US Dollar & Stock Rises as PMI Shows Business Picks up

TOPICSTags: economic data, PMI, S&P500, Trade, Trump, Trump Tariff, US Stock

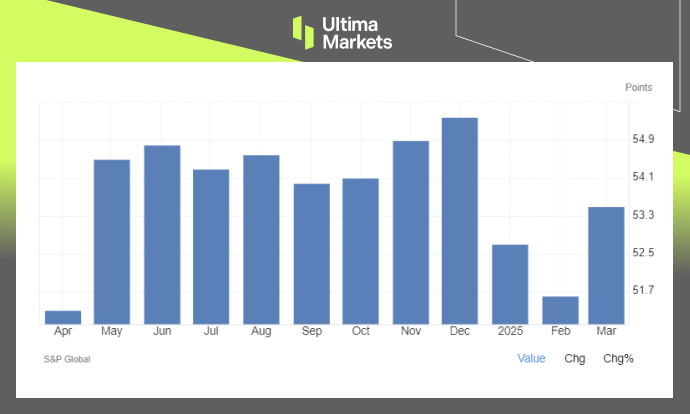

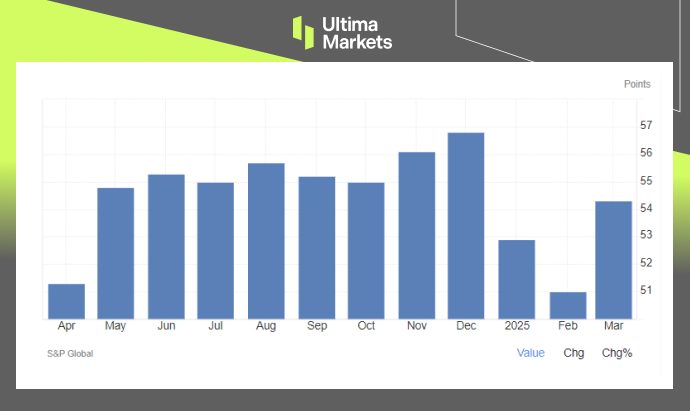

The S&P Global Flash US Composite PMI rose to 53.5 in March, up from 51.6 in February, marking the strongest growth in private sector activity in three months. Meanwhile, over the Service and Manufacturing PMI data showed a mixed outlook:

- S&P Global Flash US Services PMI climbed to 54.3, surpassing market expectations of 50.8.

- S&P Global Flash US Manufacturing PMI, however, declined to 49.8, down from 52.7 in February.

(S&P Global Flash US Composite PMI; Source: Trading Economics)

(S&P Global Flash US Service PMI: Source: Trading Economics)

Since the US economy is primarily driven by the service sector, the strong rebound in service output eased concerns about a potential economic slowdown triggered by Trump’s policies. As a result, the US stock market extended its gains yesterday.

US Dollar & Stock Indices Gain on Optimism

Stronger economic data boosted investor confidence, leading to gains across the three major U.S. stock indices, as concerns over Trump’s tariff policies temporarily eased.

Meanwhile, the U.S. dollar, which had been under pressure due to earlier “Trumpcession” concerns, saw a mild recovery. The Dollar Index (DXY) traded above 104.00 for the first time in three weeks, signaling renewed strength in the greenback.

(US S&P500 Index, Day Chart; Source: Ultima Markets MT4)

The S&P 500 Index has gained more than 4.5% since hitting its 7-month low in early March, now regaining footing above the 5730 level. However, the U.S. benchmark index remains at a critical resistance zone between 5850 and 5730, where a clear bullish confirmation is yet to be seen.

Trump’s “Reciprocal Tariffs” Remains Uncertainty

Despite the recent gains in the U.S. stock market driven by renewed investor optimism, uncertainty lingers as Trump’s “reciprocal tariffs” set for announcement in early April remain a key concern for investors.

However, the focus has narrowed to a select group of countries with substantial trade imbalances and higher tariff rates on U.S. goods. President Trump has also signaled a more flexible and targeted approach, suggesting that countries may negotiate exemptions or adjustments by addressing trade imbalances and lowering their tariffs on U.S. exports.

This toned-down stance from Trump has provided some relief to the markets, easing concerns about an aggressive escalation in trade tensions.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server