Greenback Weakens Amid Waning Investor Confidence

TOPICSSince the announcement of “reciprocal tariffs” on April 2, the U.S. Dollar has experienced a sharp decline of over 4%. This unexpected drop signals a shift in investor sentiment, with capital flowing out of U.S. assets and into European and Asian markets.

Investor Confidence and Capital Outflows

The Trump administration’s decision to impose reciprocal tariffs has raised significant concerns about the U.S. economic direction. The immediate market response has been one of increased caution, as investors question the long-term stability of U.S. financial markets.

he tariffs, targeting countries like the European Union and Japan, have sparked tension with traditional allies, leading to criticism from these trade partners. This heightened geopolitical risk has eroded trust in U.S. economic leadership, triggering notable capital outflows.

U.S. assets, particularly Treasury bonds, have experienced a marked decline, with investors seeking safer or more stable alternatives. This sell-off has caused Treasury yields to rise, reflecting heightened risk aversion and a reduced appetite for U.S. financial instruments.

Fed’s Cautious Approach Amid Trade Tensions

Despite encouraging signs in March’s inflation data, the Federal Reserve’s monetary policy remains cautious. Atlanta Fed President Raphael Bostic emphasized that the U.S. is still far from its 2% inflation target, signaling that a shift toward tightening is unlikely in the near future.

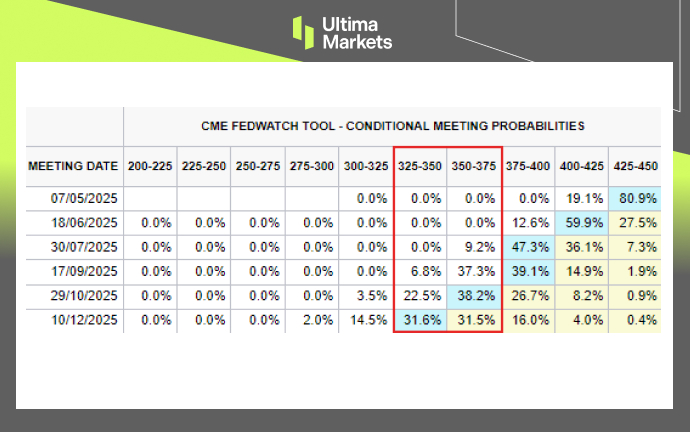

However, according to the CME FedWatch Tool, investors are now pricing in two to three interest rate cuts before the end of 2025, up from the previous expectation of only one to two cuts. This shift reflects growing concerns that broader economic risks may weigh on growth.

(CME FedWatch 2025 Rate Probabilities; Source: CME Group)

U.S. Dollar Remains Under Pressure

As confidence in U.S. assets continues to wane, expectations of further Fed easing are intensifying, which is putting additional downward pressure on the U.S. Dollar. Last week, the Dollar reached its lowest level in three years, falling below the key psychological level of 100.

(USDX+, U.S. Dollar Index, Daily Chart; Source: Ultima Market MT5)

With the U.S. Dollar hovering near this critical level, the ongoing uncertainty surrounding U.S. economic policy and global trade tensions suggests a challenging road ahead for the Dollar.

Technically, if the U.S. Dollar Index (USDX) remains below the 101.80 mark, the bearish trend is likely to continue, pointing to further downside movement in the Dollar.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server