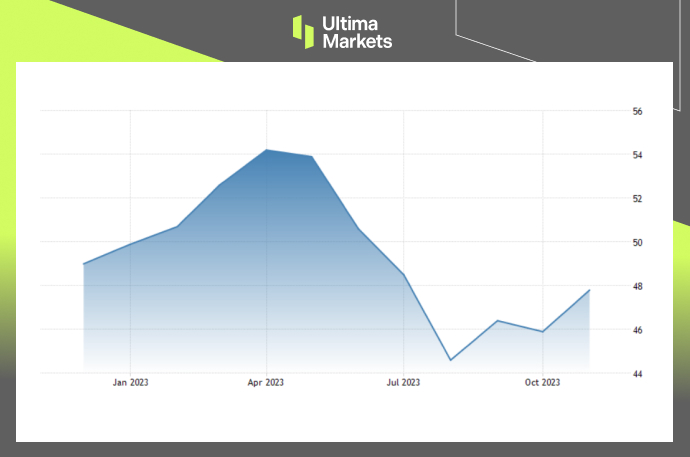

Germany Composite PMI: A Positive Turn Amidst Contraction

The HCOB Germany Composite PMI for November 2023 surpassed initial estimates, reaching 47.8, up from the preliminary 47.1 and the October reading of 45.9.

While the index indicates an ongoing contraction, it’s noteworthy that the pace of decline was the slowest in four months. Notably, signs of stabilization surfaced, particularly in the services sector. Manufacturing production also witnessed the smallest drop since May.

Despite the overall contraction, total new business and foreign new work experienced their least severe declines in five and seven months, respectively. This positive trend occurred despite a slight decline in employment.

On the pricing front, output charge inflation remained steady at October’s 32-month low, while input cost inflation accelerated. Business expectations, while improving for the second consecutive month, continue to remain cautiously optimistic.

(Germany Composite PMI,HCOB)

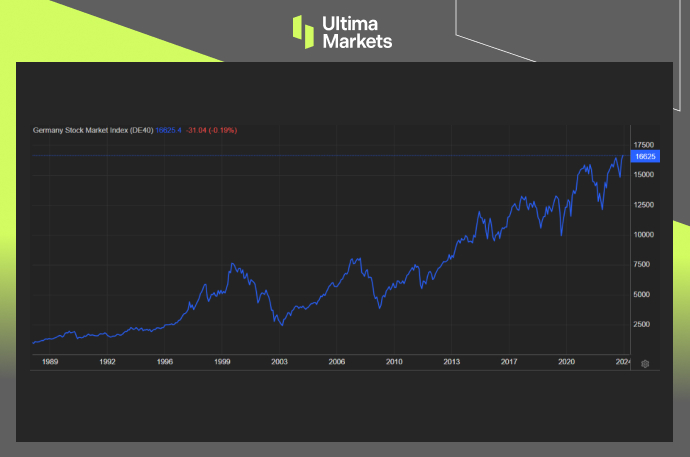

DAX Rally Propelled by ECB Dovish Notes

The DAX index witnessed a remarkable surge following a dovish shift in the European Central Bank’s (ECB) tone, particularly articulated by influential ECB board member Isabel Schnabel. Schnabel’s comments, suggesting a significant fall in inflation, signal a departure from previous inclinations toward interest rate hikes.

This shift in perspective has elevated expectations of a rate cut, with investors anticipating a reversal of the steepest increase in interest rates in the ECB’s quarter-century history.

Isabel Schnabel, a key figure in the conservative camp of policymakers, emphasized that policymakers should not commit to steady rates through mid-2024. This stance contrasts with her earlier support for rate hikes as a measure to counter high inflation.

The DAX responded positively to this shift, reaching an all-time peak of 16,656 before settling 0.75% higher. The November US private payrolls, falling below forecasts, further fueled hopes of central banks trimming rates ahead of schedule.

(DAX Index Historical Performance)

Frequently Asked Questions

Q1: What is the significance of the HCOB Germany Composite PMI?

A1: The HCOB Germany Composite PMI serves as a crucial economic indicator, reflecting the overall health of Germany’s private sector. Despite a reading below 50 indicating contraction, specific details within the index reveal nuances such as the pace of decline, stabilization signs, and sector-specific performance.

Q2: How did Isabel Schnabel’s comments impact the DAX index?

A2: Isabel Schnabel’s dovish remarks, signaling a notable decrease in inflation and a shift away from potential rate hikes, propelled the DAX index to record highs. The market responded positively, with investors anticipating a reversal of recent interest rate increases.

Bottom Line

Explore more about the DAX index, PMI data, Germany manufacturing, and other related topics in this comprehensive article tailored for those seeking in-depth insights into the current economic landscape.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4