You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

Why the Nikkei 225 Index Surpassed Expectations in 2023?

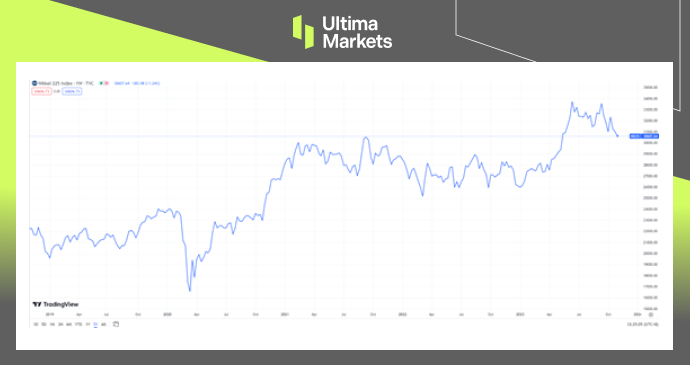

When it comes to the Japanese economy, that clichéd comment always pops up in our mind: “The Lost Decades“. Since the collapse of the bubble economy in the 1980s and 1990s, the Nikkei 225 Index has been sluggish.

Especially when the COVID-19 epidemic broke out a few years ago, the Index once fell to a low of more than 16,000. Everything seems to indicate that the “lost decades” of Japan’s economy will continue.

The Nikkei 225’s Remarkable Journey

The Nikkei 225 index, however, defied all logic by making a turnaround just after it hit bottom at the beginning of the recession.

This year, on 19th of May, the Nikkei 225 index went beyond 30,800 points, achieving its highest level since 1990. That said, the Japanese stock market has kept rising ever since. It was as high as 33,000 just in June, beating most stock markets throughout the globe.

Why has the Japanese stock market, which has been in the doldrums for many years, been able to come back to life and continue to rise this year? After this round of surge, can the Nikkei 225 Index further continue its rise in the future? This article will take you to find out.

The low financing cost of Japanese Yen

The exchange rate is usually crucial to a country’s stock market. For many non-U.S. currencies, once the domestic currency exchange rates against the U.S. dollar rise, the stock market prices will rise accordingly.

China’s A-shares are a typical example. Once the RMB exchange rate against the U.S. dollar rises, the performance of A-share market will tend to start an upward trend. But Japan’s stock market is exactly a counterexample.

In the past five years (as of the time of writing), the exchange rate of the Japanese yen against the US dollar has fallen by approximately 23.75%, but the Nikkei 225 index has increased by approximately 38%, obviously showing a negative correlation.

The reasons for this phenomenon mainly lie in two aspects:

- Extremely low financing cost of Japanese Yen

- Continuous inflow of foreign capital into Japan’s stock market

Since it is widely known that, following Japan’s economic bubble burst some thirty years ago, the BoJ has been engaged with slack monetary policies for quite some time in an endeavor at reviving market sentiment.

It is clear that for so many years the Bank of Japan’s efforts to rehabilitate the market have gone unnoticed. However, those efforts helped to maintain Japan’s incredibly low-interest rates and finance costs.

By lowering interest rates and purchasing government bonds, the Bank of Japan has effectively kept funding costs down. This means that businesses and investors can obtain funds at a lower cost, stimulating investment activity and increasing market liquidity.

Low financing costs also provide companies with more room for capital returns, thus creating a basis for stock market gains.

Yet, it is no hidden secret that the Japanese yen has a very low cost of financing. This rate has been relatively low over multiple decades. So, the low financing rate by itself is definitely insufficient to justify the reason why the Nikkei 225 Index has shot up in the past few years. This leads to the second reason: the inflow of foreign capital.

Foreign Capital Inflow: Shaping Market Dynamics

Foreign capital accounts for more than half of the trading volume in the Japanese stock market, and the flow of foreign capital has an important impact on the Japanese stock market.

The internationalization of Japan’s securities market started early: Since the revision of the Foreign Exchange Law in 1980, Japan has relaxed restrictions on bond investment by non-residents; in 1989, foreign capital was allowed to set up funds for investment; in 1992, the threshold was significantly lowered further, which greatly facilitated foreign investment.

Subsequently, the number and transaction volume of foreign investors continued to increase. As of 2021, the number of foreign investors in Japanese exchanges has risen to about 30%, and the trading volume of foreign investors has exceeded 60%.

Since 2005, foreign investors’ purchases of Japanese domestic equity securities have shown obvious synchrony with the trend of the Nikkei 225 Index. This shows that the movement of foreign capital affects the performance of the Japanese stock market to a great extent.

The “Buffett Effect” boosts Japanese stock market valuations

The topic pertaining to foreign capital inflows should also not miss mentioning Buffett’s effect. Increasingly, foreign institutions that are associated with Buffet have improved their positions in Japan’s shares, which makes the Nikkei 225 Index grow.

Already, in the opening years of the pandemic outbreak at this point (in 2020), Buffett had started buying equity shares in the country’s five leading exchange bodies. For example, during his speech in early May this year at a Berkshire Hathaway shareholder meeting, even Buffett declared these five companies to be “smart, big” and that they operate “intelligently”.

Everyone knows that Buffet is a “value investor” and a long-time investor in stocks with low prices. Buffet’s value investing entails screening for highly profitable firms, reliable cash flows, solid profitability records as well as outstanding leadership.

Today, though Buffet continues to put more of his investment into Japanese companies and he views this as among the markets with great prospects for investment ventures. No doubt, this has attracted more market attention and enhanced the trend in the Japanese equity market.

First of all, Buffett’s investment behavior is seen as an endorsement of Japanese companies to some extent. This will increase investors’ confidence in these Japanese-listed companies, thereby driving up stock prices.

Secondly, Buffett is led by long-term investment, and his investment behavior demonstrates his confidence in the long-term growth potential of the company. This long-term investment concept has a positive impact on encouraging investors to maintain a patient and persistent investment attitude.

After seeing Buffett’s success in the Japanese market, investors also tend to adopt a longer-term investment strategy and hold stocks with more confidence, which in turn steadily promotes the rise of the stock market.

Can the Nikkei 225 Index continue its rise in the future?

Short-term funds may raise the trend for any country’s stock market in the short run, but the long-term success of a stock market depends on its fundamentals; therefore, the fundamentals of the Japanese stock market are no exception.

However, the Japanese economy has long faced a problem, that is, the existence of a large number of “zombie companies” that has hindered economic development. The so-called zombie companies refer to those companies that have stopped production, semi-stopped production, suffered losses for consecutive years, or are insolvent.

They mainly rely on government subsidies and bank loan renewals to survive and operate. Since the Japanese economic bubble thirty years ago, the Bank of Japan has fueled bail-outs to a large number of companies in order to save the market, which has led to the existence of a large number of zombie companies.

On September 21 this year, Toshiba, a former symbol of Japan’s manufacturing industry and with a history of 150 years, was officially delisted. Many people believe that the collapse of Toshiba, a famous Japanese company, seems to mean that Japan’s manufacturing industry is losing its last fig leaf. But if we look at it from another perspective, we may have a completely different feeling.

Toshiba’s decline has actually been foreshadowed for a long time. As early as more than ten years ago, Toshiba’s operating income had been declining year by year. In this regard, Toshiba can only continue to “shut down departments” to survive.

In 2015, Toshiba sold its image sensor business to Sony; in 2016, it sold its home appliance business to Midea; in 2017, it sold its TV business to Hisense; in 2018, it sold its computer business to Sharp; in 2022, it sold HVAC business to Carrier.

It can be said that Toshiba is no longer a star representative of the Japanese economy, but is increasingly looking like a typical zombie company. If zombie companies like Toshiba can successfully delist, then for the Japanese market, it will be more like creating a new atmosphere.

This is just like investors in China’s A-shares market often complain that China’s stock market cannot usher in a bull market because of the lack of a reasonable delisting mechanism, which has led to many junk-listed companies dragging down the performance of A-shares.

With Toshiba’s delisting, Japan seems to have taken a step ahead of A-shares in this regard and has begun to take the initiative to clear out zombie companies.

In addition to eliminating the remains of the old era, Japan seems to be paying more and more attention to cultivating the “unicorns” of the new era. During the “lost decades”, Japan has been criticized for its lack of innovative unicorns.

As of the first quarter of this year, among the 1,026 unicorn companies in the world, Japan, the world’s third largest economy, only has six companies.

Nikkei 225 New Horizons: Nurturing Innovation

But all this seems to be changing. The past year 2022 was called the “Year of Entrepreneurship” in Japan. According to research by KPMG, Japanese startups raised a total of 877.4 billion yen in 2022, a record high.

At the same time, these funds are not concentrated in traditional industries, but have poured into emerging industries such as the Internet, financial technology, new energy, and blockchain.

Driven by the new trend, Japan’s GDP in the second quarter of this year grew by as much as 6% year-on-year. Although it was later revised to 4.8%, this is still a very impressive result for a developed economy.

Of course, just one-quarter GDP growth is certainly not enough to prove that the Japanese economy has completely escaped the lost decades. Moreover, such achievements are mainly achieved by relying on export growth, and Japan’s domestic personal consumption is still relatively weak.

Therefore, we believe that the current Japanese economy does show some new trends, but whether it can continue in the future requires further observation to see whether Japanese citizens can be affected by these new trends, so as to increase personal consumption and investment, and whether integration of Japanese society can emerge.

Key Takeaways

• The extremely low financing cost of the Japanese yen and the continuous influx of foreign capital into the Japanese market have jointly promoted the rise of the Nikkei 225 Index.

• The “Buffett effect” further boosted Japanese stock market valuations.

• The future trend of the Nikkei 225 Index depends on Japan’s local economic and social fundamentals.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server