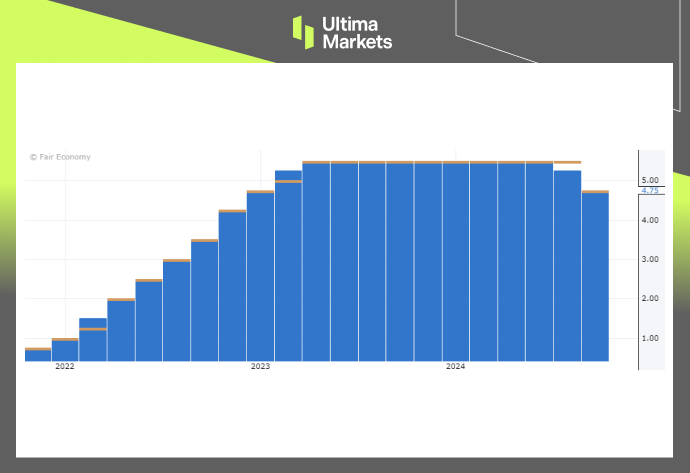

On Wednesday, New Zealand’s central bank cut interest rates by 50 basis points and maintained that policy remains restrictive, despite inflation returning to target levels. This decision prompted markets to anticipate further aggressive easing, leading to a sharp decline in the New Zealand dollar. The reduction of the cash rate to 4.75% was in line with market expectations and the majority of economists’ forecasts. As a result, NZDUSD dropped 1.23%, closing at 0.6062.

(Reserve Bank of New Zealand’s Official Cash Rate, Source: Forex Factory)

(NZDUSD Daily Price Chart, Source: Trading View)

New Zealand’s rate cuts are in line with similar moves by central banks globally as policymakers unwind their aggressive tightening measures aimed at combating inflation. The Federal Reserve, for instance, reduced rates by an outsized 50 basis points at its last meeting in September. However, Australia, New Zealand’s neighbor, remains an outlier in this easing trend, as policymakers there have stated that restrictive conditions must persist longer to tame inflation.

“The Committee agreed that it is appropriate to cut the official cash rate by 50 basis points to achieve and maintain low and stable inflation, while avoiding unnecessary volatility in output, employment, interest rates, and the exchange rate,” the central bank noted in its policy statement. The October meeting further underscored the bank’s dovish stance, signaling no clear indications of slowing down in November. With inflation within the target range and a fragile labor market, the RBNZ is expected to ease rates more rapidly.

“The New Zealand economy now has excess capacity, encouraging price and wage-setting behavior to adapt to a low-inflation environment. Lower import prices have also contributed to disinflation,” the RBNZ statement added. Some economists are now forecasting an even larger 75 basis-point cut in November, compared to earlier expectations of 50 basis points, citing the extended gap between policy reviews from November to February as a factor in why the cash rate may not need to remain so restrictive.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server