Cad

The Canadian dollar, also known as Loonie or Funds.

Bookmark

-

Call Option

A currency trade which exploits the interest rate difference between two countries. By selling a currency with a low rate of interest and buying a currency with a high rate of interest, the trader will receive the interest difference between the two countries while this trade is open.

Bookmark

-

Canadian Ivey Purchasing Managers (Cipm) Index

A monthly gauge of Canadian business sentiment issued by the Richard Ivey Business School.

Bookmark

-

Candlestick Chart

A chart that indicates the trading range for the day as well as the opening and closing price. If the open price is higher than the close price, the rectangle between the open and close price is shaded. If the close price is higher than the open price, that area of the chart is not shaded.

Bookmark

-

Day Trader

Speculators who take positions in commodities and then liquidate those positions prior to the close of the same trading day.

Bookmark

-

Day Trading

Making an open and close trade in the same product in one day.

Bookmark

-

Deal

A term that denotes a trade done at the current market price. It is a live trade as opposed to an order.

Bookmark

-

Dealer

An individual or firm that acts as a principal or counterpart to a transaction. Principals take one side of a position, hoping to earn a spread (profit) by closing out the position in a subsequent trade with another party. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission.

Bookmark

-

Dealing Spread

The difference between the buying and selling price of a contract.

Bookmark

-

Ecb

European Central Bank, the central bank for the countries using the euro.

Bookmark

-

Economic Indicator

A government-issued statistic that indicates current economic growth and stability. Common indicators include employment rates, Gross Domestic Product (GDP), inflation, retail sales, etc.

Bookmark

-

End Of Day Order (eod)

An order to buy or sell at a specified price that remains open until the end of the trading day.

Bookmark

-

Est/Edt

The time zone of New York City, which stands for United States Eastern Standard Time/Eastern Daylight time.

Bookmark

-

Estx50

A name for the Euronext 50 index.

Bookmark

-

Factory Orders

The dollar level of new orders for both durable and nondurable goods. This report is more in depth than the durable goods report which is released earlier in the month.

Bookmark

-

Fed

The Federal Reserve Bank, the central bank of the United States, or the FOMC (Federal Open Market Committee), the policy-setting committee of the Federal Reserve.

Bookmark

-

Fed Officials

Refers to members of the Board of Governors of the Federal Reserve or regional Federal Reserve Bank Presidents.

Bookmark

-

Figure/The Figure

Refers to the price quotation of '00' in a price such as 00-03 (1.2600-03) and would be read as 'figure-three.' If someone sells at 1.2600, traders would say 'the figure was given' or 'the figure was hit.

Bookmark

-

Fill

When an order has been fully executed.

Bookmark

-

G7

Group of 7 Nations - United States, Japan, Germany, United Kingdom, France, Italy and Canada.

Bookmark

-

G8

Group of 8 - G7 nations plus Russia.

Bookmark

-

Gap Gapping

A quick market move in which prices skip several levels without any trades occurring. Gaps usually follow economic data or news announcements.

Bookmark

-

Gearing (Also Known As Leverage)

Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account. It is expressed as a percentage or a fraction.

Bookmark

-

Ger30

An index of the top 30 companies (by market capitalization) listed on the German stock exchange – another name for the DAX.

Bookmark

-

Handle

Every 100 pips in the FX market starting with 000.

Bookmark

-

Hawk/Hawkish

A country's monetary policymakers are referred to as hawkish when they believe that higher interest rates are needed, usually to combat inflation or restrain rapid economic growth or both.

Bookmark

-

Hedge

A position or combination of positions that reduces the risk of your primary position.

Bookmark

-

Hit The Bid

To sell at the current market bid.

Bookmark

-

Hk50/Hkhi

Names for the Hong Kong Hang Seng index.

Bookmark

-

Illiquid

Little volume being traded in the market; a lack of liquidity often creates choppy market conditions.

Bookmark

-

Imm

The IMM, or International Monetary Market, is a part of the Chicago Mercantile Exchange (CME) that deals with trading currency and interest rate futures and options.

Bookmark

-

Imm Futures

A traditional futures contract based on major currencies against the US dollar. IMM futures are traded on the floor of the Chicago Mercantile Exchange.

Bookmark

-

Imm Session

8:00am - 3:00pm New York.

Bookmark

-

Indu

Abbreviation for the Dow Jones Industrial Average.

Bookmark

-

Japanese Economy Watchers Survey

Measures the mood of businesses that directly service consumers such as waiters, drivers and beauticians. Readings above 50 generally signal improvements in sentiment.

Bookmark

-

Japanese Machine Tool Orders

Measures the total value of new orders placed with machine tool manufacturers. Machine tool orders are a measure of the demand for companies that make machines, a leading indicator of future industrial production. Strong data generally signals that manufacturing is improving and that the economy is in an expansion phase.

Bookmark

-

Jpn225

A name for the NEKKEI index.

Bookmark

-

Keep The Powder Dry

To limit your trades due to inclement trading conditions. In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises.

Bookmark

-

Kiwi

Nickname for NZD/USD (New Zealand Dollar/U.S. Dollar).

Bookmark

-

Knock-Ins

Option strategy that requires the underlying product to trade at a certain price before a previously bought option becomes active. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated.

Bookmark

-

Knock-Outs

Option that nullifies a previously bought option if the underlying product trades a certain level. When a knock-out level is traded, the underlying option ceases to exist and any hedging may have to be unwound.

Bookmark

-

Last Dealing Day

The last day you may trade a particular product.

Bookmark

-

Last Dealing Time

The last time you may trade a particular product.

Bookmark

-

Leading Indicators

Statistics that are considered to predict future economic activity.

Bookmark

-

Level

A price zone or particular price that is significant from a technical standpoint or based on reported orders/option interest.

Bookmark

-

Leverage

Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. It allows traders to trade notional values far higher than the capital they have. For example, leverage of 100:1 means you can trade a notional value 100 times greater than the capital in your trading account.*

Bookmark

-

Macro

The longest-term trader who bases their trade decisions on fundamental analysis. A macro trade’s holding period can last anywhere from around six months to multiple years.

Bookmark

-

Manufacturing Production

Measures the total output of the manufacturing aspect of the Industrial Production figures. This data only measures the 13 sub-sectors that relate directly to manufacturing. Manufacturing makes up approximately 80% of total Industrial Production.

Bookmark

-

Market Call

A request from a broker or dealer for additional funds or other collateral on a position that has moved against the customer.

Bookmark

-

Market Maker

A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial product.

Bookmark

-

Market Order

An order to buy or sell at the current price.

Bookmark

-

Nas100

An abbreviation for the NASDAQ 100 index.

Bookmark

-

Net Position

The amount of currency bought or sold which has not yet been offset by opposite transactions.

Bookmark

-

New York Session

8:00am – 5:00pm (New York time).

Bookmark

-

No Touch

An option that pays a fixed amount to the holder if the market never touches the predetermined Barrier Level.

Bookmark

-

Nya.X

Symbol for NYSE Composite index.

Bookmark

-

Offer (Also Known As The Ask Price)

The price at which the market is prepared to sell a product. Prices are quoted two-way as Bid/Offer. The Offer price is also known as the Ask. The Ask represents the price at which a trader can buy the base currency, which is shown to the right in a currency pair. For example, in the quote USD/CHF 1.4527/32, the base currency is USD, and the ask price is 1.4532, meaning you can buy one US dollar for 1.4532 Swiss francs.

In CFD trading, the Ask represents the price a trader can buy the product. For example, in the quote for UK OIL 111.13/111.16, the product quoted is UK OIL and the ask price is £111.16 for one unit of the underlying market.

Bookmark

-

Offered

If a market is said to be trading offered, it means a pair is attracting heavy selling interest, or offers.

Bookmark

-

Offsetting Transaction

A trade that cancels or offsets some or all of the market risk of an open position.

Bookmark

-

On Top

Attempting to sell at the current market order price.

Bookmark

-

One Cancels The Other Order (oco)

A designation for two orders whereby if one part of the two orders is executed, then the other is automatically cancelled.

Bookmark

-

Paid

Refers to the offer side of the market dealing.

Bookmark

-

Pair

The forex quoting convention of matching one currency against the other.

Bookmark

-

Paneled

A very heavy round of selling.

Bookmark

-

Parabolic

A market that moves a great distance in a very short period of time, frequently moving in an accelerating fashion that resembles one half of a parabola. Parabolic moves can be either up or down.

Bookmark

-

Partial Fill

When only part of an order has been executed.

Bookmark

-

Quantitative Easing

When a central bank injects money into an economy with the aim of stimulating growth.

Bookmark

-

Quarterly Cfds

When a central bank injects money into an economy with the aim of stimulating growth.

Bookmark

-

Quote

An indicative market price, normally used for information purposes only.

Bookmark

-

Rally

A recovery in price after a period of decline.

Bookmark

-

Range

When a price is trading between a defined high and low, moving within these two boundaries without breaking out from them.

Bookmark

-

Rate

The price of one currency in terms of another, typically used for dealing purposes.

Bookmark

-

Rba

Reserve Bank of Australia, the central bank of Australia.

Bookmark

-

Rbnz

Reserve Bank of New Zealand, the central bank of New Zealand.

Bookmark

-

Sec

The Securities and Exchange Commission.

Bookmark

-

Sector

A group of securities that operate in a similar industry.

Bookmark

-

Sell

Taking a short position in expectation that the market is going to go down.

Bookmark

-

Settlement

The process by which a trade is entered into the books, recording the counterparts to a transaction. The settlement of currency trades may or may not involve the actual physical exchange of one currency for another.

Bookmark

-

Shga.X

Symbol for the Shanghai A index

Bookmark

-

Takeover

Assuming control of a company by buying its stock.

Bookmark

-

Technical Analysis

The process by which charts of past price patterns are studied for clues as to the direction of future price movements.

Bookmark

-

Technicians/techs

Traders who base their trading decisions on technical or charts analysis.

Bookmark

-

Ten (10) Yr

US government-issued debt which is repayable in ten years. For example, a US 10-year note.

Bookmark

-

Thin

A illiquid, slippery or choppy market environment. A light-volume market that produces erratic trading conditions.

Bookmark

-

Ugly

Describing unforgiving market conditions that can be violent and quick.

Bookmark

-

Uk Average Earnings Including Bonus/ Excluding Bonus

Measures the average wage including/excluding bonuses paid to employees. This is measured quarter-on-quarter (QoQ) from the previous year.

Bookmark

-

Uk Claimant Count Rate

Measures the number of people claiming unemployment benefits. The claimant count figures tend to be lower than the unemployment data since not all of the unemployed are eligible for benefits.

Bookmark

-

Uk Hbos House Price Index

Measures the relative level of UK house prices for an indication of trends in the UK real estate sector and their implication for the overall economic outlook. This index is the longest monthly data series of any UK housing index, published by the largest UK mortgage lender (Halifax Building Society/Bank of Scotland).

Bookmark

-

Uk Jobless Claims Change

Measures the change in the number of people claiming unemployment benefits over the previous month.

Bookmark

-

Value Date

Also known as the maturity date, it is the date on which counterparts to a financial transaction agree to settle their respective obligations, i.e., exchanging payments. For spot currency transactions, the value date is normally two business days forward.

Bookmark

-

Variation Margin

Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations.

Bookmark

-

Vix Or Volatility Index

Shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge."

Bookmark

-

Volatility

Referring to active markets that often present trade opportunities.

Bookmark

-

Wedge Chart Pattern

Chart formation that shows a narrowing price range over time, where price highs in an ascending wedge decrease incrementally, or in a descending wedge, price declines are incrementally smaller. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts.

Bookmark

-

Whipsaw

Slang for a highly volatile market where a sharp price movement is quickly followed by a sharp reversal.

Bookmark

-

Wholesale Price

Measures the changes in prices paid by retailers for finished goods. Inflationary pressures typically show earlier than the headline retail.

Bookmark

-

Working Order

Where a limit order has been requested but not yet filled.

Bookmark

-

Wsj

Acronym for The Wall Street Journal.

Bookmark

-

Xag/Usd

Symbol for Silver Index.

Bookmark

-

Xau/Usd

Symbol for Gold Index.

Bookmark

-

Xax.X

Symbol for AMEX Composite Index.

Bookmark

-

YER

Yemeni Rial. The currency of Yemen. It is subdivided into 100 fils.

Bookmark

-

Yemeni Rial

See YER.

Bookmark

-

Yen

See JPY.

Bookmark

-

Yield

Yield is the return on an investment and is usually expressed as a percentage.

Bookmark

-

Yuan Renminbi

See CNY

Bookmark

-

ZAR

Rand. The currency of South Africa. It is subdivided into 100 cents.

Bookmark

-

ZMW

Zambian Kwacha. The currency of Zambia. It is subdivided into 100 Ngwee.

Bookmark

-

ZWL

Zimbabwe Dollar. The currency of Zimbabwe. It is subdivided into 100 cents.

Bookmark

-

Zambian Kwacha

See ZMW.

Bookmark

-

ZigZag

A technical indicator that draws tops and bottoms - filtering out noise.

Bookmark

-

Zimbabwe Dollar

See ZWL.

Bookmark

Bookmarked Trading Term(s)

Cancel

Confirm