On Tuesday, a softer-than-expected rise in US producer prices in July, up 0.1% against estimates of 0.2% eased dollar. The Dollar Index dipped 0.51%, closed at 102.6 against other major currencies. The higher goods costs offset by more affordable services, signaling a continued moderation in inflation. This led to a rally in Treasuries, driving tiled down in response to the PPI report.

(US Dollar Index Daily chart)

The modest 0.1% month-on-month rise in the final demand PPI, along with the unchanged core PPI for July, may not be as positive as it seems at first glance. Nevertheless, it remains consistent with the Fed’s preferred core PCE price index, indicating an annualized increase at a pace below 2%.

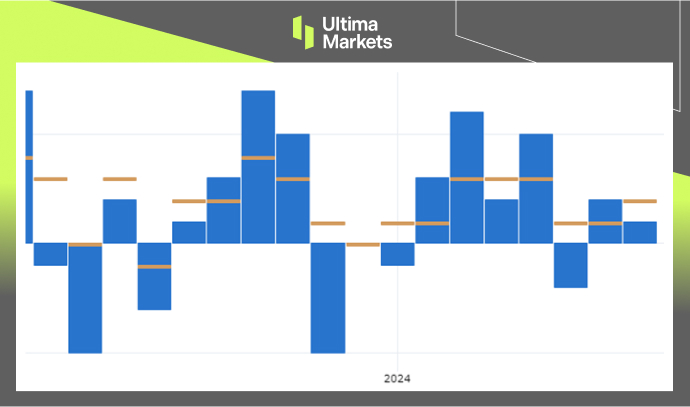

(US PPI m/m data)

More importantly, the consumer price index report on Wednesday will serve as a pivotal indicator, guiding the Federal Reserve’s decisions on interest-rate policy. The data will provide crucial insights into whether inflationary pressures are persisting or subsiding, influencing the trajectory of future rate adjustments.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server