U.S. Non-Farm Payrolls Data Exceeds Expectations

TOPICSTags: FED, NFP, Payroll, Powell, Unemployment Rate

NFP Report Signals a Pause in Fed Rate Cuts

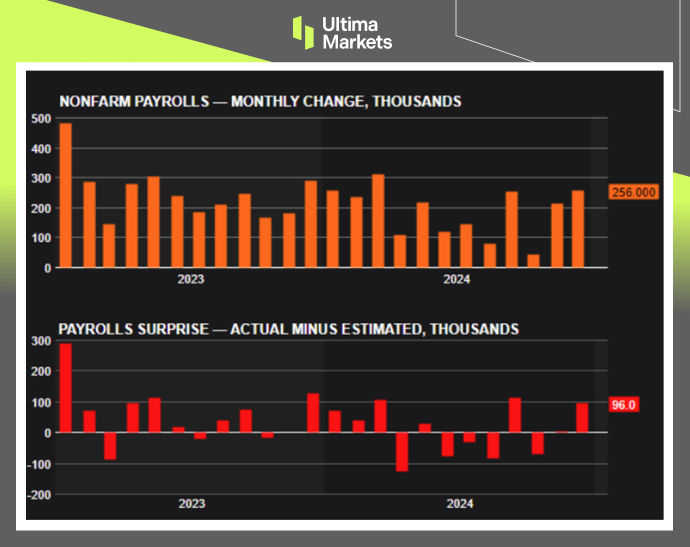

Last Friday, data from the U.S. Bureau of Labor Statistics showed that the U.S. economy added more jobs than expected in December, and this increases chances of the Federal Reserve not lowering interest rates during its next policy meeting.

The jobs market created 256,000 new jobs in December which is greater than the economists’ expectation of 160,000. The number for November was however revised downwards to 212,000. The unemployment rate also improved to 4.1% from expectations of 4.2%. Against the background of the increase in the proportion of employed in the U.S. to the working-age population, growth in average hourly earnings of 0.3% was recorded in December after a higher appraisal of 0.4% in November. Wages grew by over the year by 3.9%, somewhat moderate than in November where there was an increase of 4 percent.

(Source: U.S. Non-Farm Payrolls Data, LSEG DataStream)

The strong December payroll statistics reduce the need for the Federal Reserve to raise interest rates substantially more than the previous meeting minutes suggested. The U.S. rate futures market fully priced in a pause in the Fed’s easing cycle for the January meeting, after publication of data, according to LSEG estimates. The current expectations are only 27 basis points (bps) of easing further in 2025 which amounts to one rate cut with the first during the June meeting.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server