US Dollar Drops Below 99 as Euro Thrives

TOPICSThe U.S. dollar continued its downward trajectory on Monday, April 21, with the U.S. Dollar Index (USDX) falling below the 99-point mark, its lowest level in over three years. Year-to-date, the greenback has depreciated by nearly 9% against a basket of major currencies, as escalating trade tensions and growing political uncertainty weigh heavily on investor confidence.

(US Dollar Index—USDX+, Day-Chart; Source: Ultima Markets MT5)

Investors Shift Away from U.S. Assets

The dollar’s decline reflects a broader trend of investors pulling away from U.S.-related assets. Concerns are rising over the economic fallout from the Trump administration’s aggressive tariff policies, which have sparked disputes with several major economies.

At the same time, rising inflationary pressures and mounting political risks—particularly President Trump’s ongoing public criticism of Federal Reserve Chair Jerome Powell—have cast doubt on the Fed’s independence and its ability to manage monetary policy effectively.

As a result, investors have increasingly shifted their allocations toward safe-haven assets such as gold, which has recently surged past $3,400, marking a new all-time high.

Euro Rises to 3-Years High

The euro, which holds the largest weight in the USDX, has strengthened steadily amid dollar weakness. It reached its highest level since the February 2022 U.S. when Fed’s kicked off with the tightening cycle, supported not only by the greenback’s slide but also by improving sentiment toward the European economy.

The European Union’s ramped-up defense and infrastructure spending has further boosted the euro, reflecting stronger fiscal commitment amid global trade uncertainty.

Confidence in U.S. Policy Dented

The Trump administration’s rapidly shifting trade policies and unpredictable tariff decisions have made investors increasingly cautious about U.S. economic leadership. Tariffs on multiple key trade partners have invited broad international criticism and stoked concerns about long-term disruptions to global supply chains.

“The confidence in the U.S. economy is eroding as the Trump administration continues to undermine global free trade principles,” said Ultima Market Senior Analyst Shawn. “The erratic policy decisions and political pressure on the Fed are making investors question the credibility of U.S. financial leadership.”

With uncertainty still looming over both trade policy and monetary direction, the U.S. dollar is likely to stay under pressure in the near term. Until clearer signals emerge from the Federal Reserve and global trade tensions ease, markets are expected to maintain a risk-off stance, favoring gold, the euro, and other safe-haven assets.

Euro/Dollar Outlook

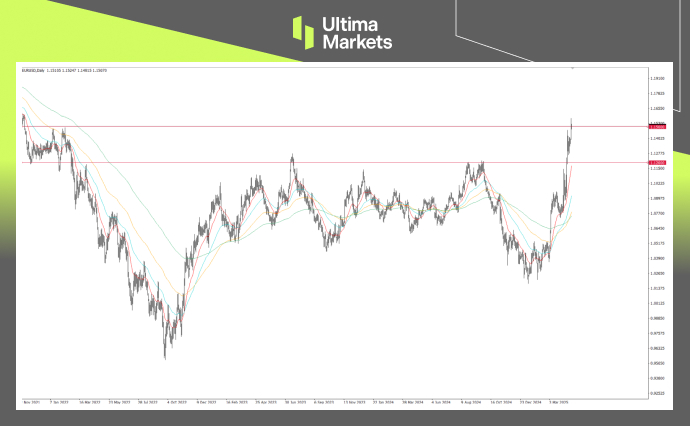

The EUR/USD is likely to remain strong amid ongoing market uncertainty. However, with the pair approaching the key 1.1500 level, and potential resistance from February 2022, a technical pullback may be expected.

(EUR/USD, Daily Chart Analysis; Source: Ultima Markets MT5)

From a technical perspective, the overall outlook remains bullish, but caution is warranted due to the possibility of a pullback. As long as EUR/USD trades above the 1.1200 level, the bullish trend should remain intact, unless there is a clear shift in market sentiment.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server