In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the GOLD for July 18, 2024.

Key Takeaways

- Members’ speeches: Fed Governor Waller said that based on potential scenario analysis, the timing of a rate cut is getting closer. The exact timing of the rate cut is deemed not important. At the same time, Barkin also expressed his confidence that the Fed will discuss whether it is still appropriate to describe inflation as high in the upcoming July policy meeting.

- Expectations of rate cuts: Expectations that the Fed will cut interest rates in September rose substantially, and lower interest rate settings usually increase the attractiveness of interest-free assets such as gold. In addition, the UBS report also pointed out that investors have a general interest in buying gold on dips recently, which may be one of the reasons for the rapid price rebound.

Technical Analysis

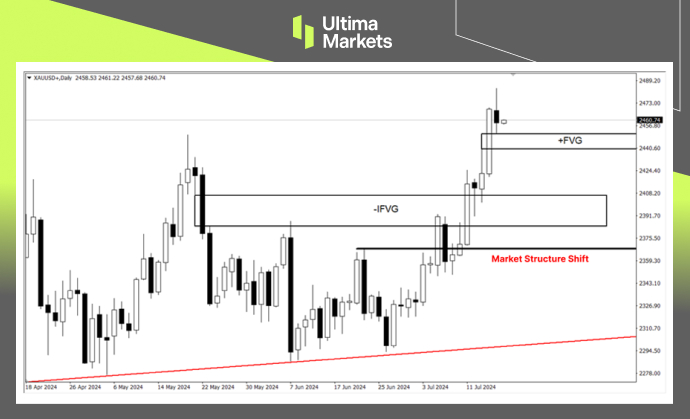

Daily Chart Insights

- Price Action: Gold prices have started an upward trend ever since their breakout at the bottom level. However, after setting a record high this week, selling pressure re-emerges. It is worth noting waiting for a possible continuation of bullish momentum before entering the market.

- Fair value gap: Gold prices broke through historical highs, and the overly strong upward trend left an upward fair value gap (FVG). Short-term bears tend to step back into the FVG range. Switching to a smaller timeframe is suggested to pay attention to its price action near the closest support near the gap and be on the lookout for bullish opportunities.

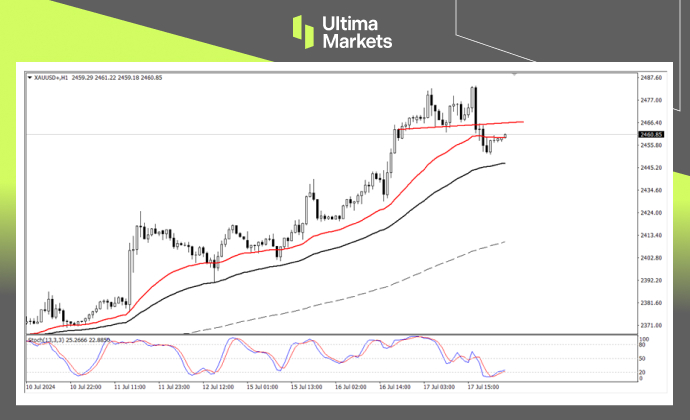

1-hour Chart Analysis

- Stochastic oscillator: The indicator sends a bullish signal in the oversold area, suggesting that the bearish force is at a disadvantage in the short term. There is a possibility that gold prices will rebound and continue their upward trend during the Asian session.

- Neckline suppression: The gold price fell below the red neckline after the formation of double-top structure. If gold price fails to close above the neckline during the Asian session, there is still a significant risk of extended depreciation.

- MA group: The 33-MA (red) and 65-MA (black) lines support the further decline of the gold price. There are suppression resistance areas above and below. Therefore, gold prices are more likely to converge and oscillate during the Asian session until the intraday trend direction is determined.

Pivot Indicator

- According to the trading central in Ultima Markets APP, the central price of the day is established at 2483.00,

- Bullish Scenario: Bullish sentiment prevails above 2483.00, first target 2500.00, second target 2514.00;

- Bearish Outlook: In a bearish scenario below 2483.00, first target 2444.00, second target 2430.00.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server