Swiss Franc Weakens as SNB Considers Negative Interest Rates

TOPICSSwiss Franc Remains as Safe-Haven Currency

On Friday, Swiss National Bank (SNB) Chairman Martin Schlegel hinted at the possibility of reintroducing negative interest rates if necessary. While the central bank is not in favour of negative rates, it may resort to them to curb investor demand for the safe-haven franc. Following the remarks, the Swiss franc weakened against the U.S. dollar, with USD/CHF rising 0.77% to close at $0.8934.

(USDCHF Daily Price Chart, Source: Trading View)

Schlegel also emphasized that the Swiss franc is likely to remain a preferred safe-haven currency during periods of uncertainty. While this poses challenges, Switzerland is well-positioned to manage them. The SNB remains committed to maintaining price stability, targeting inflation within a 0-2% range over the medium term, he added.

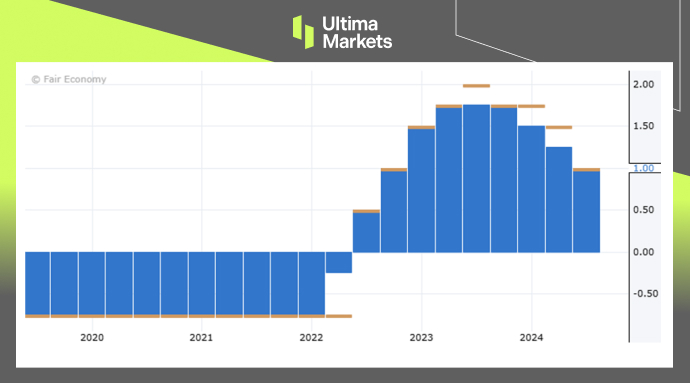

Switzerland has previous experience with negative rates, using the policy to temper the franc’s strength, which exacerbates difficulties for exporters grappling with subdued global demand. However, the SNB exited negative rates in September 2022, aligning with other central banks in raising borrowing costs after successfully controlling inflation.

In 2024, the SNB has reduced its benchmark interest rate three times, bringing it down to 1%, with further cuts anticipated. Current market expectations suggest a 72% probability of a 25-basis-point cut and a 28% probability of a 50-basis-point cut at the central bank’s December meeting.

(Swiss National Bank’s Policy Rate, Source: Forex Factory)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server