Recent report revealed that Tesla managers was being asked to identify their subordinates’ position which were critical to their operations, fuelling speculation for a massive layoff in the company. The query, which was sent out to managerial levels soon after Tesla cancelled bi-annual performance review for some of its employees.

The report came as the company faces stiff competition in the global market and softening demand for electrical cars. According to a separate report, Tesla sold only one unit in South Korea last month as consumers casts their doubt on its quality of production.

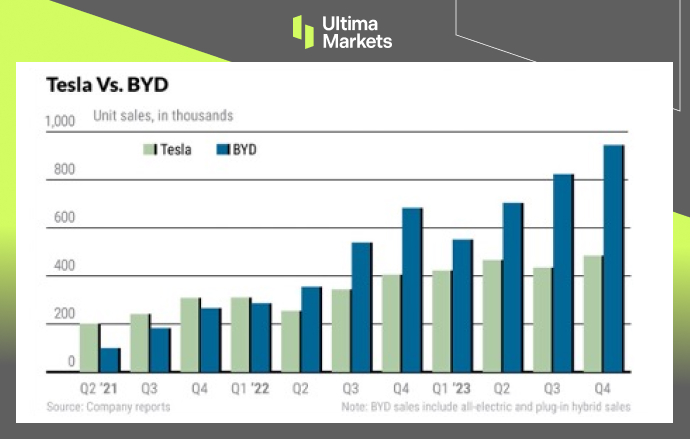

Moreover, Tesla faces immense competition in their biggest market potential – China as their main rival, BYD continues to see solid vehicle sales growth. Despite efforts from Tesla in reducing the selling price for a third of their offerings, BYD reported solid sales growth, with its figure growing more than double. Tesla’s sliding market share is alarming, with analysts downgrading their rating and target price for its stock.

(Comparison of unit sales between Tesla and BYD)

Comparatively, Tesla reported deep earnings slump in Q4 2023, with CEO Elon Musk warned for a “notably lower” growth in 2024. On the other hand, BYD came in strong in terms of delivery, albeit missing earnings expectation due to large price cuts. For the time being, due to bleak outlook and immense price war within the electric car industry, we may see further divergence in both company’s performance due to varying targeting strategy and approach.

As of writing, Tesla share price ticks up 0.02% to 187.62 during after-hours trading session.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server