Dollar Index Surges to One-Month High Amidst Uncertainty Over Rate Cuts

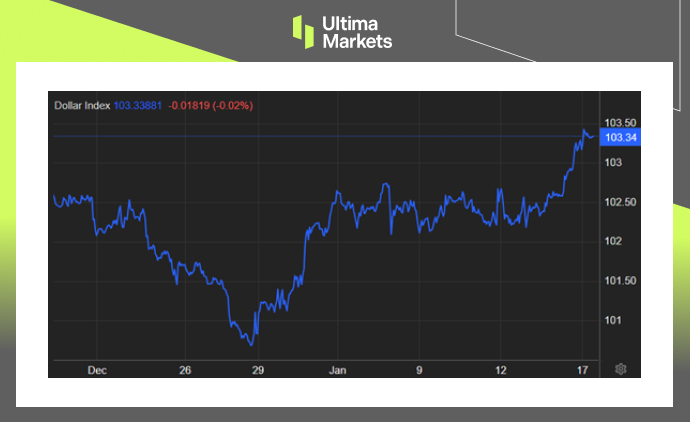

The dollar index has surged to a one-month high, reaching an impressive 103.4 on the index. This unexpected spike comes as investors reassess their expectations for interest rate cuts, reflecting a shift in sentiment that has captured the attention of financial markets.

(Dollar Index Monthly Chart)

Federal Reserve’s Stance on Rate Cuts

Federal Reserve Governor Christopher Waller has played a crucial role in shaping this narrative. Expressing confidence in the economy.

Christopher Waller stated, “With strong economic activity and job markets along with gradually declining inflation toward 2 percent, I see no reason to move or cut rates rapidly like in the past.” This declaration has contributed to a significant recalibration of expectations.

Changing Odds for a March Rate Cut

The probability of a 25 basis point rate cut in March has seen a notable decline, standing at 61% currently—down from 77% just last week. Investors are carefully monitoring indicators from the U.S. Federal Reserve, and the recent shift has had a profound impact on the dollar’s performance.

Impact on Global Currencies

The ripple effect of this uncertainty is evident across various currencies. The euro, for instance, has experienced a decline of over 0.5%. European Central Bank officials’ hawkish statements contrast with data showing a significant drop in the next 12-month consumer inflation expectations.

In a similar vein, the pound has slipped by up to 0.7% following data indicating slower-than-expected wage growth. This development has increased the likelihood of the Bank of England implementing interest rate cuts as early as May.

Key Insights from Financial News Outlets

- Reuters: Dollar Rallies to One-Month High as Fed Cut Outlook Dims

- The Economic Times: Dollar at One-Month High as Rate Cut Expectations Ease

- Yahoo Finance: FOREX-Dollar Hits One-Month High as Fed Rate-Cut Outlook Dims

- Investing.com: US Dollar Hits One-Month Peak on Fed Rate Cut Caution

- Yahoo Finance UK: Dollar at One-Month Peak on Easing Rate-Cut Bets

- Shafaq News: Dollar Reaches One-Month High as Rate Cut Expectations Diminish

- FX Empire: US Dollar Index News: DXY Firms Ahead of Crucial Retail Sales Data

Asian Market Impact

The repercussions of these developments are not confined to the U.S. market. Asian stocks are struggling, influenced by a murky economic outlook in China and diminishing expectations of a global rate cut.

Frequently Asked Questions

Q1: Why has the dollar reached a one-month high?

A1: The dollar’s surge is attributed to a shift in investor expectations regarding interest rate cuts, influenced by statements from Federal Reserve Governor Christopher Waller.

Q2: What is the current probability of a March rate cut?

A2: The probability stands at 61%, down from 77% last week, reflecting changing sentiments in the financial market.

Q3: How are global currencies reacting to this uncertainty?

A3: Currencies like the euro and pound are experiencing fluctuations, influenced by factors such as hawkish statements from central banks and economic indicators.

Global Economic Uncertainties

Amidst global economic uncertainties, the U.S. Dollar Index has soared to a one-month peak, reaching 103.58. This surge is driven by a combination of factors, including the ongoing uncertainty surrounding the global economic landscape.

In conclusion, the dynamics of the financial market are evolving rapidly, shaped by the Federal Reserve’s stance, changing odds of a March rate cut, and the subsequent impact on global currencies. Investors are advised to stay vigilant and adapt their strategies accordingly.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server