Eurozone Countries Stocks Close Trading Session On A Downturn

The recent fluctuations in European equities have captured the attention of investors and analysts alike. In this article, we delve into the factors influencing the Stoxx 50 and Stoxx 600 indices, shedding light on the broader implications for the Eurozone.

Understanding Market Trends

Softened Impact of ISM Services PMI

The softer-than-expected ISM services PMI in the US triggered renewed expectations of a Federal Reserve rate cut by March. This development provided some relief for European government bonds, mitigating losses in the equities market.

Headline Inflation Rate Surge

Recent data indicates a rebound in the Eurozone’s headline inflation rate to 2.9% in December, a notable increase from the previous month’s 2.4%. This surge raises concerns about persistent inflation, potentially prompting the European Central Bank (ECB) to extend its hawkish policy stance.

Impact of US Jobs Report

A robust jobs report in the US contributed to tightened financial conditions in the Eurozone. The interconnected global financial system highlighted by the report reverberated across industries, impacting stocks in the Eurozone.

Stoxx 50 and Stoxx 600 Performance

Stoxx 50: Navigating Challenges

Despite initial losses, the Stoxx 50 managed to recover slightly, closing 0.25% lower after a 1% dip during the trading session. This index, representing 50 major European stocks, reflects the resilience of the Eurozone market.

(Stoxx 50 Daily Chart)

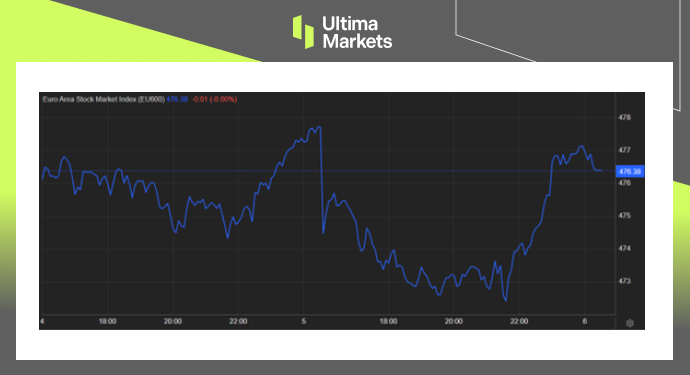

Stoxx 600: Assessing Broader Market Trends

The Stoxx 600, comprising 600 stocks from various European countries, mirrored the Stoxx 50’s trajectory. Exploring the STOXX Europe 600 Index, we uncover the complex interplay of factors influencing this comprehensive market indicator.

(Stoxx 600 Daily Chart)

Impact on Key Players

Luxury Giants Facing Global Rate Sensitivity

French luxury giants, such as LVMH and Hermes, experienced significant losses, falling close to 1.5%. Their sensitivity to global rates exposes the intricate balance these industry leaders navigate in the face of economic shifts.

Industrial Giants in Frankfurt

Industrial giants in Frankfurt, including Siemens and Schneider, saw declines of 1.2%. These companies, integral to the Eurozone’s industrial landscape, grapple with the broader economic context and its impact on their stocks.

Frequently Asked Questions

Q: How did the ISM services PMI impact European equities?

A: The softer-than-expected ISM services PMI in the US influenced expectations of a Federal Reserve rate cut, providing relief for European government bonds.

Q: What prompted concerns about inflation in the Eurozone?

A: Recent data revealing a surge in the Eurozone’s headline inflation rate to 2.9% raised concerns about persistent inflation, potentially leading to an extended hawkish policy stance by the ECB.

Q: How did the US jobs report affect financial conditions in the Eurozone?

A: A robust US jobs report contributed to tightened financial conditions in the Eurozone, showcasing the interconnected nature of the global financial system.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server