The European Central Bank’s Recent Interest Rate Hike and Its Impact on the Euro

The European Central Bank (ECB) raised the three key interest rates by 25 bps.

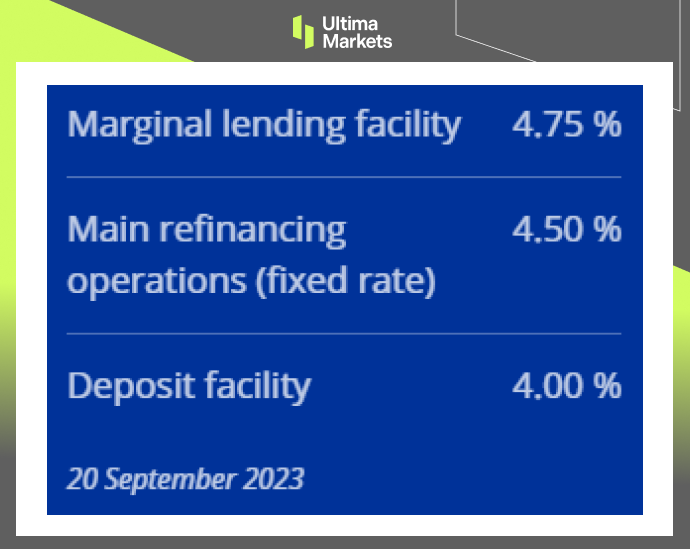

Starting from September 20, 2023, the marginal lending facility, main refinancing operations, and deposit facility will increase to 4.75%, 4.50%, and 4.00% respectively, setting a record since the euro was introduced in 1999.

(Latest ECB interest rate, ECB)

A Historic Interest Rate Shift in ECB

The ECB raised the benchmark interest rate from a historical low of -0.5% to the current record high in 20 years and 14 months.

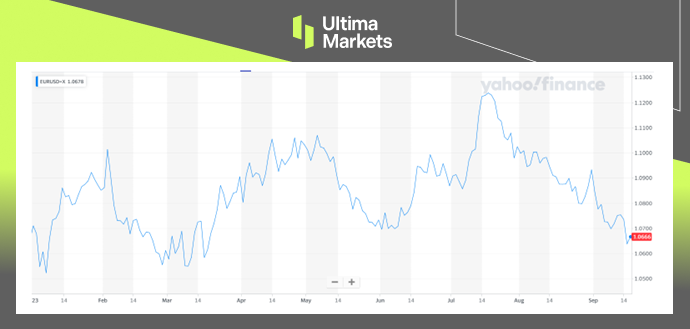

Although Eurozone inflation has cooled, reaching 5.3% in August, the same as in July, it is still far beyond the 2% target. Rising interest rates put pressure on the euro, which fell to its lowest level against the dollar in five months.

(EUR /US YTD Chart)

ECB’s Inflation Control and Economic Growth Prospects

European Central Bank President Christine Lagarde said at the press conference that inflation in the eurozone has been hovering at a high level for too long, core inflation is still too high, and food and energy costs continue to put upward pressure on prices.

She reiterated that the ECB is committed to bringing inflation back to its 2% target. At the same time, the economy is expected to grow by 0.7% this year, 1% next year, and 1.5% in 2025, which is lower than the previous forecast growth of 0.9%, 1.5%, and 1.6%.

The Global Implications

The ECB’s move has not only had a profound impact on the Eurozone but has also sent ripples across the global financial landscape. It underscores the central bank’s unwavering commitment to achieving price stability, even at the expense of economic growth prospects.

In conclusion, the ECB’s decision to raise interest rates to their highest levels in over two decades is a clear signal of its determination to tackle inflation. While this move may have consequences for the Euro and economic growth in the short term, it demonstrates the central bank’s commitment to maintaining price stability in the Eurozone.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server