Comprehensive AUD/USD for November 15, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the AUD/USD for 15th November 2023.

AUD/USD Key Takeaways

- CPI hits the dollar: U.S. October CPI and core CPI data were both lower than expected, and interest rate futures price the Fed’s current interest rate hike cycle to a complete end

- The Fed’s interest rate cut cycle is coming: The overall interest rate hike cycle is expected to end, leading the market to begin to expect a cumulative 100 basis points interest rate cut by the end of next year, with the first round of interest rate cuts as early as May. These have put extreme pressure on the dollar to sell off.

AUD/USD Technical Analysis

AUD/USD Daily Chart Insights

- Stochastic Oscillator: The indicator sent a bull signal above the 50 midline yesterday, suggesting that the exchange rate will start a strong upward trend.

- 65-day moving average: The exchange rate strongly exceeded the 65-day moving average yesterday, and the resistance line converted into a support line. The probability of the Australian dollar continuing to depreciate is low.

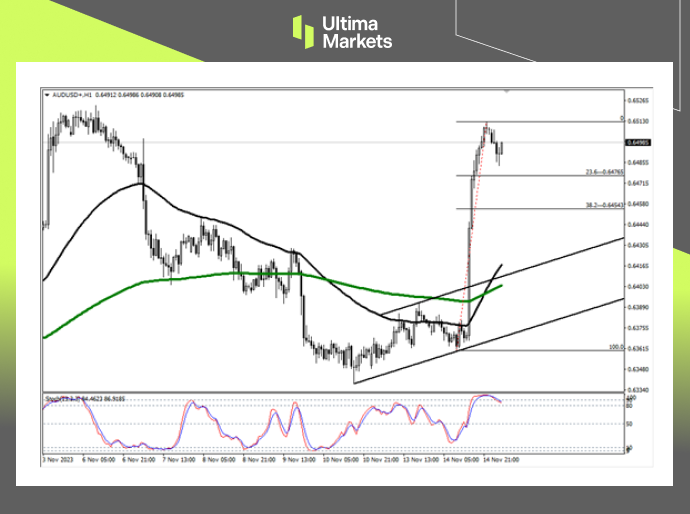

AUD/USD 1-hour Chart Analysis

- Stochastic oscillator: The indicator enters the overbought area to form a short signal, suggesting that the subsequent market will enter a correction. Traders should not rush to enter the market chasing high prices, as the profit-loss ratio is inappropriate.

- Fibonacci retracement levels: In a rapidly rising market, the correction usually looks towards the 23.6% and 38.2% Fibonacci retracement levels.

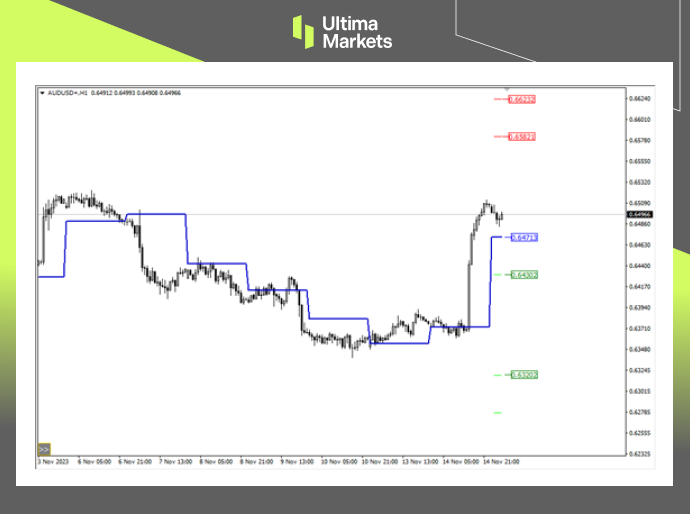

Ultima Markets MT4 Pivot Indicator

- According to the pivot indicator in Ultima Markets MT4, the central price of the day is established at 0.64713,

- Bullish Scenario: Bullish sentiment prevails above 0.64713, first target 0.65821, second target 0.66232;

- Bearish Outlook: In a bearish scenario below0.64713, first target 0.64302, second target 0.63202.

Conclusion

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4