U.S Producer Prices Increase Less Than Expected

TOPICSTags: FED, Inflation, PPI, Producer Price, Trump

Fed Holds Firm Amid Slower Producer Price Growth

US producer prices saw a less than an expected increase in December, this increase was aided by the stable service prices that offset the rise in the goods costs. This establishes the fact that the inflation is still on a downward trend, even after certain stagnation has occurred in the months leading up to this.

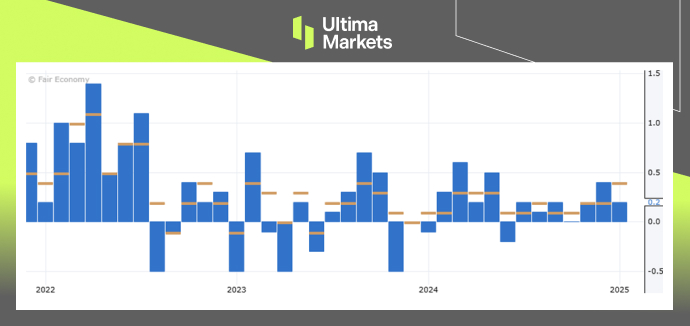

The Labor Department’s Bureau of Labor Statistics has stated that the Producer Price Index (PPI) for final demand has surged by 0.2% as of December after the prediction rate reached a rate of 0.4% in November. The increase predicted by economists was 0.3%, however, these estimates were at odds with the consensus of economists.

(U.S. PPI m/m Chart, Source: Bureau of Labor Statics)

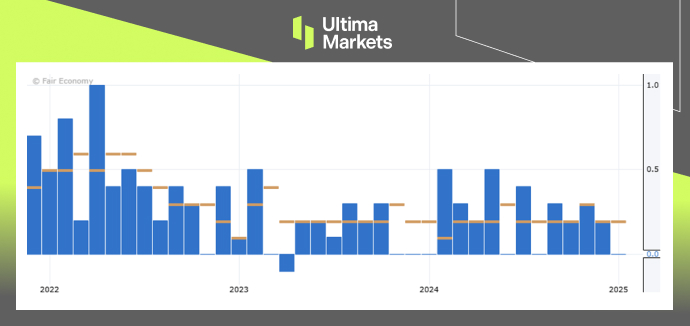

Meanwhile, the core PPI which excluding food, energy, and trade edged up by 0.1% for the second consecutive month. On an annual basis, core PPI rose 3.3%, down from 3.5% in November. However, some economists cautioned against overinterpreting December’s modest PPI increase, noting that producer prices often soften during this month.

(U.S. Core PPI m/m Chart, Source: Bureau of Labor Statics)

Despite the easing in producer inflation, reported by the Labor Department on Tuesday, expectations remain that the Federal Reserve will hold off on cutting interest rates until at least the second half of the year. This is due to a strong labor market and the potential inflationary impact of tariffs on imported goods proposed by President-elect Donald Trump’s incoming administration.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server