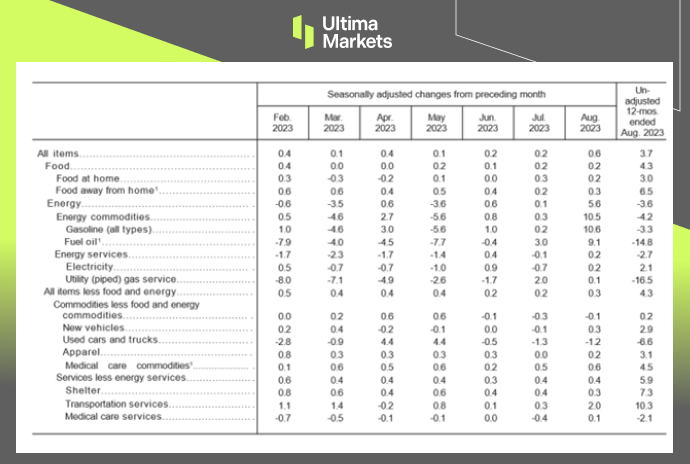

Main Point: ASX 200 Index’s Recent Decline

The ASX 200 Index tumbled 1.3% to below 7,000 on Sep. 22, hitting its lowest levels in six months and tracking losses on Wall Street overnight as the US Federal Reserve’s hawkish pause continued to weigh on investor sentiment.

The benchmark index is also on track to lose nearly 5% this week for its second consecutive weekly decline. Domestically, investors digested data showing Australia’s manufacturing activity contracted further in September, while services activity turned expansionary.

Impact on Key Sectors

Commodity-linked stocks led the decline with sharp losses from BHP Group (-2%), Rio Tinto (-2.3%), Fortescue Metals (-2.2%), Woodside Energy (-0.9%) and Newcrest Mining (-0.9%). Heavyweight financial, technology, and consumer-related firms slumped as well.

(ASX 200 Index daily chart)

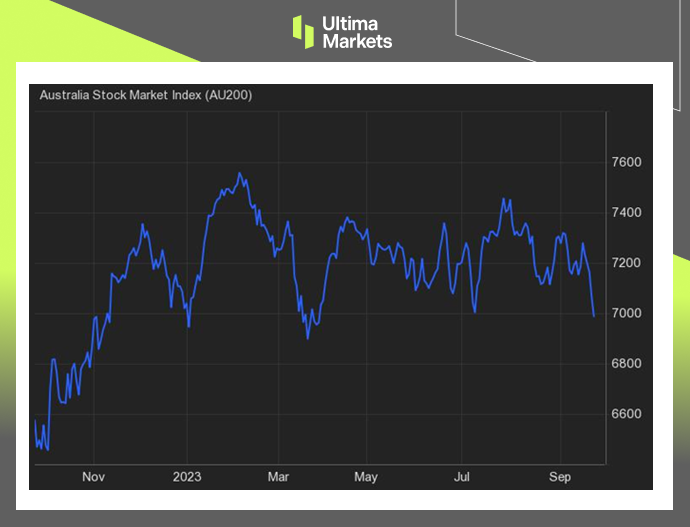

The Judo Bank Flash Australia Manufacturing PMI

The Judo Bank Flash Australia Manufacturing PMI fell to 48.2 in September 2023, from 49.6 in the previous month, flash estimates showed. It pointed to the lowest reading in 4 months, indicating continued deteriorating business conditions across the sector.

Inflation and Pricing Strategies

A sharper fall in new orders led to manufacturing output shrinking for a tenth straight month in September. Consequently, firms reduced their purchasing activity and inventory holdings.

That said, employment levels rose with some manufacturers still facing a shortage of labor to support ongoing operations. Staffing constraints also led to a marginal lengthening of lead times.

Input cost inflation eased amid the drop in purchasing activity, while firms also raised their own selling prices at a slower rate.

(Judo Bank Australia Manufacturing PMI, S&P Global)

Implications and Conclusion

In conclusion, the ASX 200 Index’s recent nosedive results from a complex interplay of domestic and international factors.

The US Federal Reserve’s hawkish stance, along with domestic issues, especially the manufacturing sector’s contraction, has deepened economic uncertainties.

While challenges persist, businesses have demonstrated resilience in adapting to the evolving landscape.

In this volatile market, comprehending the intricacies of the ASX 200 Index’s journey is vital for investors and analysts alike.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4