You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

RBNZ might hold rates unchanged while institutions short on NZD

TOPIKTags: news

August 15, 2023 at 2:12 am

The Federal Reserve Bank of New Zealand will announce the latest interest rate decision on Wednesday, and the market expects to keep the OCR official cash rate unchanged at 5.50%. At the moment, global economics are cooling, while the figures released by RBNZ are not strong enough. Consequently, RBNZ gains space to keep interest rates unchanged and time to observe the inflation situation further.

NZ economic data displays a mixed picture, with inflation data tapering off despite resilient demand, leaving investors conflicting signals. NZ economic conditions have not weakened as badly as previously expected.

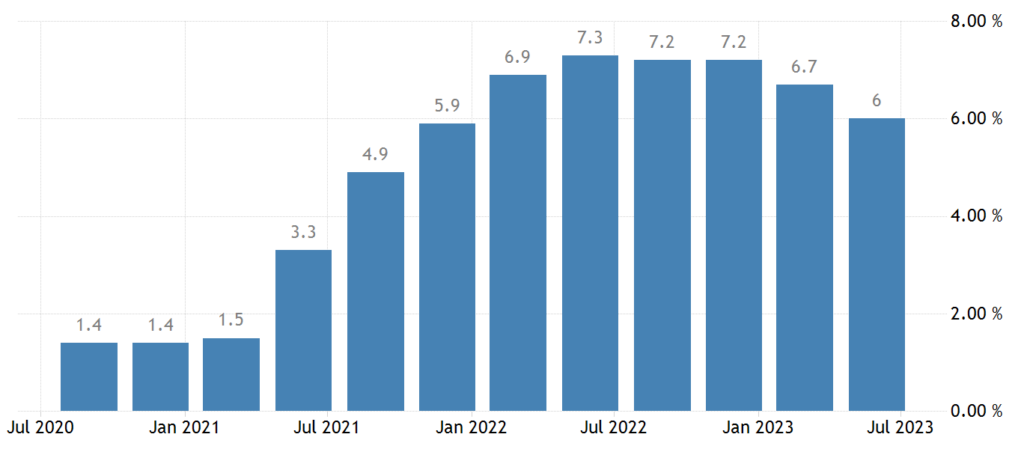

(NZ inflation rates in one year)

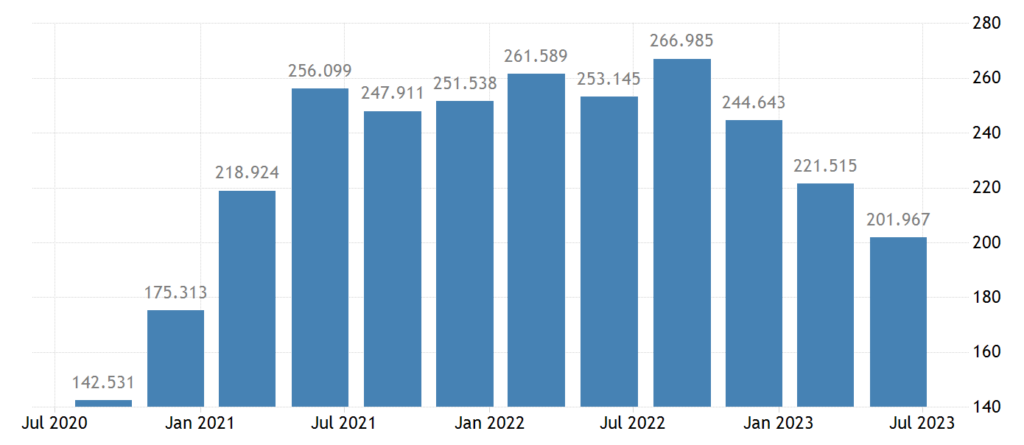

Although inflation has started to fall, it has remained high. The strong labor market has prompted RBNZ to postpone an expected rate cut originally scheduled for the fourth quarter of 2023 until the second quarter of 2024. The wage growth has declined, however, stayed at an elevated level, hampering RBNZ to reach its inflation goal. NZ’s GDP growth rate is expected to pick up slightly in 2023, showing some resilience in its economy.

(NZ job vacancies decreased since July 2022)

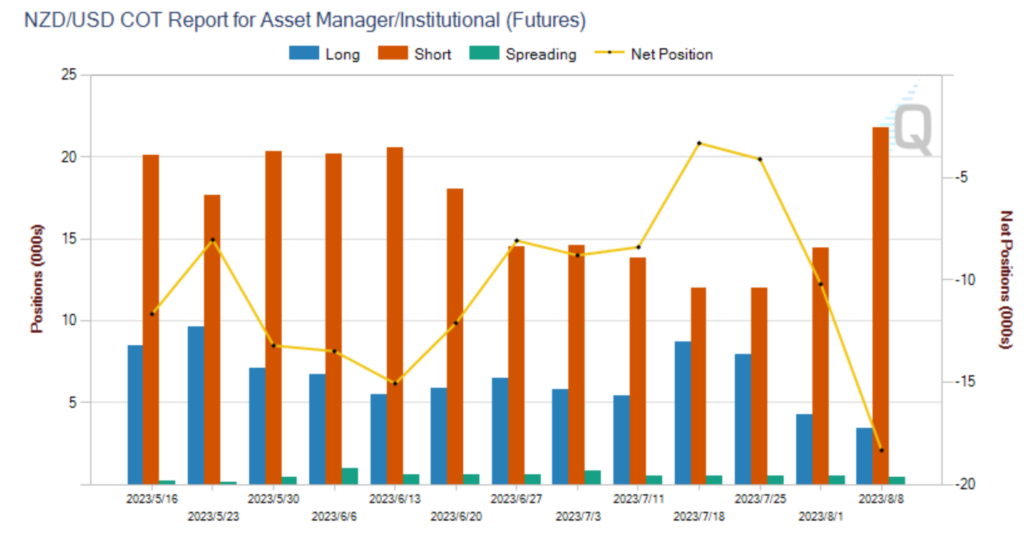

A ‘watch, worry, and wait’ stance seems the most likely outcome of the OCR review. However, some institutions believe it is possible to see rates go up to 5.75% in the future. The divergence reflects market uncertainty toward inflation and the economic outlook.

(Institutional short positions increased on NZD/USD)

The positions held by Institutional investors last week showed bearish sentiments on NZD/USD. If RBNZ unexpectedly raises interest rates, NZ’s exchange rate will rise rapidly in the short run.

(NZD/USD weekly chart, Ultima Markets MT4)

From a technical standpoint, the NZD /USD weekly cycle has fallen into short-term weakness, and the bottom is about to look at the Fibonacci 61.8% retracement position of the upward trend since September 2022.

Overall, with mixed data, inflation and the economic outlook will remain important considerations in the RBNZ’s decision-making. Investors need to pay attention to the comments on inflation and the economy in the review, as well as the subsequent market reaction to obtain more clues about the direction of monetary policy.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Mengapa Berdagang Logam & Komoditi dengan Ultima Markets?

Ultima Markets menyediakan persekitaran kos dan pertukaran yang paling kompetitif untuk komoditi lazim di seluruh dunia.

Mohon sekarangMemantau pasaran secara terus

Pasaran terdedah kepada perubahan dalam penawaran dan permintaan

Menarik kepada pelabur yang hanya berminat dalam spekulasi harga

Kecairan mendalam dan pelbagai tanpa yuran tersembunyi

Tiada dealing desk dan tiada sebut harga semula

Pelaksanaan pantas melalui pelayan Equinix NY4

Sertai ekosistem perdagangan terbaik

Undang-undang

Ultima Markets merupakan ahli The Financial Commission, sebuah badan bebas antarabangsa yang bertanggungjawab untuk menyelesaikan konflik dalam pasaran Forex dan CFD.

Semua pelanggan Ultima Markets dilindungi dibawah perlindungan insuran daripada Willis Towers Watson (WTW), syarikat insuran antarabangsa yang ditubuhkan pada 1828, layak untuk tuntutan sehingga US$1,000,000 setiap akaun.

Ultima Markets ialah broker CFD pertama yang menjadi sebahagian daripada United Nations Global Compact.

Pendedahan Risiko

Amaran Risiko:Berdagang Forex dan CFD membawa risiko kerugian lebih besar daripada pelaburan awal anda dan berdagang berdasarkan dana yang mampu. Anda tidak memiliki atau mempunyai sebarang hak ke atas aset yang mendasari derivatif (seperti hak untuk menerima pembayaran dividen). Pastikan anda memahami sepenuhnya risiko yang terlibat. Berdagang produk berleveraj mungkin tidak sesuai untuk semua pelabur. Sebelum berdagang, sila ambil kira tahap pengalaman anda, objektif pelaburan dan dapatkan nasihat kewangan bebas jika perlu. Sila pertimbangkan dokumen undang-undang kami dan pastikan anda memahami sepenuhnya risiko sebelum anda membuat sebarang keputusan perdagangan.

Amaran Nasihat Am:Maklumat di laman web ini adalah bersifat umum sahaja dan sebarang nasihat telah disediakan tanpa mengambil kira objektif, keadaan kewangan atau keperluan anda. Sehubungan itu, sebelum bertindak atas nasihat tersebut, anda harus mempertimbangkan kesesuaian sebarang nasihat dengan mengambil kira objektif, keadaan kewangan dan keperluan anda, dan selepas mempertimbangkan dokumen undang-undang.

Sekatan Serantau:Maklumat atau peranti di laman web ini tidak ditujukan atau ditawarkan kepada penduduk di bidang kuasa tertentu seperti Amerika Syarikat, Korea Utara dan lain-lain. Untuk maklumat lanjut, sila hubungi pasukan sokongan pelanggan Ultima Markets.

Nama dagangan Ultima Markets Ltd, diberi kuasa dan dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan 'FSC' Mauritius sebagai Peniaga Pelaburan (Penjual Perkhidmatan Penuh, tidak termasuk Pengunderaitan) (No. lesen GB 23201593). Alamat pejabat berdaftar: Tingkat 2, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

hak cipta © 2025 Ultima Markets Ltd. Hak cipta terpelihara.

-

Messenger

Continue on Messenger

Take the conversation to your Messenger account. You can return anytime.

Scan the QR code and then send the message that appears in your Messenger.

Open Messenger on this device. -

Instagram

Continue on Instagram

Take the conversation to your Instagram account. You can return anytime.

Scan the QR code to open Instagram. Follow @ultima_markets to send a DM.

Open Instagram on this device. -

Live Chat

-