You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

Focus on AUD/JPY.

Fundamentally speaking, Japan’s inflation has not declined, which increases the probability of the Bank of Japan’s future tightening policy. After a long-term depreciation, the yen has space for a short-term rebound. AUD/JPY has less room for arbitrage than USD/JPY. With strong USD, please watch out for AUD/JPY bear.

Technically speaking, the AUD/JPY daily stochastic oscillator shows a dead cross, falling below the 50 median line.

(Golden daily cycle, Ultima Markets MT4)

The exchange rate began to decline after falling below the 65- day moving average. It is worth noting that before the short-term moving average crosses again, the market has a high probability of touching the 240 -day moving average and rising again.

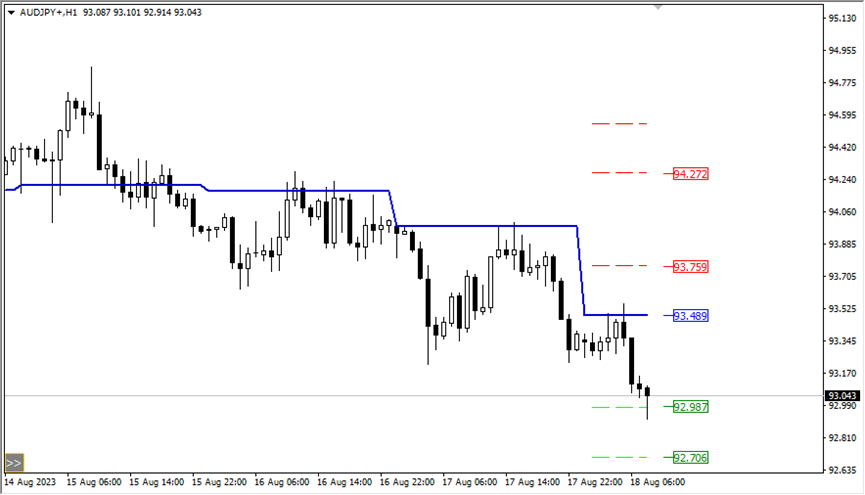

(AUD/JPY in 1 -hour period, Ultima Markets MT4)

In 1-hour period, the bearish trend is obvious, and the exchange has fallen below the 2400 -period moving average. However, there is a certain probability that it will find support and rebound there. You may wait for short entry here.

(AUD/JPY in 1 -hour period, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price is 93.489,

Bullish above 93.489, the first target is 93.759, and the second target 94.272.

Bearish below 93.489, the first target is 92.987, and the second target is 92.706.

Disclaimer Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Mengapa Berdagang Logam & Komoditi dengan Ultima Markets?

Ultima Markets menyediakan persekitaran kos dan pertukaran yang paling kompetitif untuk komoditi lazim di seluruh dunia.

Mohon sekarangMemantau pasaran secara terus

Pasaran terdedah kepada perubahan dalam penawaran dan permintaan

Menarik kepada pelabur yang hanya berminat dalam spekulasi harga

Kecairan mendalam dan pelbagai tanpa yuran tersembunyi

Tiada dealing desk dan tiada sebut harga semula

Pelaksanaan pantas melalui pelayan Equinix NY4

Sertai ekosistem perdagangan terbaik

Undang-undang

Ultima Markets merupakan ahli The Financial Commission, sebuah badan bebas antarabangsa yang bertanggungjawab untuk menyelesaikan konflik dalam pasaran Forex dan CFD.

Semua pelanggan Ultima Markets dilindungi dibawah perlindungan insuran daripada Willis Towers Watson (WTW), syarikat insuran antarabangsa yang ditubuhkan pada 1828, layak untuk tuntutan sehingga US$1,000,000 setiap akaun.

Ultima Markets ialah broker CFD pertama yang menjadi sebahagian daripada United Nations Global Compact.

Pendedahan Risiko

Amaran Risiko:Berdagang Forex dan CFD membawa risiko kerugian lebih besar daripada pelaburan awal anda dan berdagang berdasarkan dana yang mampu. Anda tidak memiliki atau mempunyai sebarang hak ke atas aset yang mendasari derivatif (seperti hak untuk menerima pembayaran dividen). Pastikan anda memahami sepenuhnya risiko yang terlibat. Berdagang produk berleveraj mungkin tidak sesuai untuk semua pelabur. Sebelum berdagang, sila ambil kira tahap pengalaman anda, objektif pelaburan dan dapatkan nasihat kewangan bebas jika perlu. Sila pertimbangkan dokumen undang-undang kami dan pastikan anda memahami sepenuhnya risiko sebelum anda membuat sebarang keputusan perdagangan.

Amaran Nasihat Am:Maklumat di laman web ini adalah bersifat umum sahaja dan sebarang nasihat telah disediakan tanpa mengambil kira objektif, keadaan kewangan atau keperluan anda. Sehubungan itu, sebelum bertindak atas nasihat tersebut, anda harus mempertimbangkan kesesuaian sebarang nasihat dengan mengambil kira objektif, keadaan kewangan dan keperluan anda, dan selepas mempertimbangkan dokumen undang-undang.

Sekatan Serantau:Maklumat atau peranti di laman web ini tidak ditujukan atau ditawarkan kepada penduduk di bidang kuasa tertentu seperti Amerika Syarikat, Korea Utara dan lain-lain. Untuk maklumat lanjut, sila hubungi pasukan sokongan pelanggan Ultima Markets.

Nama dagangan Ultima Markets Ltd, diberi kuasa dan dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan 'FSC' Mauritius sebagai Peniaga Pelaburan (Penjual Perkhidmatan Penuh, tidak termasuk Pengunderaitan) (No. lesen GB 23201593). Alamat pejabat berdaftar: Tingkat 2, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

hak cipta © 2025 Ultima Markets Ltd. Hak cipta terpelihara.

-

Messenger

Continue on Messenger

Take the conversation to your Messenger account. You can return anytime.

Scan the QR code and then send the message that appears in your Messenger.

Open Messenger on this device. -

Instagram

Continue on Instagram

Take the conversation to your Instagram account. You can return anytime.

Scan the QR code to open Instagram. Follow @ultima_markets to send a DM.

Open Instagram on this device. -

Live Chat

-