Focus on GBP/USD today.

Fundamentally speaking, the BoE and Fed are heading for a showdown now, and this is the only factor that affect the exchange rate between the two. First, the BoE tightening policy has not yet been clarified, While the Fed’s rate hike has come to an end. Second, although the probability of the Fed’s raising rates in 2023 has decreased, any positive economic data may trigger Fed’s move again, resulting in an elevated USD.

Before the BoE’s MPC meeting and the US’s nonfarm payrolls due this week, the GBP/USD is dominated by market sentiment in the short run. It is necessary to alert of any technical breakthrough.

Technically speaking, the GBP/USD daily cycle is about to approach the 65- day moving average, and the stochastic oscillator has also entered the oversold zone.

(GBP/USD daily cycle, Ultima Markets MT4)

It is still too early to say that the bear is gone for GBP, so you must stay alert.

(GBP/USD 4 -hour cycle, Ultima Markets MT4)

In the 4- hour period, the exchange rate has fallen to the upward trend line, while the stochastic oscillator indicator shown divergence signals. As a result, a short-term rebound is expected.

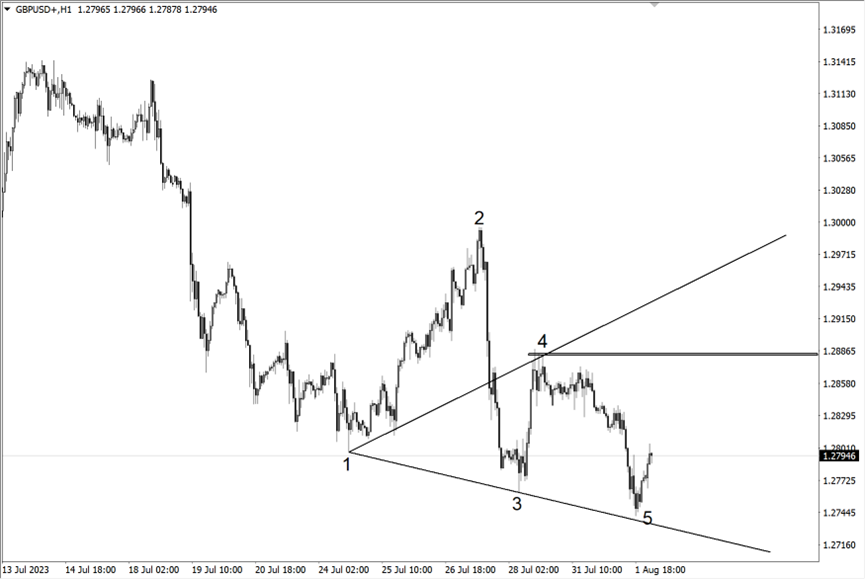

(GBP/USD in 1- hour period, Ultima Markets MT4)

In 1- hour period, the price action shows a clear Wolfe wave pattern. Point 3 is below point 1, as point 4 retreats to the price range between point 2 and point 3, and point 5 rebounds upward after falling to the line connecting point 1 and point 3. In the short term, GBP/USD has a certain chance of rebounding. The first target looks at the level of point 4, and the second target looks at line connecting point 1 and point 4 .

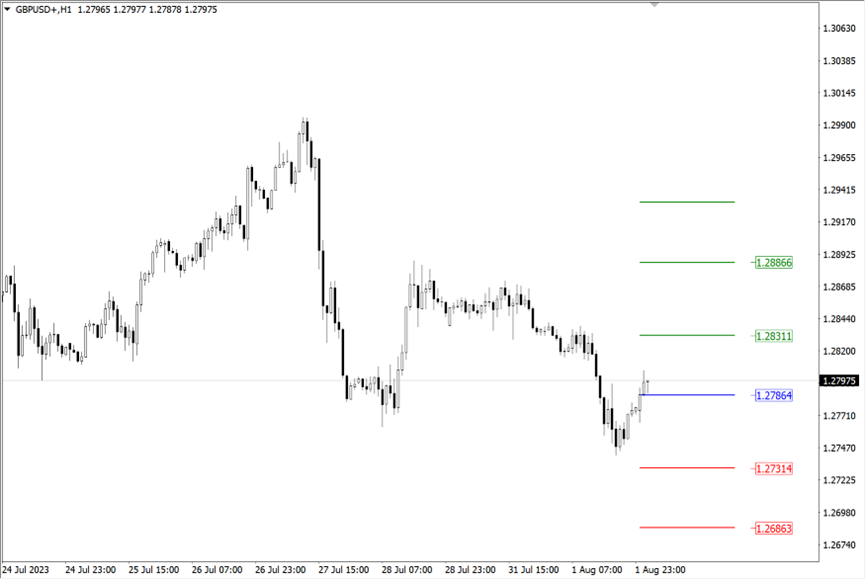

(GBP/USD in 1- hour period, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price is 1.27864,

Bullish above 1.27864, the first target is 1.28311, and the second target 1.28866.

Bearish below 1.27864, the first target is 1.27314, and the second target 1.26863.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4