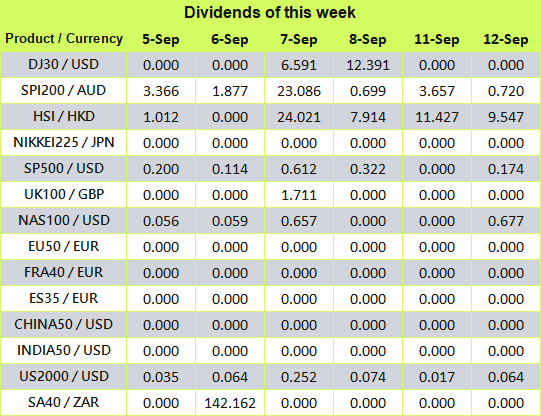

9.12 FX Daily GBP/USD

TOPICSFocus on GBP/USD today.

Fundamentally, UK is to release its latest August unemployment data on Tuesday. The previous PMI final value data for the manufacturing industry confirmed a downward trend, shrinking for the sixth consecutive month. If the job market shows weakness as well, although inflationary pressure decreases, the outlook for the UK economy may be interpreted as sluggish by the market.

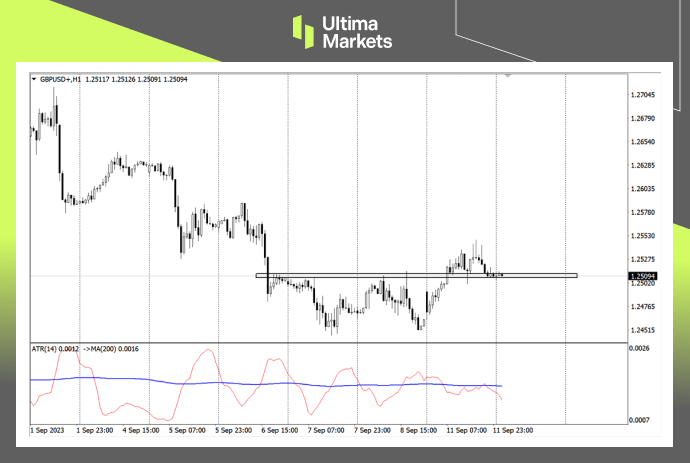

Technically, it can be observed from the weekly chart of the pound that although the random volatility indicator is still in a downward trend, the market is still trapped in the volatility range of the moving average group.

( Weekly chart of GBP/USD, source: Ultima Markets MT4)

The 5-week moving average suppressed the rebound in the exchange rate, while the 33-week and 65-week moving averages supported further downward movements in the market. There is still a possibility of further volatility in the market this week.

(Daily chart of GBP/USD, source: Ultima Markets MT4)

The short forces on the copper daily chart temporarily have the upper hand. The stochastic oscillator crosses downwards. Since the downward trend since early August has been a downward motive wave, there is a certain probability that the recent decline will continue the extended downward trend.

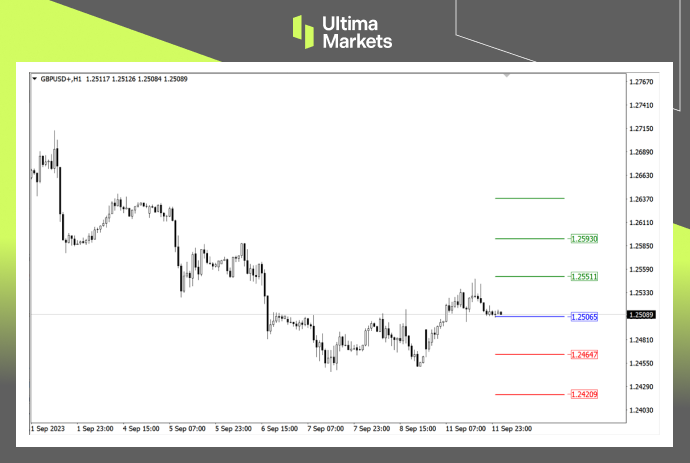

(1-hour chart of GBP/USD, source: Ultima Markets MT4)

On the daily chart, yesterday’s rebound in the market led to a random volatility indicator sending out a bullish signal, but due to yesterday’s K line being only a cross star, the upward momentum of the rebound may be limited. Even if the rebound continues, it is still necessary to conservatively look towards the resistance 1.25675.

(1-hour chart of GBP/USD, source: Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price on that day is 1.25065,

Bullish above 1.25065, with the first target of 1.25511 and the second target of 1.25930

Bearish below 1.25065, with first target 1.24647 and second target 1.24209

Disclaimer

Comments, news, research, analysis, prices and other information contained in this article can only be regarded as general market information, provided only to help readers understand the market situation, and do not constitute investment advice. Ultima Markets will not be responsible for any loss or loss (including but not limited to any loss of profits) that may arise from the direct or indirect use or reliance on such information.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4