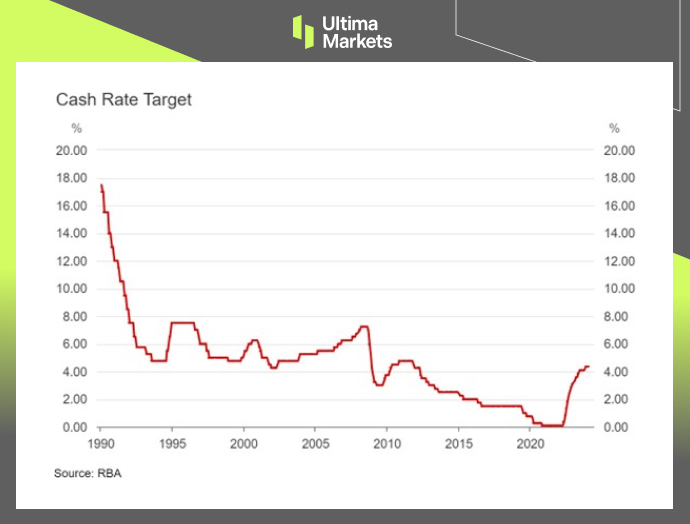

The RBA board previously met 11 times a year, except January, to decide on interest rates. From this year, they will meet eight times only. During its first monetary policy meeting of 2024, the Reserve Bank of Australia elected to leave official cash rates unchanged at 4.35 percent, a widely anticipated decision given cooling inflationary pressures.

This status quo decision follows 425 cumulative basis points worth of interest rate hikes enacted by the central bank over the past two years to rein in the breakaway inflation unleashed in the wake of the COVID pandemic. While noting mounting evidence of moderating cost and supply-side pressures, the RBA observed that stubbornly high services inflation meant overall price growth remains uncomfortably above target.

Although further policy tightening remains on the table should incoming data warrant such action, RBA officials emphasized that the exact trajectory of rates will hinge on the evolving inflation and employment outlook alongside updated risk assessments of the expansion’s durability. Policymakers stressed the necessity of inflation convincingly returning sustainably to the 2-3 percent target range in 2025 before consolidating around the mid-point in 2026 as a precondition for eventual policy normalization.

In concluding its statement, the RBA committee pledged consistent vigilance in tracking trends in the global economy, domestic demand, the labor market, and especially inflation to inform appropriate steering of monetary policy over the medium-term horizon.

The Australian dollar edged up to around $0.65 following the RBA’s decision, marking a small recovery from its lowest point in 11 weeks. However, the Aussie’s gains were limited by a strengthening US dollar, as upbeat US economic data and hawkish comments from the Federal Reserve reduced hopes of future interest rate cuts in the US.

(RBA Cash Rate for 3 Decades)

(AUDUSD Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4