Pound Sterling Strengthens After PMI Release

TOPICSTags: BoE, GBP/USD, PMI, Policy Rate, Pound Sterling

Bank of England Remain Cautious in Rate Cut

On Monday, the Pound Sterling strengthened against the US Dollar after a business activity survey signalled rising prices in Britain, while investors prepared for a series of central bank meetings this week, including the Bank of England’s decision on Thursday. GBP/USD climbed 0.57%, closing at 1.2682.

(GBP/USD Daily Price Chart, Source: Trading View)

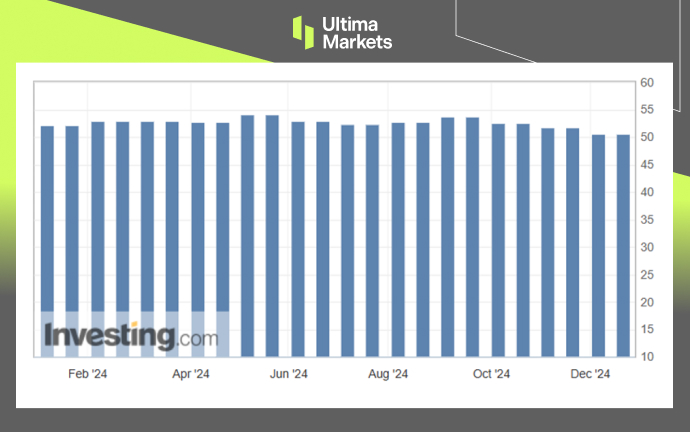

The preliminary S&P Global Flash Composite Purchasing Managers’ Index (PMI) remained unchanged at 50.5 in December, just above the 50.0 threshold that separates growth from contraction. However, it fell short of economists’ expectations for an increase to 50.7, according to a Reuters poll.

(UK Composite PMI Chart, Source: Investing.com)

Prices charged by businesses rose at the fastest rate in nine months, driven by increasing input costs, including wages. The PMI survey highlighted an economic stagnation in the final quarter of 2024, with potentially worse conditions anticipated in early 2025. This suggests that policymakers at the Bank of England may approach interest rate cuts cautiously, as renewed inflation pressures could exacerbate economic risks in 2025.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server