Deflationary Pressures Continue to Haunt China

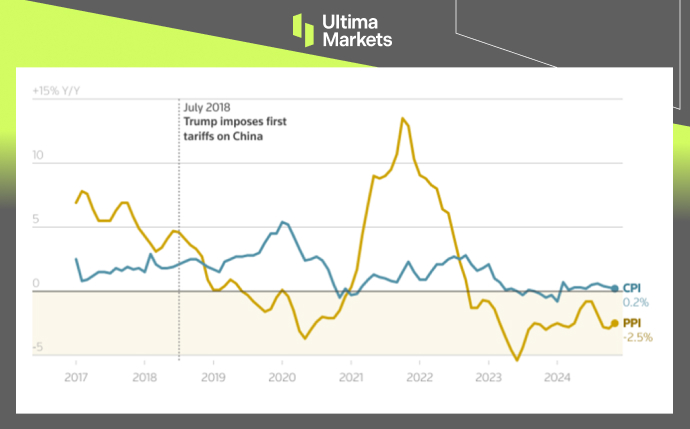

On Monday, the National Bureau of Statistics reported that China’s consumer price index (CPI) was up only 0.2% y/y in November, compared with the 0.3% rise in October and well below the expected 0.5% increase.

(China CPI y/y and PPI y/y Chart, Source: LSEG Data Stream)

The world’s second-largest economy is under increasing pressure due to new tariffs that could be implemented if Donald Trump wins a second term and structural headwinds that are yet to dissipate. Additional policy support is increasingly looking warranted for fragile economic growth.

Household spending has beaten forecasts over the past few months, partly on the back of government-subsidized trade-in programs for cars and home appliances, but that has been too weak to change the direction of the broader slowdown.

Instead of injecting liquidity directly into the economy, Beijing announced in November a 10 trillion yuan debt package designed to ease local governments’ funding pressures. Meanwhile, the government’s advisers are urging a 2025 economic growth target of around 5.0%, warning that strong fiscal policies would be required to counter the eventual shock to Chinese exports from the next set of U.S. tariff rises.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server