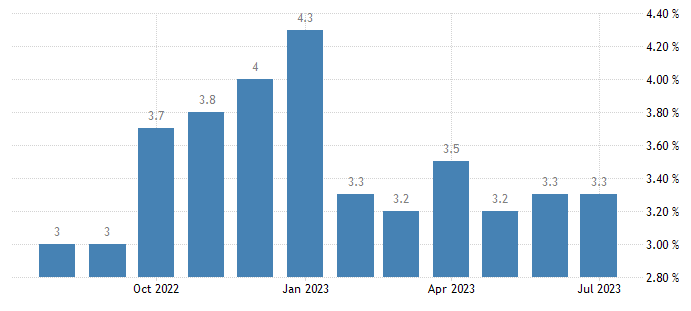

Japan announced the latest July core CPI annual rate excluding fresh foods rose 3.1% year-over-year, slightly down from 3.3% in the previous month. The figure matched with the Bank of Japan’s expectation. The slowdown is linked to lower energy prices, especially data from the Tokyo region showing a slight deceleration in inflation.

(Japan’s inflation level in the past year)

The BOJ’s holding back on raising rates makes a sharp contrast to its peers. The Bank of Japan has taken steps to curb potential economic risks, including allowing long-term government bond yields to rise to 1%. However, the monetary policies have not prevented the yen from depreciation.

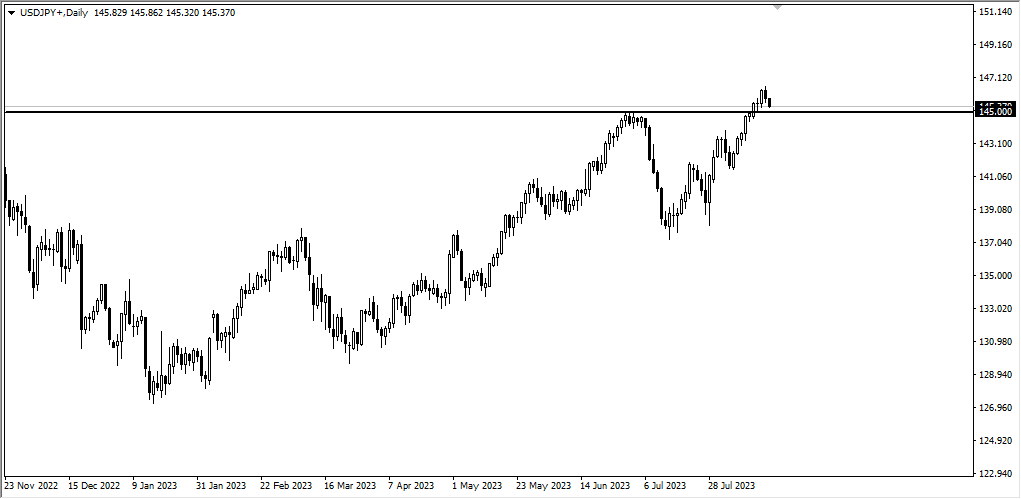

The exchange rate of USD/JPY began to fall in the past two days but remained above the high of 145. Over time, Japan’s low rate could lead to capital outflows, putting downward pressure on the yen.

(USD/JPY daily cycle, Ultima Markets MT4)

External factors may play a key role in reviving the yen. A crisis or recession could deter rate cuts. However, the strong U.S. economy reduces possibility.

Although the Japanese government could intervene the yen’s depreciation, its long-term course might remain unchanged. 150 marks a turning point. If USD/JPY rises above it, the Bank of Japan is expected to step into the market.

Overall, inflation and the global economy continue to affect the yen. Under the current circumstances, the Bank of Japan’s easing policy may continue to support the trend of yen depreciation, but external factors may still cause some changes in short term.

Disclaimer Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Mengapa Berdagang Logam & Komoditi dengan Ultima Markets?

Ultima Markets menyediakan persekitaran kos dan pertukaran yang paling kompetitif untuk komoditi lazim di seluruh dunia.

Mohon sekarangMemantau pasaran secara terus

Pasaran terdedah kepada perubahan dalam penawaran dan permintaan

Menarik kepada pelabur yang hanya berminat dalam spekulasi harga

Kecairan mendalam dan pelbagai tanpa yuran tersembunyi

Tiada dealing desk dan tiada sebut harga semula

Pelaksanaan pantas melalui pelayan Equinix NY4