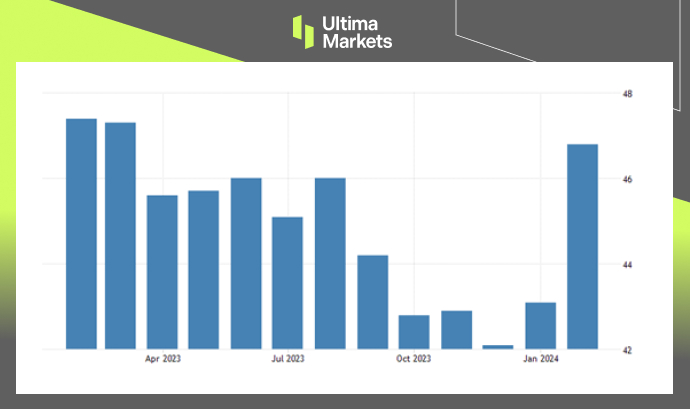

The HCOB France Manufacturing PMI increased to 46.8 in February 2024 from 43.1 in January, which was higher than market expectations of 43.5. Although the PMI remained below the 50 mark that indicating contraction for the 13th straight month, the February reading was the highest since March 2023.

The increase was largely attributable to improvements in the new orders index, which rose over seven points, significantly reducing the decline in production. Some manufacturers reported higher output as they worked to restock inventory. Additionally, the pace of job cuts in manufacturing moderated. Regarding prices, input costs continued to decrease, suggesting supply chain disruptions have not pushed up production expenses thus far. Looking ahead, French manufacturers’ expectations for the next 12 months were broadly neutral.

(France Manufacturing PMI, S&P Global)

The CAC 40 saw an increase of 0.7%, wrapping up at 7,966 last Friday, marking a new all-time high and exceeding the performance of its European counterparts due to positive corporate updates.

The industrial gas titan, Air Liquide, achieved a record high, leading to the surge in Paris with a hike of 2.2% following its annual results for 2023. The firm doubled its aim for the operating margin for 2022 to 2025 and increased the suggested dividend by 8.5% to 3.20 euros.

Capegemini, Michelin, and Stellantis also reported notable progress, with gains of 1.99%, 1.76%, and 1.57%. Simultaneously, traders will keep an eye out for fresh corporate updates and recent comments from monetary policymakers at the Fed and ECB, showing prudence ahead of probable interest rate reductions. The CAC 40 saw a weekly advancement of 2.8%, followed by US equities’ advance.

(CAC 40 Index Yearly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server