Taiwan Exports Set for Strong 1Q24 Growth as Economic Recovery Gains Momentum

In December 2023, Taiwan witnessed a remarkable surge in exports, defying market expectations and setting the stage for a promising start to 2024. This article explores the key factors driving this growth and the challenges that lie ahead.

December 2023: A Closer Look

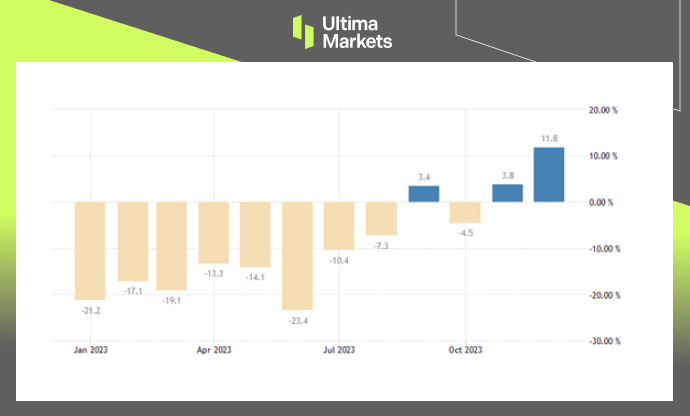

The month of December 2023 saw Taiwan’s exports surge by 11.8% year-on-year, reaching a robust USD 39.9 billion. This exceeded market expectations and marked the highest export expansion since July 2022. Notably, the primary driver of this boost was a staggering 94.7% surge in shipments of information, communication, and audio-video products.

(Exports YoY, MoF Taiwan)

However, certain sectors experienced declines, including plastics and rubber (-3.2%), machinery (-2.8%), parts of electronic products (-1.2%), and base metals (-1.1%).

Regional Dynamics

From a regional perspective, China and Hong Kong recorded a contraction in imports from Taiwan (-6.4%), while exports to the United States soared by 49.7%. Other markets that contributed significantly to the growth included ASEAN countries (+21.7%), Europe (+16.0%), and Japan (+10.1%).

Annual Performance and Outlook for 2024

Despite the impressive December performance, Taiwan’s overall exports for the year 2023 were still 9.8% lower than the corresponding period in 2022.

Looking ahead into 2024, sustaining and building upon December’s export momentum will be crucial for Taiwan to return its foreign shipments to pre-2023 levels. The trajectory will largely hinge on global macroeconomic conditions and the resolution of trade frictions.

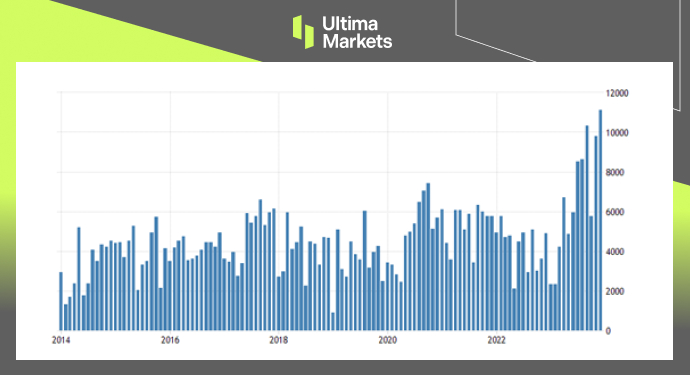

Trade Surplus: A Double Surge

In tandem with the export growth, Taiwan’s trade surplus witnessed a significant expansion in December 2023. The surplus doubled from USD 4.9 billion in the same month of 2022 to USD 11.1 billion.

On an annual scale, Taiwan’s trade surplus for 2023 reached a substantial USD 80.6 billion, showcasing a remarkable increase from the USD 51.3 billion surplus recorded in 2022.

(Balance of Trade, MoF Taiwan)

Frequently Asked Questions

Q1: What contributed to the significant growth in Taiwan’s exports in December 2023?

A1: The primary driver was a remarkable 94.7% surge in shipments of information, communication, and audio-video product.

Q2: Which regions saw the most substantial increase in imports from Taiwan?

A2: The United States recorded a remarkable 49.7% increase in imports from Taiwan, while ASEAN countries, Europe, and Japan also contributed significantly to the growth.

Q3: Despite the December surge, why is there still a year-on-year decline in Taiwan’s overall exports for 2023?

A3: While December showcased robust growth, the overall annual exports for 2023 were still 9.8% lower than the corresponding period in 2022.

Bottom Line

As Taiwan navigates the complex landscape of global trade, the surge in exports in December 2023 provides a positive outlook for the coming year. The country’s ability to sustain and build upon this momentum will play a pivotal role in shaping its economic recovery.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server