BOJ Keeps Policy Steady but Reduces Its Dovish Stance

TOPICSTags: Bank of Japan, CPI, interest rates, JPY, USDJPY

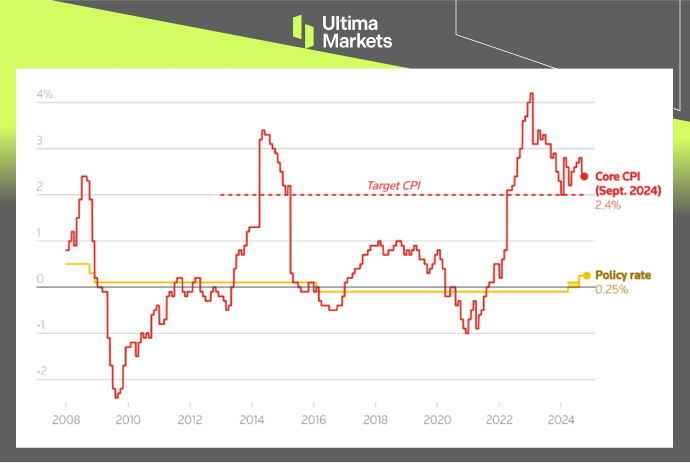

Bank of Japan maintain Policy Rate of 0.25%

On Thursday, the Bank of Japan maintained ultra-low interest rates and indicated a need to monitor global economic developments closely, emphasizing its attention to risks impacting Japan’s fragile domestic recovery when considering future policy tightening.

(Japan’s Core CPI and BOJ’s Policy Rate, Source: LSEG)

Governor Ueda’s comments appeared less dovish than before, suggesting that the BOJ can afford to spend time examining potential impacts from factors like U.S. economic uncertainties and financial market volatility. Consequently, the dollar briefly dipped to 152 yen from over 153 yen following Ueda’s remarks, which market participants interpreted as increasing the likelihood of a rate hike in December.

(USDJPY Daily Price Chart, Source: Trading View)

Recent Tokyo CPI data shows an expanding pass-through effect from rising wages into service prices. The central bank also projected that inflation would hover near its 2% target in the coming years, affirming its commitment to continue raising borrowing costs if economic recovery remains steady. Further analysis will be necessary to confirm whether this trend will extend nationwide.

Additionally, domestic data indicates that wage and price movements align with forecasts. Although downside risks to the U.S. and global economies have eased somewhat, other uncertainties persist, leaving the baseline outlook unclear. Taking further steps will only be considered as confidence in economic stability improves.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server