Australian Inflation Holds at 2.4%, Core Inflation Eases

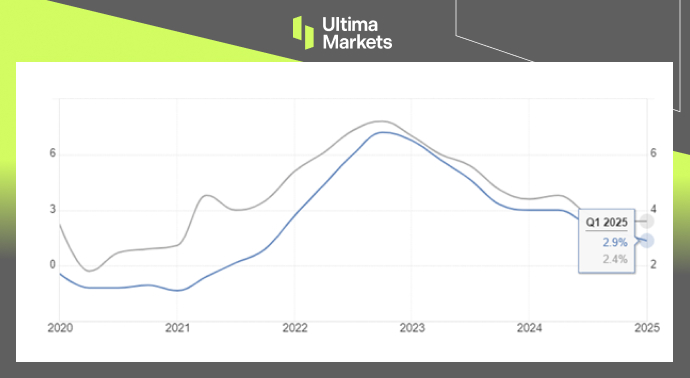

TOPICSAustralia’s annual inflation rate for Q1 2025 held steady at 2.4%, unchanged from the previous quarter but slightly above market expectations of 2.3%. Despite the surprise, this remains the lowest inflation rate since Q1 2021, indicating continued progress in taming price pressures.

Meanwhile, the Trimmed Mean CPI — a key measure of core inflation — eased further to 2.9% year-on-year in Q1 2025, down from 3.2% in the previous quarter. This marks the lowest core inflation reading since Q4 2021, supporting the view that underlying inflationary pressures are gradually moderating.

(Australia’s Annual Inflation Rate; Source: Australian Bureau of Statistic)

RBA Policy Outlook

The softer inflation print, particularly the easing of core inflation, strengthens the case for the Reserve Bank of Australia (RBA) to maintain its current policy stance. While headline inflation remains at 2.4%, the continued decline in core inflation suggests the RBA may take small steps toward further easing.

The RBA’s last rate cut was in February 2025, reducing the cash rate from 4.35% to 4.1%. However, the RBA held rates steady at its April meeting, emphasizing progress toward the inflation target before considering further tightening.

With signs of a loosening labor market and core inflation falling within the 2-3% target range, markets are pricing in a potential rate cut at the RBA’s upcoming May meeting.

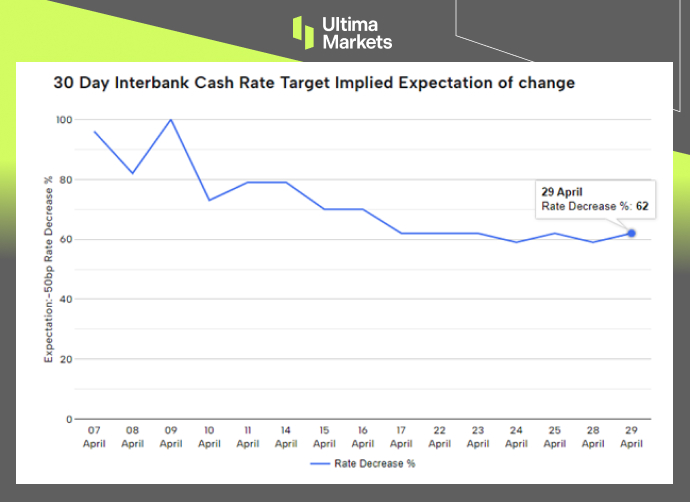

(ASX Cash Rate Target Tracker; Source: asx.com.au)

According to the ASX 30-Day Interbank Cash Rate Futures, the May 2025 contract implies a 62% probability of a 25-basis point rate cut at the next RBA meeting.

Meanwhile, global economic uncertainties, including trade tensions, have prompted the RBA to consider rate cuts to stimulate domestic growth.

AUDUSD Outlook: Consolidation at 200-day average

After the CPI release, the Australian Dollar saw a brief spike as markets reacted to mixed signals. However, the easing in inflation has increased expectations for a rate cut, limiting the upside potential for AUD unless global risk sentiment improves or the RBA turns unexpectedly hawkish.

(AUDUSD, Day-Chart Analysis; Source: Ultima Market MT5)

From a technical perspective, AUDUSD remains range-bound, hovering near the 0.6400 key level and the 200-day moving average.

A sustained break below 0.6400 could open the door for further downside, though the weaker U.S. Dollar in the current market environment may contain significant downside movement.

AUDJPY Outlook: Downside Risk with Yen Strengthening

AUDJPY may face increased downside risk if the Japanese Yen strengthens due to deteriorating risk sentiment from trade tensions and a potential hawkish shift from the Bank of Japan (BoJ).

(AUDJPY, 4-H Chart Analysis; Source: Ultima Market MT5)

Technically, the recent AUDJPY rebound met resistance around the 92.00–91.30 range. Failure to break above this level could trigger a downside move. Additionally, the formation of a rising wedge pattern suggests a bearish reversal if the pair breaks lower.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server