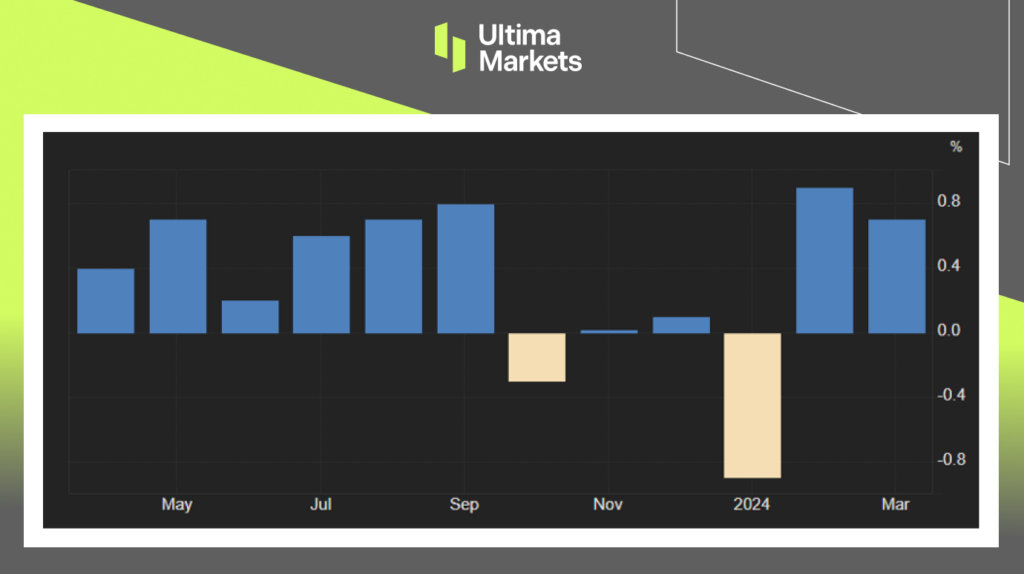

In March 2024, retail sales in the United States increased by 0.7% from the previous month. The rise followed a revised increase of 0.9% in February, which was significantly higher than the anticipated 0.3%. Such figures indicate that consumer spending is holding strong.

Among the 13 major categories, sales rose in eight. Notable jumps were observed in sales at online retailers by 2.7%, gasoline stations by 2.1%, various other retailers also by 2.1%, and in the area of building materials and garden supplies by 0.7%. Additionally, food and beverage stores saw a 0.5% rise, health and personal care stores saw a 0.4% upturn, as did food services and drinking places.

In contrast, declines were noted in the sectors of sporting goods, hobbies, musical instruments, and book stores at a rate of 1.8%, clothing at 1.6%, electronics and appliances at 1.2%, general merchandise stores at 1.1%, automotive at 0.9%, and furniture at 0.3%. When food services, car dealerships, building material outlets, and gas stations were excluded, the core retail sales that contribute to GDP calculations saw a significant increase of 1.1%.

(U.S. Retail Sales,Census Bureau)

On Monday, the dollar index climbed above 106, hitting its highest mark in over five months, fueled by growing signs of a robust US economy which led to speculation that the Federal Reserve might maintain its current interest rates for an extended period. Additionally, the US dollar received a boost as a preferred option during uncertain times after increased tensions in the Middle East, following Iran’s attack on Israel. However, indications that neither Tehran nor Tel Aviv anticipates immediate retaliatory actions have since eased market anxieties.

(Dollar Index Six-month Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server