With easing policy, Yen sets to depreciate

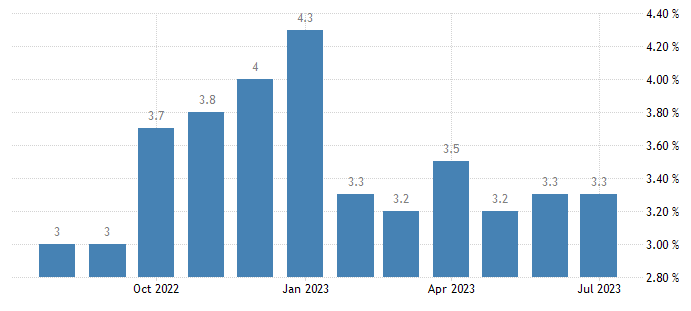

Japan announced the latest July core CPI annual rate excluding fresh foods rose 3.1% year-over-year, slightly down from 3.3% in the previous month.

The figure matched with the Bank of Japan’s expectation. The slowdown is linked to lower energy prices, especially data from the Tokyo region showing a slight deceleration in inflation.

(Japan’s inflation level in the past year)

A Cautious Approach by the Bank of Japan

The BOJ’s holding back on raising rates makes a sharp contrast to its peers. The Bank of Japan has taken steps to curb potential economic risks, including allowing long-term government bond yields to rise to 1%. However, the monetary policies have not prevented the yen from depreciation.

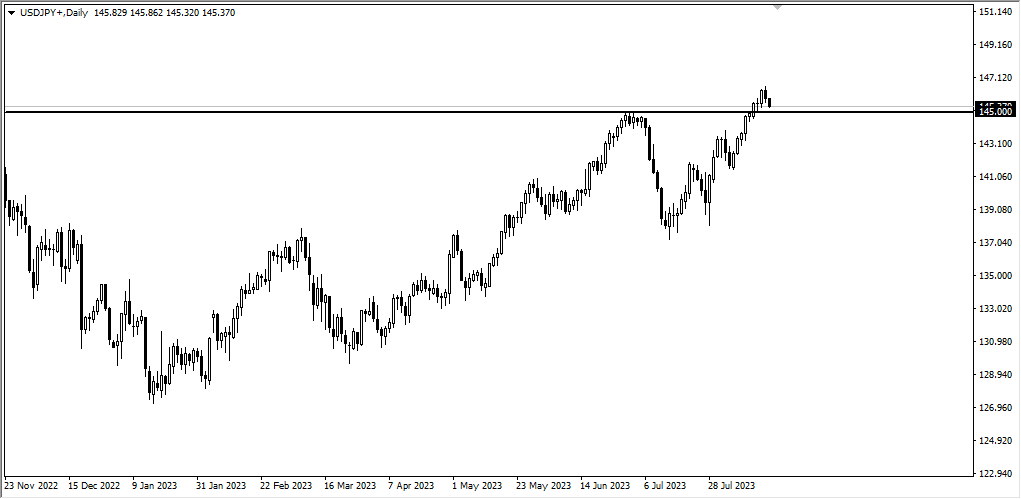

The USD/JPY Exchange Rate

The exchange rate of USD/JPY began to fall in the past two days but remained above the high of 145. Over time, Japan’s low rate could lead to capital outflows, putting downward pressure on the yen.

(USD/JPY daily cycle, Ultima Markets MT4)

External Factors at Play

The future of the yen is not solely determined by Japan’s economic policies. External factors, such as global crises or recessions, can play a crucial role in shaping the currency’s fate. A crisis or recession might deter further rate cuts, yet the strength of the U.S. economy reduces this possibility.

A Turning Point at 150

Although the Japanese government could intervene the yen’s depreciation, its long-term course might remain unchanged. 150 marks a turning point. If USD/JPY rises above it, the Bank of Japan is expected to step into the market.

The Ongoing Tug-of-War

In summary, Japan’s inflation levels and the state of the global economy continue to be key determinants in the yen’s value. Under the current circumstances, the Bank of Japan’s easing policy is likely to support the trend of yen depreciation.

However, it’s essential to remember that external factors can still bring about short-term changes in this delicate balance.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4