Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Understanding Japan’s Inflation and Its Impact on the Yen

With easing policy, Yen sets to depreciate

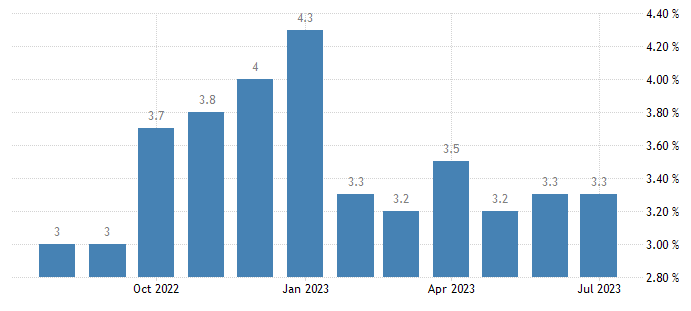

Japan announced the latest July core CPI annual rate excluding fresh foods rose 3.1% year-over-year, slightly down from 3.3% in the previous month.

The figure matched with the Bank of Japan’s expectation. The slowdown is linked to lower energy prices, especially data from the Tokyo region showing a slight deceleration in inflation.

(Japan’s inflation level in the past year)

A Cautious Approach by the Bank of Japan

The BOJ’s holding back on raising rates makes a sharp contrast to its peers. The Bank of Japan has taken steps to curb potential economic risks, including allowing long-term government bond yields to rise to 1%. However, the monetary policies have not prevented the yen from depreciation.

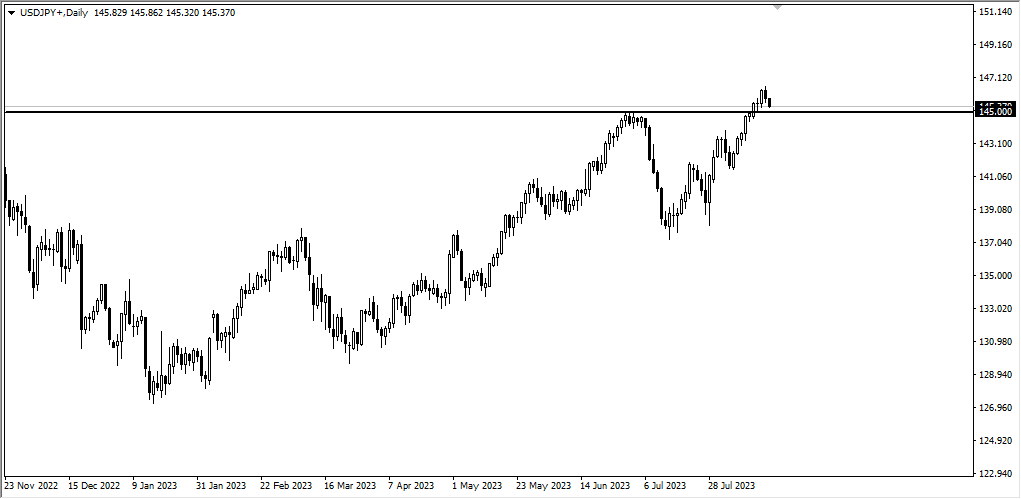

The USD/JPY Exchange Rate

The exchange rate of USD/JPY began to fall in the past two days but remained above the high of 145. Over time, Japan’s low rate could lead to capital outflows, putting downward pressure on the yen.

(USD/JPY daily cycle, Ultima Markets MT4)

External Factors at Play

The future of the yen is not solely determined by Japan’s economic policies. External factors, such as global crises or recessions, can play a crucial role in shaping the currency’s fate. A crisis or recession might deter further rate cuts, yet the strength of the U.S. economy reduces this possibility.

A Turning Point at 150

Although the Japanese government could intervene the yen’s depreciation, its long-term course might remain unchanged. 150 marks a turning point. If USD/JPY rises above it, the Bank of Japan is expected to step into the market.

The Ongoing Tug-of-War

In summary, Japan’s inflation levels and the state of the global economy continue to be key determinants in the yen’s value. Under the current circumstances, the Bank of Japan’s easing policy is likely to support the trend of yen depreciation.

However, it’s essential to remember that external factors can still bring about short-term changes in this delicate balance.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server