Canada’s Inflation Falls to 1.8% in December

TOPICSTags: BOC, Canada Inflation, CPI, Cut Rates, USD/CAD

Canada’s December Inflation Slows with Mid-Month Tax Break

Canada’s annual inflation rate slowed in December, as data released on Tuesday revealed. This was partly due to a sales tax break introduced mid-month, which reduced the prices of alcohol, restaurant food, and children’s clothing.

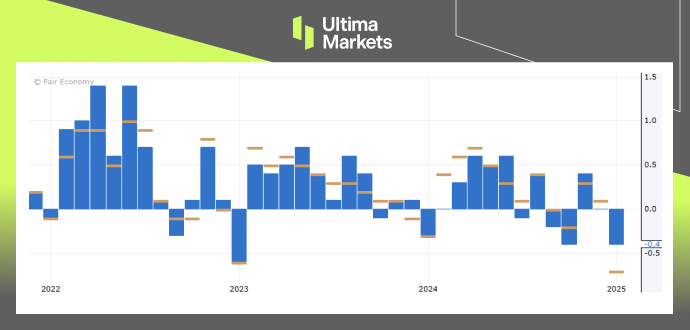

The annual inflation rate dropped to 1.8%, according to Statistics Canada, slightly below expectations and a marginal decrease from the previous month’s 1.9%. On a month-over-month basis, the consumer price index contracted by 0.4%. Annually, prices for alcoholic beverages purchased from stores fell by 1.3% in December, compared to a 1.9% increase in November, while food purchased at restaurants declined by 1.6% after rising 3.4% the month before.

(Canada’s CPI m/m Chart, Source: Forex Factory)

BoC May Cut Rates Again as Inflation Drops

The consistent easing of prices remaining at or below the Bank of Canada’s 2% target since August, which has enabled the central bank to lower its key policy rate by a total of 175 basis points since June, bringing it to 3.25%.

A further decline in inflation in December could prompt the central bank to implement another rate cut next week. However, BoC Governor Tiff Macklem indicated last month that future rate cuts would proceed gradually. Currency markets currently predict an 81% probability of a 25-basis-point rate cut on January 29.

Technical Analysis of USD/CAD Chart

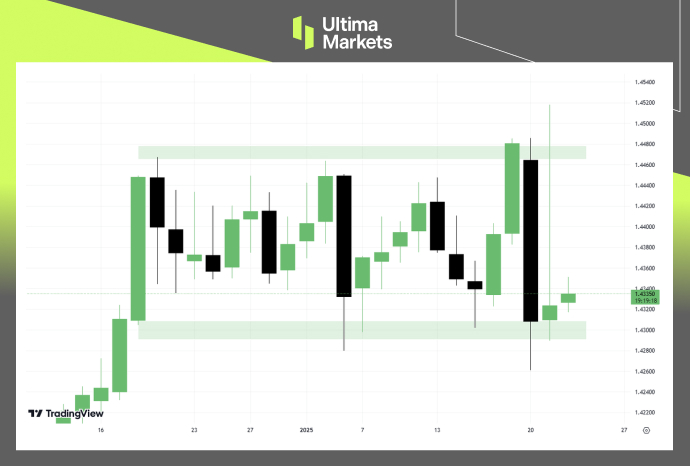

(USD/CAD Daily Price Chart, Source: Trading View)

From a technical perspective, the USD/CAD currency pair is trading within an oscillation zone. It recently retested the support zone and rebounded with minimal bullish momentum. If the price does not break through this support zone downward, it is highly likely to drive the price upward.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server