Home Depot’s Strong Q3 2023 Performance

Home Depot (HD.US), the world’s largest home improvement specialty retailer, has experienced a significant boost in sales during the third quarter of 2023. This surge can be attributed to increased customer spending on repair work and small renovation projects.

The company’s revenue of $37.71 billion has slightly exceeded the anticipated $37.70 billion, showcasing a robust financial performance.

Home Depot’s Financial Overview

Earnings per share, on an adjusted basis, stood at $3.81, surpassing the forecast of $3.76. Despite a recent trend of declining same-store sales, Home Depot remains resilient in the face of challenges. The company projects a modest 3% to 4% drop in the current quarter, narrowing its previous forecast.

Increased interest rates, especially for mortgages, have affected the number of homes being built. According to government data, the number of home starts during the first nine months of this year was 12% lower than it was during the same time last year.

Home Depot’s Strategic Guidance

Richard McPhail, the CFO of Home Depot, noted that the current year represents a period of moderation in home improvement. However, he emphasized that Home Depot’s customers are financially sound, with income gains and wealth gains in recent years, along with excess savings. Despite the moderation, customers remain engaged in home improvement activities.

Fiscal Year 2023 Forecast

Home Depot has revised its guidance for the fiscal year 2023.

The earlier estimate of a 2% to 5% fall in revenue is revised to a prediction of a 3% to 4% decline compared to fiscal year 2022. The prior projection range of 7% to 13% now stands at a fall of 9% to 11% year over year for adjusted earnings per share.

A cash dividend of $2.09 per share for the third quarter has been issued by the corporation.

Stock Performance and Market Trends

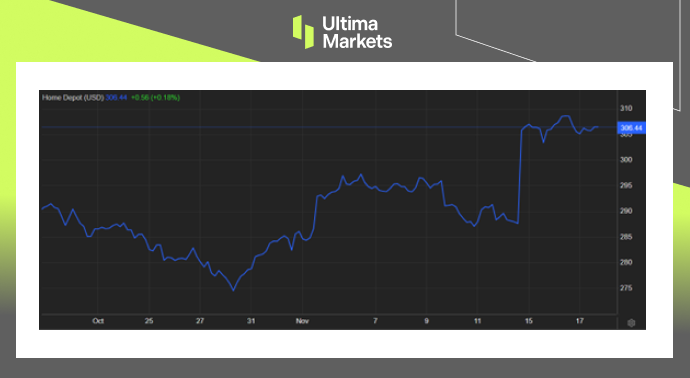

Despite a roughly 9% decline in Home Depot’s stock performance compared to the S&P 500 index this year, the company has experienced an upward trend, fueled by a broad-market rally.

Home Depot’s stock remains an intriguing option for investors, considering its historical strength in the home improvement retail sector.

(Home Depot Stock Performance One-month Chart)

Bottom Line

In conclusion, Home Depot’s Q3 2023 performance reflects its resilience in the face of challenges, offering investors a nuanced perspective on the home improvement retail sector.

Explore the intricate details of Home Depot’s financials, stock performance, and market trends to make informed investment decisions.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4