August ISM Surprise: A Perspective On Economic Fireworks

THEMENAugust Service ISM Surged, Heating up Concerns Over Inflation

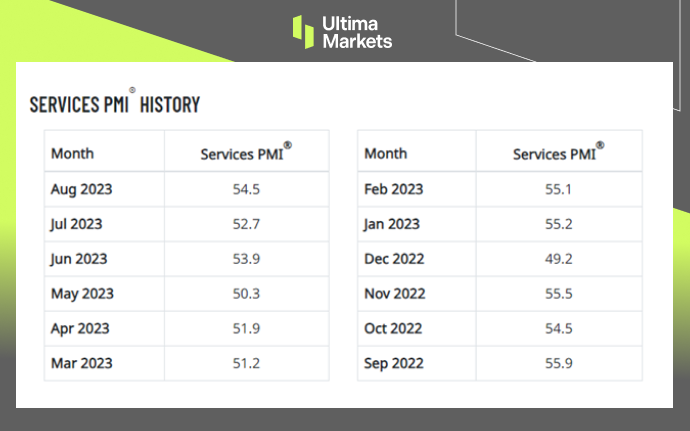

The Institute for Supply Management released the ISM services index for August, which showed a recovery in business activity. The index unexpectedly rose to 54.5 from market expectations of 52.5, up from 52.7 in July and reaching a six-month peak.

From the analysis of the service industry portfolio, as many as 13 of the 18 industries surveyed by the ISM non-manufacturing industry have increased.

Industries such as catering and accommodation, real estate leasing, construction, retail, transportation and warehousing have shown steady expansion of new order demand and willingness to recruit.

The service industry data was better than expected, driving up treasury yields, meanwhile, putting pressure on stock markets. The three major U.S. stock indexes all ended in decline.

The ISM Non-Manufacturing Index profile

The ISM Non-Manufacturing Index is a comprehensive indicator that tracks non-manufacturing activities such as employment trends, prices, new orders and other sub-items.

The index takes 50 as the critical point. If the index is at 50, it means that the economy of this month remains unchanged from the previous month; if the index is above 50 for several consecutive months, it indicates that non-manufacturing activities are expanding and prices are rising, implying that the overall economy is in expanding state.

On the contrary, when the index is below the 50 level, it means that the overall economy is in a state of contraction.

(Service PMI, Institute for Supply Management ISM)

Conclusion

The August ISM services index report has introduced a level of unpredictability and excitement to the financial landscape. It’s not just a data report; it’s a narrative, a story with twists and turns that continue to unfold.

To stay updated on this ever-evolving economic drama and gain access to expert analysis, make sure to follow our platform closely. We offer the key to unraveling the complex world of finance and economics, providing you with a structured approach to understanding the latest developments.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server