Trump Tariffs Announced, FOMC Minutes Highlight Trade Risks

TOPICSTags: Federal Reserve, FOMC, Trump, Trump Tariffs, USD/JPY

Trump’s Latest Tariffs Spark Trade Tensions

U.S. President Donald Trump has announced a new round of tariffs, escalating trade tensions. On Tuesday, he imposed a 25% tariff on automobile imports and threatened further tariffs on semiconductor and pharmaceutical imports.

The auto tariffs are aimed at pressuring trade partners like the EU and Japan to lower their tariffs on U.S. cars. Trump argues that the EU’s 10% auto tariff is unfair compared to the 2.5% tariff the U.S. imposes on European car imports.

Since Trump’s inauguration a month ago, he has announced a series of tariffs policy, escalating trade tensions globally, which includes:

- Imposed a 10% tariff on all Chinese imports, in addition to existing tariffs.

- Temporary delay of a 25% tariff on imports from Mexico and Canada for one month.

- 25% tariff on steel and aluminum imports, set to take effect on March 12.

- 25% tariff on auto imports, also taking effect on March 12.

FOMC Minutes: Closely Monitoring Trade Developments

Earlier today, the latest release of the Federal Reserve’s January meeting minutes revealed the Fed concerns over the potential economic impact of recent tariff announcements. Policymarkers highlighted that they are going to monitor global trade development closely, as the could influence future monetary policy decision.

Over the current economic outlook, FOMC members expressed concerns about inflation remaining above the 2% target. They stressed the importance of seeing “further progress on inflation” before considering any interest rate adjustments. The Committee expects the path to achieving the inflation target to be gradual and potentially uneven.

Meanwhile, they remained confident in the labor market, describing it as being in a “solid position” but remained vigilant about potential risks.

Technical Outlook on USDJPY

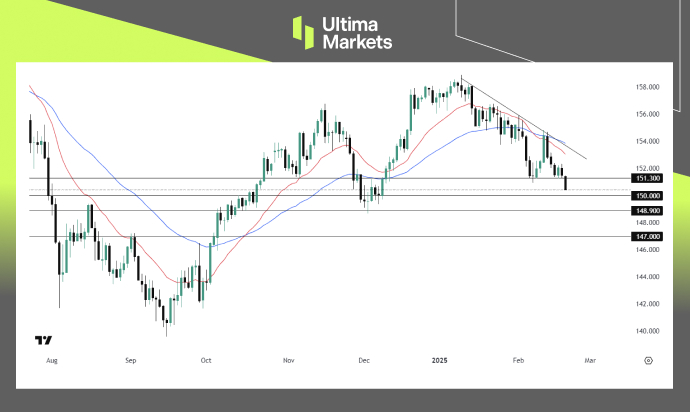

(USDJPY, 4H Chart Analysis, Source: Trading View)

USDJPY extended losses after breaking below the 151.30 support level, largely driven by escalating global trade concerns. This development increases the likelihood of the pair testing the key psychological level at 150.00.

If trade tensions continue to escalate due to the latest tariff policies, the Japanese yen could further strengthen as a safe-haven asset, exerting additional downward pressure on USDJPY. A decisive break below 150.00 could open the door for a move toward 148.90, though this level may offer limited support.

Further bearish momentum could push USDJPY toward 147.00, marking a five-month low for the pair.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server