Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

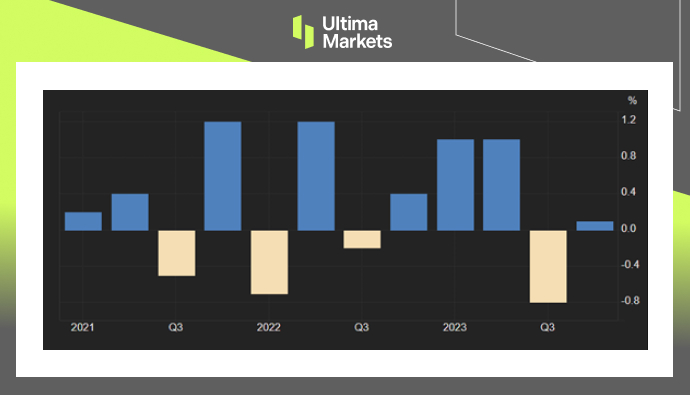

In the last quarter of 2023, Japan’s Gross Domestic Product (GDP) experienced an increase of 0.1% QoQ, contrary to the initial reports that predicted a 0.1% decrease, and the 0.8% decrease seen in the third quarter. The slight rise helped the economy avoid going into the predicted recession. Interestingly, this increment was supported by an unexpected rise in capital expenditure, which was 2.0% higher than that in earlier reports and Q3 data that reflected a 0.1% drop.

Moreover, the economy’s positive performance was enhanced by the net trade sector, given that exports, which increased by 2.6%, were stronger than imports that only increased by 1.7%. However, personal consumption, which constitutes over half of the economy, unfortunately, experienced a shrink for the third consecutive quarter at a rate of 0.3%. This was because of increased cost pressures and lingering global economic uncertainties.

A larger than anticipated reduction characterized government spending, falling 0.2% rather than the projected decrease of 0.1%. Previously, government expenditure had risen 0.3% in the third quarter. In the same manner, public investment had a sharper contraction of 0.8%, going beyond the forecasted 0.7% decrease. A pullback of 1.0% has already been recorded in public investment during the third quarter.

The most recent statistics have strengthened conjectures that the Bank of Japan may commence policy tightening soon, with some speculators betting on a rate increase in March. Junko Nakagawa, a member of the BOJ board, recently announced that the outlook for the economy to reach a beneficial cycle of inflation and wages is perceivable. From an external perspective, the yen gained from depreciation in the greenback and Treasury yields due to a mild perspective on the Federal Reserve’s monetary protocol. The value of the Japanese yen strengthened, surpassing the 147 mark against the U.S. dollar, attaining its highest exchange rate in more than a month.

(GDP Growth Rate QoQ%, Japan Cabinet Office)

(USDJPY Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4