Key Indicators and Market Impact Jobless Claim

Decline in Jobless Claims

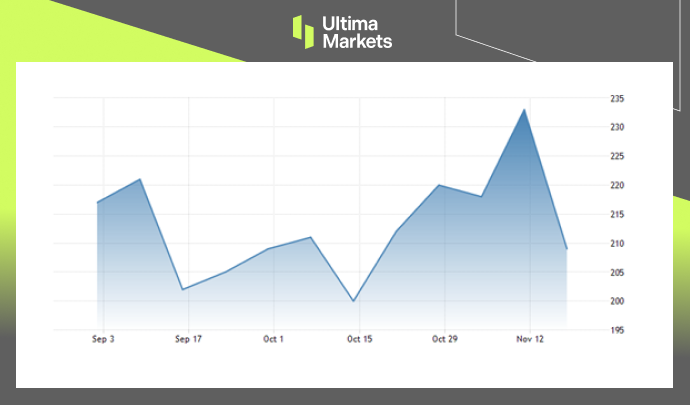

The United States Department of Labor’s most recent statistics shows a notable decrease in unemployment claims for the week ending November 18. Unemployment claims fell to 209,000, below market forecasts and reversing a three-month high from the week before.

Continuing claims, measuring ongoing unemployment, also plummeted by 22,000 to 1,840,000, rebounding from a two-year high reported in the last labor market update.

(Initial Jobless Claims, United States Department of Labor)

US Dollar Holds Gains

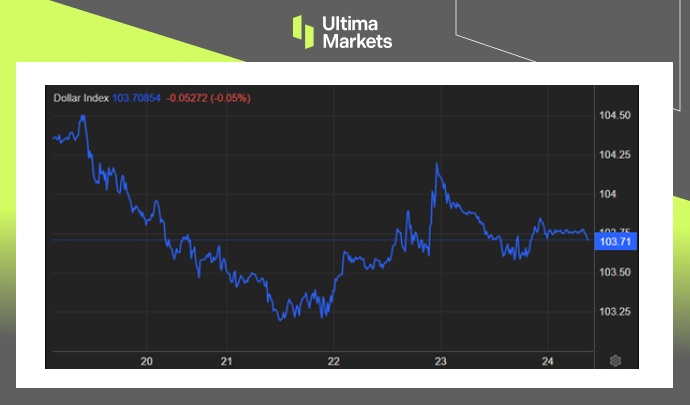

Simultaneously, the U.S. dollar showcased strength for a second consecutive session, propelling the dollar index above 104 levels. This resilience is noteworthy, especially during subdued market activity in Japan and the U.S. due to holiday periods.

Recent data suggests the Federal Reserve may not be inclined to cut interest rates in the near future, further supporting the dollar’s gains.

(Dollar Index Weekly Chart)

Inflation Expectations on the Rise

One-year-ahead inflation expectations surged to 4.5% in November, according to the University of Michigan’s final consumer survey reading. This 7-month high, up from preliminary estimates and October figures, contributes to the argument for maintaining current interest rate levels.

Federal Reserve’s Policy Implications

The positive jobless claims data indicates that the anticipated labor market slowdown has not materialized. Consequently, the Federal Reserve is likely to uphold its current stance on interest rates.

There’s a potential for further tightening in the future to fortify economic stability, reflecting the cautious approach to monetary policy.

Economic Outlook and Market Trends

Robust Jobless Claims and Labor Market Resilience

Despite concerns of a slowdown, robust jobless claims figures underscore the resilience of the U.S. labor market. This data showcases a workforce that continues to weather economic challenges, laying the groundwork for sustained economic growth.

Impact on Dollar Index and Global Rates

The dollar’s ascent, evident in the index surpassing the 104 levels, carries implications for global rates. The market’s perception of the Federal Reserve’s reluctance to cut interest rates contributes significantly to the dollar’s strength, influencing global economic dynamics.

Frequently Asked Questions

Q: How significant is the drop in jobless claims?

A: The drop of 24,000 in jobless claims is substantial, signaling a robust labor market and defying expectations.

Q: What does the rise in inflation expectations mean for the economy?

A: The increase in inflation expectations to 4.5% suggests growing confidence in economic stability, contributing to the dollar’s resilience.

Q: How might the Federal Reserve respond to these developments?

A: The Federal Reserve is likely to maintain its current stance on interest rates, with potential future tightening to support economic stability.

In conclusion, the recent decline in jobless claims and the dollar’s resilience paint a positive picture for the U.S. economy. The Federal Reserve’s careful monitoring of these developments will play a crucial role in shaping future monetary policy.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4