Comprehensive EUR/USD Analysis for December 22, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the EUR/USD for 22nd December 2023.

EUR/USD Key Takeaways

- Weak dollar: Since policy rates in the United States, the Eurozone and the United Kingdom have remained unchanged since the third quarter of 2023, they may have reached the peak of this tightening cycle. The dollar continues to weaken after Powell’s recent dovish comments.

- U.S. PCE data: Tonight, the United States will release November personal consumption expenditure (PCE) data. If the data is weak, the EURUSD may appreciate further. However, due to the current strong U.S. economy and weak economic growth in the Eurozone, we cannot rule out the possibility of buying expectations and selling facts.

EUR/USD Technical Analysis

EUR/USD Daily Chart Insights

- Stochastic Oscillator: The indicator entered the overbought area, but it did not send any short signal, suggesting that bulls still have the upper hand and the short-term exchange rate still has the momentum to continue rising.

- Price Action: After adjustment for 5 trading days, the exchange rate rose strongly yesterday, and the final closing price was near the previous high. If today’s market price breaks through yesterday’s high, there will be long trading opportunities, and the next target can be the purple 2400-day moving average.

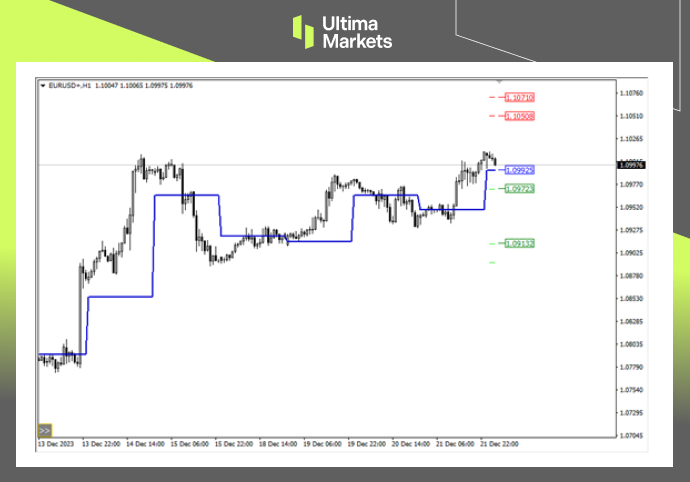

EUR/USD 1-hour Chart Analysis

- Stochastic Oscillator: The indicator has issued a short signal in the overbought area, suggesting that the exchange rate is about to fall. Since the daily chart is still in a bullish trend, the expected decline is considered a short-term adjustment.

- Joint resistance area: The current exchange rate is blocked at 1.100. Near this price is the dual resistance area of the upper edge of the upward channel and the previous high. Therefore, there is a probability of a downward adjustment in the Asian session first.

- 7-period moving average: The red 7-period moving average is the moving support for the short-term upward exchange rate. On the other hand, if the exchange rate repeatedly consolidates to form a top pattern around the 7-period moving average, the possibility of a further deep correction cannot be ruled out. Therefore, for trading opportunities, you need to pay attention to the specific trend of the exchange rate during the Asian session.

Ultima Markets MT4 Pivot Indicator

- According to the pivot indicator in Ultima Markets MT4, the central price of the day is established at 1.09925,

- Bullish Scenario: Bullish sentiment prevails above 1.0992, first target 1.10508, second target 1.10710;

- Bearish Outlook: In a bearish scenario below 1.0992, first target 1.09723, second target 1.09132.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4