Unraveling the Dynamics: Bank of Japan’s Response to Accelerating Inflation

In November 2023, Japan witnessed an unexpected surge in inflation, sending ripples through its economic landscape.

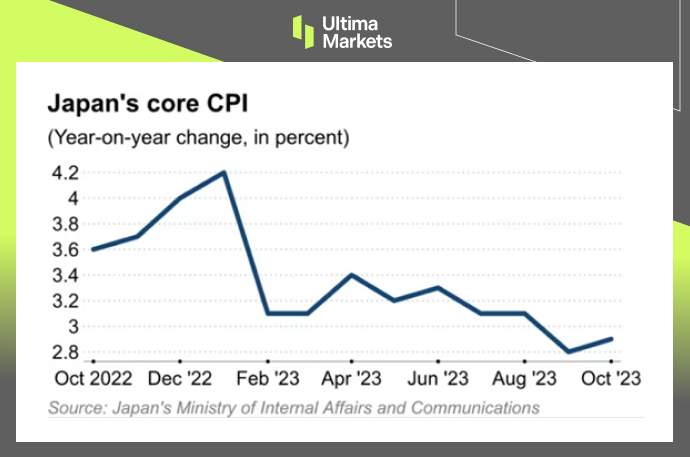

For the first time in four months, the core consumer price index—which does not include the cost of fresh food—rose 2.9% over the prior year. Concurrently, the headline inflation rate surpassed the 3% mark from the prior month to 3.3%.

These figures have ignited speculations about potential policy adjustments by the Bank of Japan (BOJ) to address the evolving economic scenario.

(Japan Core CPI, Ministry of Internal Affairs and Communications)

Manufacturing Sector Challenges

Amidst these inflationary pressures, Japan’s manufacturing sector faces its own set of challenges. According to the au Jibun Bank Manufacturing Purchasing Managers’ Index (PMI), the sector contracted for the sixth consecutive month in November.

The PMI fell to 48.1, below economist forecasts, indicating a sustained downturn. Ongoing declines in production, new orders, and employment signal challenging demand conditions both domestically and internationally. The weak PMI print underscores the persistent weakness in Japan’s crucial manufacturing industry.

Wage Growth Dilemma

Large financial holding companies emphasize the significance of the BOJ’s commitment to maintaining its current policy until wage growth accelerates rapidly. Over the past two years, wage growth in Japan has failed to reach anticipated levels, let alone show acceleration.

The BOJ’s decision to raise its inflation target aligns with its broader economic strategy. By lifting wage growth, a key long-term growth engine according to the Phillips curve, the Bank aims to create a positive impact on the Japanese economy.

Hence, the BOJ is unlikely to deviate from its ultra-accommodative monetary policy until a substantial positive shift in wage growth is observed.

Future Monetary Policy Considerations

As speculation abounds regarding potential policy adjustments, it’s essential to delve into the intricacies of the BOJ’s toolkit. The commitment to Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control (YCC) has been a cornerstone of BOJ’s approach.

The central bank’s willingness to tweak its policy, as indicated in recent statements, underscores its dedication to navigating the complex economic landscape.

Bottom Line

In conclusion, as Japan grapples with accelerating inflation and manufacturing sector challenges, the BOJ’s commitment to its monetary policy remains steadfast. The intricacies of this commitment and its potential adjustments showcase the central bank’s dedication to steering the Japanese economy through these dynamic times.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server