Focus on GBP/AUD today.

On Fundamentals, BoE raised its benchmark interest rate by 25 bps yesterday, reaching the highest level since 2008. Rising interest rates mean higher borrowing costs, meaning more pressure on many homeowners. The UK continues to be on the edge of recession. Separately, RBA’s monetary report suggests suspending interest rate hikes, however, leaves room for another 15-bps raise.

BoE’s monetary policy was significantly more hawkish than RBA’s, resulting in an appreciation of GBP/AUD since February 2023. However, BoE’s policy no longer brought bullish sentiment on the pound but worries on the British outlook. At present , the market is certian on the future peak interest rate of the RBA, which will lead to a potential bullishness on the Australian dollar .

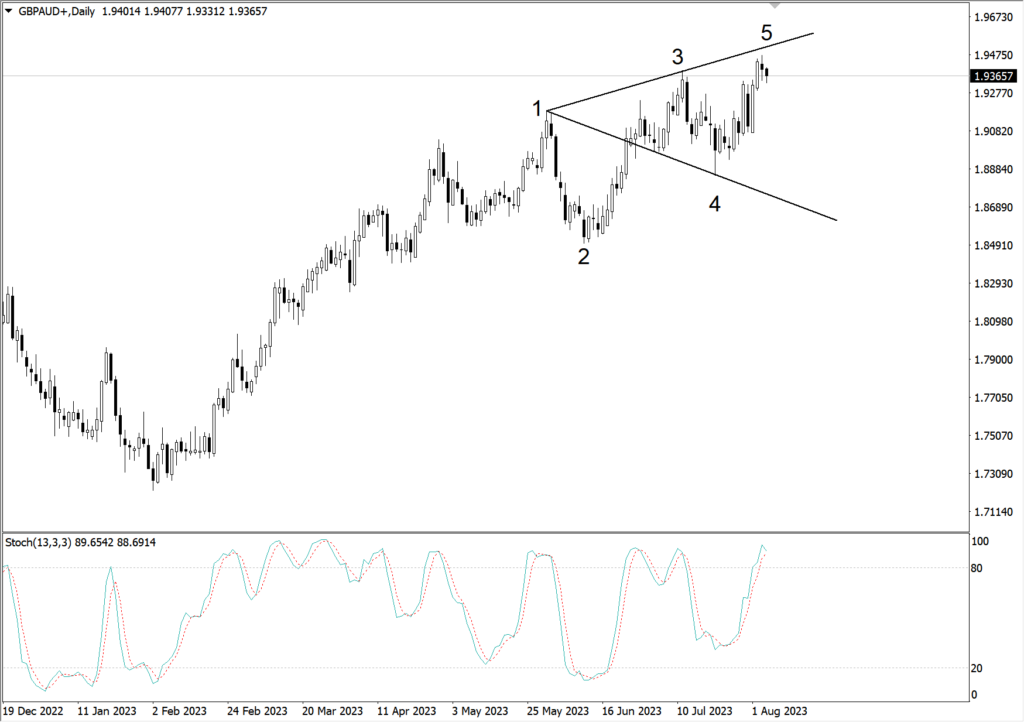

Technically speaking, the GBP/AUD daily cycle presents a potential Wolf Wave structure, but the price action structure does not display a clear bearish signal at moment.

(GBP/AUD daily cycle, Ultima Markets MT4)

The Stochastic Oscillator shows no dead cross on the daily cycle. Please be aware of GBP/JPY’s next bullish trend.

(4-hour GBP/AUD cycle, Ultima Markets MT4 )

The 4-hour Elliott Wave structure of GBP/AUD suggests that it may be in a double-saw-tooth rebound phase. After the market confirms the bearish trend, it is possible to pave a sharp downward path.

(1-hour GBP/AUD cycle, Ultima Markets MT4)

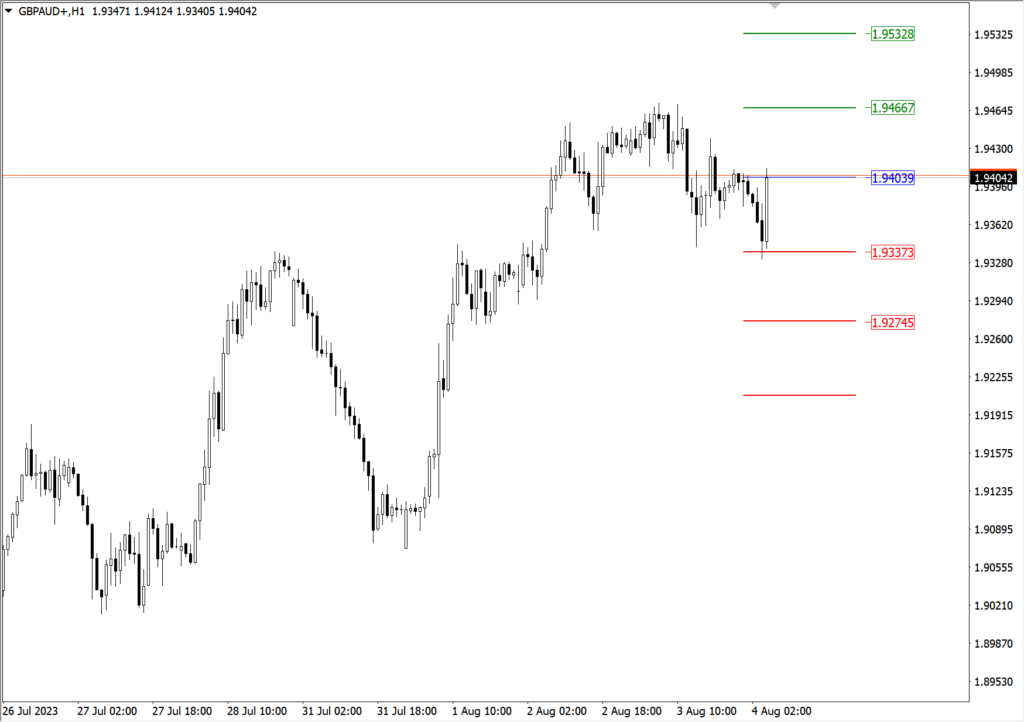

On 1-hour cycle of GBP/AUD, a turning point emerged. The exchange rate fell rapidly and was close to the previous breakthrough price. On August 2, the price action formed a potential head-and-shoulders structure. If it falls below the 1.9338 neckline, the probability of going bearish will increase.

(1- hour GBP/AUD cycle, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4 , the central price of the day is 1.94039 ,

Bullish above 1.94039, the first target is 1.94667, and the second is 1.95328.

Bearish below 1.94039, the first target is 1.93373, and the second is 1.92745.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server