U.S. Markets Rally on Rekindled Hopes for September Rate Cuts

TOPICSTags: Dollar Index, NFP, S&P 500, Unemployment Rate

The US labor market showed signs of cooling in April 2024, with employment growth decelerating and the unemployment rate ticking up. According to the latest data, the US economy added 175,000 jobs in April, falling short of market expectations of a 243,000 increase.

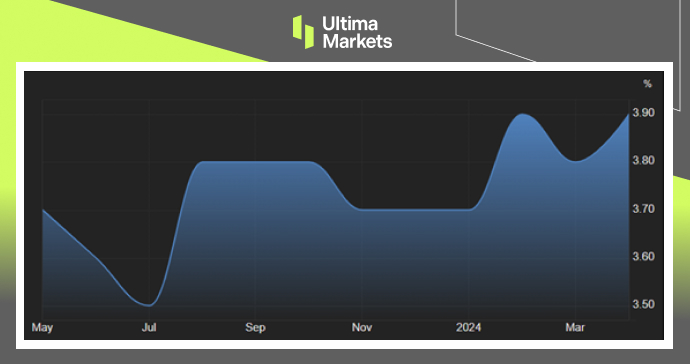

The figure also represents a significant slowdown compared to the upwardly revised 315,000 jobs added in March and trails behind the average monthly gain of 242,000 jobs over the preceding 12 months. Additionally, the unemployment rate in the United States edged up to 3.9% in April from 3.8% in March, surprising market expectations, which had forecasted the rate to remain unchanged at 3.8%.

(U.S. Unemployment Rate,Bureau of Labor Statistics)

After a lackluster jobs report, the value of the dollar index fell sharply, dropping 0.7% to a Friday low of 104.6 — the weakest it has been in more than three weeks. Concurrently, the yield on the US 10-year Treasury bond diminished to 4.47%.

Investors have adjusted their expectations, now forecasting the Federal Reserve’s initial rate reduction in September instead of November, a shift that has energized the stock markets. As a result, the S&P 500 rose by 1.26%, the Nasdaq grew by 1.99%, and the Dow Jones Industrial Average concluded the day up by 450 points (1.18%). Apple’s (AAPL.US) stock soared close to 6% following the announcement of a $110 billion share repurchase and the reporting of earnings and revenue that surpassed forecasts. Similarly, Amgen (AMGN.US) experienced a significant boost of 11.8% after exceeding earnings and revenue estimates, marking its most impressive day in almost 15 years. In contrast, Cloudflare’s (NET.US) stock plunged 16.4% after the company predicted weaker revenue for the year. Over the week, the Dow increased by 0.9%, the S&P 500 went up by 0.3%, and the Nasdaq saw a rise of 1.2%.

(Dollar Index Weekly Chart)

(S&P500 Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server