UK Stocks Rebound as NEXT Plc Achieves All-Time High

On January 4th, the FTSE 100 made a strong comeback, rebounding by 0.5% to surpass 7720 after facing two consecutive sessions of losses.

(FTSE100,1-Year Chart)

Notably, energy shares, including BP, increased by 0.5% after terminating their agreement with Equinor for supplying power to New York state from the offshore wind farm, Empire Wind 2.

British clothing retailer Next Plc (NEXT) achieved a remarkable surge of 5%, reaching a record high, and raised its annual profit outlook. However, JD Sports Fashion experienced a significant downturn of 23%, hitting a two-month low, as the sportswear retailer revised down its full-year profit forecast.

UK Consumer Borrowing and Economic Highlights

In economic news, UK consumer borrowing expanded by a net £2.0 billion in November 2023, marking the highest since March 2017 and surpassing the expected £1.4 billion rise. Additionally, loans for home purchases totaled 50.1K, surpassing forecasts.

The final PMI survey revealed that Britain’s services output in December grew more robustly than initially estimated, reaching a seven-month high in optimism.

UK Services PMI Exceeds Expectations

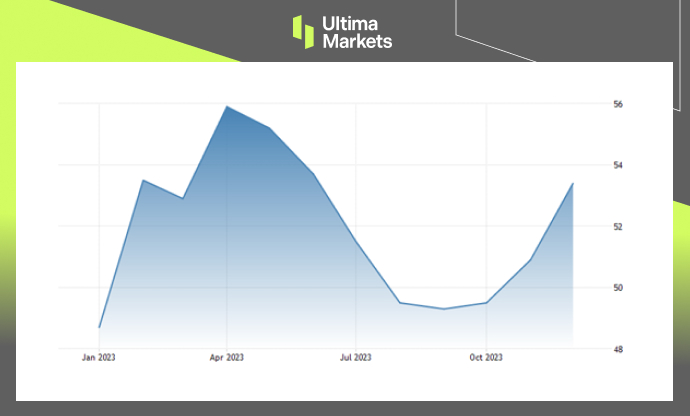

The UK Services Purchasing Managers’ Index (PMI) rose to 53.4 in December 2023 from 50.9 in November, exceeding the preliminary estimate of 52.7. This marked the second straight month of expansion in the British services sector, defying the contractionary trend across the Eurozone. The pace of growth was the fastest since June, thanks to a further increase in new orders.

(UK Services PMI,S&P Global)

Survey respondents reported tentative signs of a revival in consumer demand, particularly in financial services and technology. This growth occurred despite ongoing cost-of-living pressures, tighter household budgets, and the Bank of England’s restrictive monetary policy stance.

Additionally, wage pressures drove the sharpest input cost inflation since August, leading to subdued hiring and higher output charges. Finally, optimism toward business conditions over the next 12 months improved to a seven-month high.

Frequently Asked Questions

1. What is PMI?

PMI stands for Purchasing Managers’ Index. It is an indicator of economic health for manufacturing and service sectors. Learn more.

2. How is the UK Services PMI calculated?

The UK Services PMI is calculated based on survey responses from purchasing managers in the services sector. Details.

3. Why is the UK Services PMI important for investors?

The UK Services PMI provides insights into the activity level of purchasing managers in the services sector, reflecting economic trends and potential investment opportunities.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server