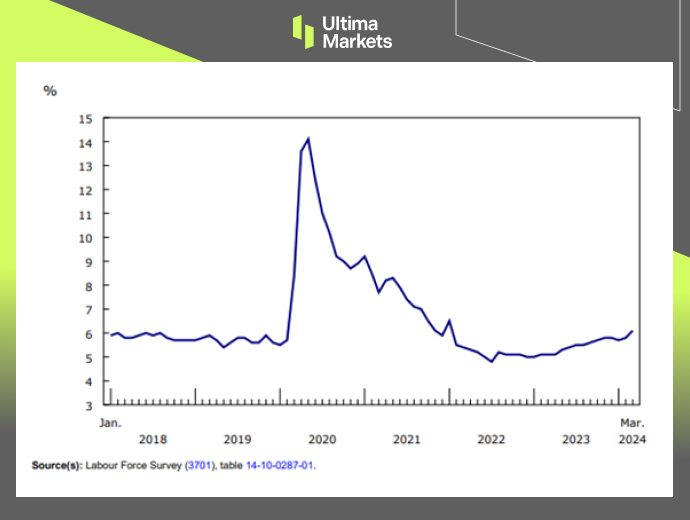

Canada saw its unemployment rate climb to 6.1% in March 2024, an increase from 5.8% the previous month, reaching the highest rate since October 2021 and significantly topping forecasts of 5.9%.

The data align with the Bank of Canada’s observations, suggesting that high interest rates are placing considerable strain on the labor market. These figures support the argument of those in favor of trimming rates potentially in the upcoming second quarter. The tally of unemployed surged by 60,000, resulting in 1.260 million jobless, with 65% having been on the job hunt for over a month.

For young people, unemployment spiked to a seven-plus-year zenith of 12.6%, up from February’s 11.6%, while the increase was more gradual for the prime working-age segment (25 to 54), ticking up from 5% to 5.2%. Meanwhile, overall net employment saw a dip by 2,200 to 20.403 million, defying the expectation of a bump by 25,000, and the pace of hourly wage growth nudged up by 10 basis points to 5%.

(Unemployment Rate,Statistics Canada)

The Canadian dollar fell to its weakest level since November, dropping below 1.36 per USD in April. This decline came after labor data highlighted a divergence in the economic outlook for Canada and the United States, leading to expectations of contrasting monetary policy paths for their respective central banks. While Canada’s labor data was weaker, the U.S. reported stronger-than-expected job numbers, underscoring the resilience of their labor market. The robust U.S. employment figures reduced pressure for looser monetary policy, bolstering the U.S. dollar’s strength against other major currencies, including the Canadian dollar.

(USDCAD Six-month Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server