The Impact of BoE’s Interest Rate Hike on the Pound and the Economy

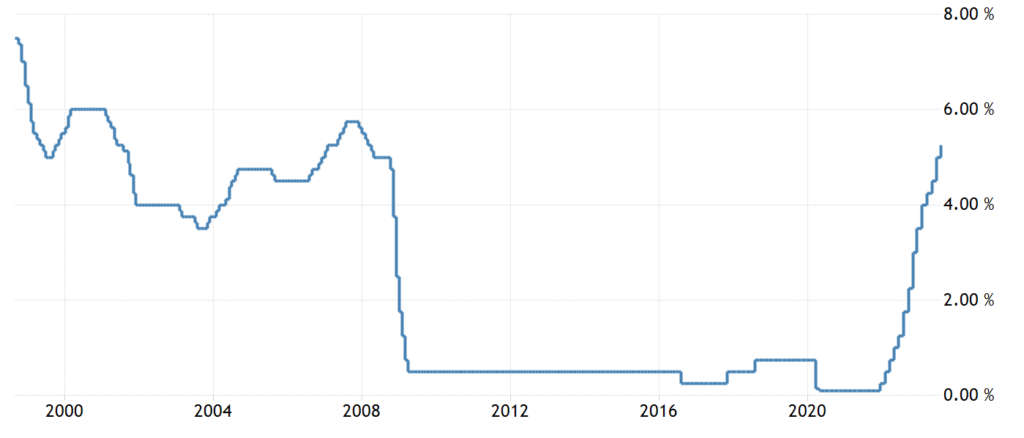

To combat inflation, the BoE makes its 14th move to raise interest rates by 25 bps, marking a new high of 5.25% since 2008.

(UK Interest rates in the past 25 years)

(BoE briefing in Aug.)

BoE’s Battle Against Inflation

BoE’s consecutive 25bps rate hikes made the market no longer optimistic on the future, lowering the estimate from 5.74% to around 5.68%. Meanwhile the pound came under pressure. BoE has repeatedly emphasized its view that the British economy would not head for a recession and revised the GDP growth rate for 2023 from 0.25% to 0.5% in May.

Heavy Borrowing Costs

High rates mean heavy borrowing costs, putting pressure on mortgage borrowers. Tenants also suffer as homeowners pass on their additional burden. The average two-year mortgage rate in the UK is now close to 7%. The future economic status will need to be verified by further data.

(4-hour graph of GBP/USD)

GBP/USD’s Reaction

Technically, GBP/USD gains upward space after interest rate hikes. In the 4-hour period, the price action shows a clear Wolfe wave.

Point 3 is below point 1, point 4 retreats to the price range between point 2 and point 3, and point 5 rebounds upward after falling to the line connecting point 1 and point 3 yesterday.

In the short term, GBP/USD has a certain chance of rebounding. The first target is at point 4, and the second target is the line connecting point 1 and point 4.

Conclusion

In conclusion, the Bank of England’s interest rate hike has introduced various challenges and opportunities in the financial landscape.

With the pound’s fluctuations, the burden on borrowers, and the technical patterns in GBP/USD, the economic impact of this decision will continue to unfold.

It’s imperative for individuals and businesses to stay informed and make well-informed financial decisions in this evolving landscape.

Disclaimer

Comments, news, research, analysis, price and all information contained in the article only serve as general information for readers, and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4