The Impact of FED’s Decision and ISM Manufacturing PMI in November 2023

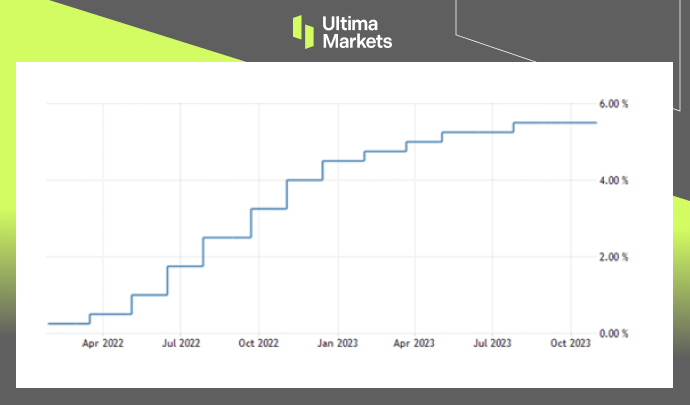

In November 2023, the Federal Reserve (FED) once again held its rates unchanged, marking the second consecutive time for such a decision. Investors and financial experts alike anticipated and conjectured about this FED move.

In addition, the Manufacturing Purchasing Managers Index (PMI) for October was released by the Institute for Supply Management (ISM), providing insight into the status of the US manufacturing industry.

Key Takeaway: FED’s Inflation Concerns

The FED’s Response to Inflation

The foremost concern addressed by the FED was the persistence of high inflation. FED Chairman Jerome Powell emphasized that inflation had exceeded the FED’s long-term target of 2%. Specifically, the total Personal Consumption Expenditures (PCE) prices had surged by 3.4% over the 12 months ending in September.

(Federal Funds Rate, FED)

Monetary Policy Consideration

Powell’s statement shed light on the FED’s approach to managing inflation. He articulated that any future rate hikes would be executed with great caution, considering factors such as the cumulative impact of prior rate adjustments, the time lag in the transmission of monetary policy effects, and the prevailing economic and financial market conditions.

Market Impact: USD Index Decline

Following the FED’s announcement, the USD index (DXY) experienced a noticeable decline, moving from 106.66 to 106.35. This underscores the strong correlation between the FED’s monetary policy decisions and currency markets, making them of paramount importance to traders and investors.

Insights into ISM Manufacturing PMI for October 2023

The Escalating Contraction

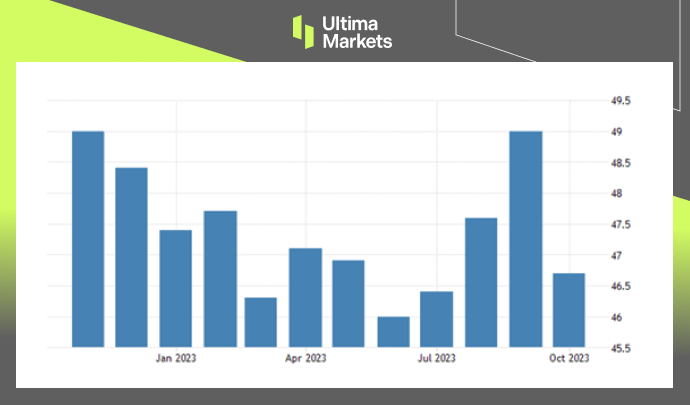

The ISM’s Manufacturing PMI data for October 2023 unveiled a worrisome trend. The U.S. manufacturing sector continued to contract, with the pace of contraction intensifying. The PMI declined by 2.3%, reaching 46.7%, in contrast to the 49% recorded in September, emphasizing the sector’s ongoing challenges.

(Manufacturing Purchasing Managers Index PMI,ISM)

Decline in New Orders

A critical factor contributing to the sector’s struggles is the downturn in new orders. Firms are grappling with reduced demand for their products, which has a detrimental impact on production and overall growth.

Challenges in Export Orders

While there was a moderate rise in the new export orders index, it remained within contraction territory. This suggests that the international market is not providing the expected boost to U.S. manufacturers.

Backlogs of Orders: A Persistent Issue

The backlogs of orders index also saw a slight decline, maintaining its position within sharp contraction territory. This signifies that manufacturers are contending with the backlog of existing orders, which can have ripple effects on future production.

Bottom Line

In conclusion, the FED’s unwavering stance on interest rates and the ISM Manufacturing PMI for October 2023 offer essential insights into the state of the U.S. economy. Staying well-informed about these developments is vital for making sound financial decisions in a constantly evolving economic landscape.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4