Tariffs Trigger Market Crash: U.S. Stock Market Pullback or Bear Market Ahead?

TOPICSLast week, President Trump’s comprehensive tariff announcement, which he referred to as “Liberation Day,” sent shockwaves through global markets. The wide-ranging tariffs have sparked fears of an escalating global trade war and the potential for a global recession.

The impact was immediate, with global stock markets experiencing a significant downturn. The three major U.S. indices saw declines of more than 20% from their recent highs. Other major stock indices worldwide were also hit hard, with the German DAX dropping 15% and Japan’s Nikkei 225 falling nearly 20% from its peak.

Tariff Hike Fuels Recession Concerns

Trump’s tariff policy, announced on “Liberation Day”, opened the door to sweeping tariffs on nearly all U.S. trade partners. This has intensified fears that the tariffs could lead to widespread global trade disruptions, further exacerbating uncertainties about the global economy, particularly the U.S. economy.

The announcement has raised concerns about potential slowdowns in production and trade, which could trigger a broader economic recession.

In response to these tariffs, China has already begun retaliating. On April 4, 2025, China announced it would impose a 34% retaliatory tariff on all U.S. imports, effective April 10, 2025. This move marks a significant escalation in trade tensions between the two largest economies in the world.

Is the U.S. Stock Market in a Correction or a Bear Market?

Global stock markets saw a sharp sell-off last week—marking the most severe weekly decline since the global tightening cycle during the high-inflation era of 2022. The U.S. stock market was hit particularly hard, with the S&P 500 plunging nearly 15% in just four trading days.

This raises a critical question: Is this merely a short-term correction, or has the market officially entered a bear market?

From a technical perspective, a market correction is generally defined as a pullback of 10% or less from recent highs within a broader uptrend. However, when losses exceed 20%, it typically signals a transition into a bear market—reflecting deeper structural concerns and more prolonged downside risks.

As of now, the S&P 500 has dropped more than 20% from its all-time high in February, which by most definitions, confirms that the U.S. stock market is no longer in correction territory—it has officially entered a bear market.

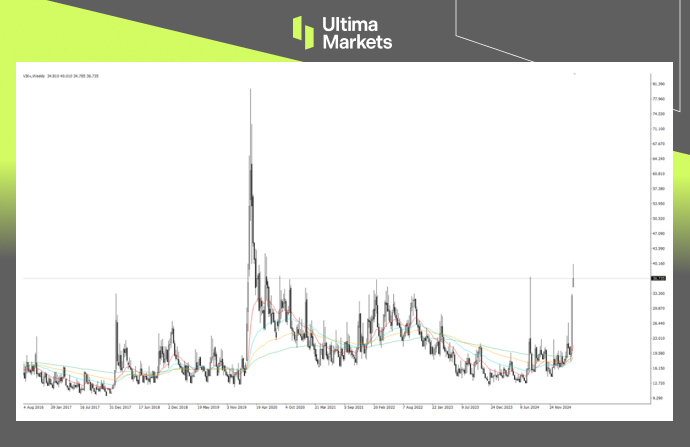

(VIX Index, Weekly Chart; Source: Ultima Market MT5)

In addition, the VIX Index—commonly known as the market’s “fear gauge”—surged to its highest level since the 2020 pandemic, briefly approaching the 40-point mark. This level typically signals elevated fear and strong pessimism in market sentiment.

Historical Bear Markets in the U.S. Stock Market

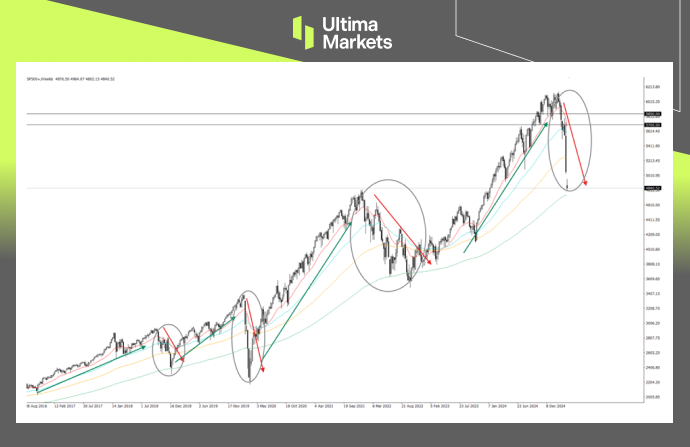

Looking back over the past decade, the U.S. stock market—particularly the S&P 500—has experienced three major bear markets:

- 2018 U.S.-China Trade War: The S&P 500 dropped 21% from its all-time high during a three-month bear market.

- 2020 Pandemic Crash: The market plunged nearly 36% from its peak in just one month.

- 2022 Fed Tightening Cycle: The S&P 500 declined 25% over the course of a year during the monetary tightening phase.

(S&P500, Weekly Chart Analysis; Source: Ultima Market MT5)

While the 2020 pandemic crash was driven by short-term panic, the 2018 and 2022 bear markets were rooted in broader fundamental concerns. These two cases are more comparable to the current situation, where the fear could not be just a temporary shock—but a deeper worry over global trade disruptions and their impact on the global economy.

Prolonged Bear Market? It Depends on What Comes Next

Is this the beginning of a prolonged bear market or just a short-term shock? It’s still too early to say, but what we do know for sure is that the U.S. stock market has already entered bear market territory. Whether it deepens or stabilizes will depend on how key developments play out. Two main factors to watch:

- Trade Tensions – Escalation or Resolution? Will we see more retaliatory measures, or will there be progress in trade negotiations? Trump’s tariffs are often used as a bargaining chip to push for better terms—so any sign of talks could shift sentiment quickly.

- Global Economic Impact We need to closely watch upcoming global economic data. If signs of economic slowdown or recession begin to surface more clearly, the risk of a prolonged bear market increases significantly.

While the current market correction is concerning, it’s important to remember that markets often go through periods of volatility—especially during times of heightened uncertainty.

The broader outlook for the global economy and financial markets remains clouded by rising recession fears, and investors should stay alert to further downside risks. As the focus shifts from trade war tensions to economic data, this week’s reports could provide valuable insight into where the markets might be headed next.

Meanwhile, traders can stay informed by following the Ultima Markets Weekly Market Outlook—brought to you by our experienced team of market analysts.

Technical Outlook for S&P 500 (SP500+)

The S&P 500 marked a 15-month low last week following a major sell-off, effectively erasing all gains made in 2024. This level is particularly significant, as it was the breakout point that sparked the bullish rally throughout last year.

(S&P500, Daily Chart Analysis; Source: Ultima Market MT5)

Now testing a key support zone, the index may see a technical rebound in the near term—especially if markets remain relatively calm and free of fresh high-impact developments.

However, any upside is likely to be limited. Given the ongoing lack of optimism in the global market outlook, and in the absence of a clear shift in technical trends or investor sentiment, the bear market is unlikely to end anytime soon.

Bear Market in Place After All!

In summary, downside risks in the global market persist. While a near-term rebound could occur, the loss of more than 20% suggests the market may be oversold. However, it’s crucial to remember that lows can always go lower, and this is an unchanging rule of financial markets.

Until there’s a significant shift in market sentiment, the U.S. stock market—and potentially the global market—will likely remain in a bearish phase.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server